|

Bitcoin is a digital currency that has been making headlines in recent years. It has been praised for its decentralized nature, security, and global accessibility, but it has also been criticized for its volatile value and the potential for illegal activities. In this article, we'll take a look at the current state of bitcoin and what you can expect if you're thinking about investing in or using it.

Bitcoin has seen a massive price increase in recent years, reaching an all-time high of around $64,000 in April 2021. This has led many people to invest in bitcoin in the hopes of making a quick profit. However, it's important to keep in mind that bitcoin is a highly volatile currency, and its value can fluctuate wildly in a short period of time. As a result, investing in bitcoin can be quite risky, and it's not recommended for people who can't afford to lose their money. Despite its volatile value, many people are still interested in using bitcoin for its other features. For example, Bitcoin transactions can be faster and cheaper than traditional bank transfers, and it can be used globally without the need for currency conversion. Additionally, Bitcoin is often considered to be a store of value, similar to gold, as it is decentralized and not controlled by any government or institution. One of the major concerns about Bitcoin is the potential for illegal activities. Bitcoin's anonymity makes it easy for people to use it for money laundering, tax evasion, and other criminal activities. This has led many governments to regulate bitcoin more tightly, which could make it harder to use in the future. Despite these concerns, there's no denying that bitcoin has changed the way people think about money. In recent years, an increasing number of businesses and merchants have begun accepting bitcoin as a form of payment, and it's likely that we'll see even more adoption in the future. Additionally, the technology behind bitcoin, the blockchain, has many potential use cases, like in supply chain and digital identity, which are being explored by different industries. In conclusion, bitcoin is a digital currency that offers many benefits, but it also comes with its own set of risks. Its value is highly volatile and it's not recommended for people who can't afford to lose their money. Additionally, the potential for illegal activities associated with its use remains a concern. Still, it's an exciting technology and one to keep an eye on, as its future is likely to be intertwined with that of other technologies, like blockchain and cryptocurrency.

0 Comments

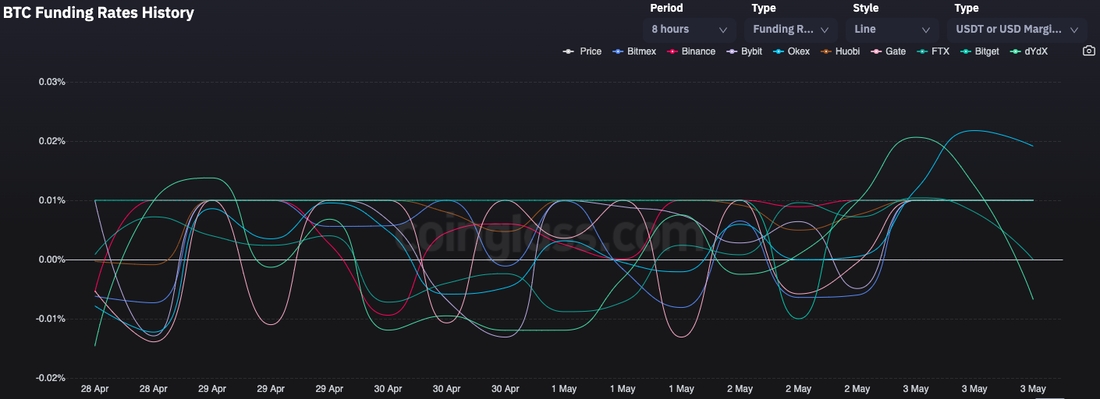

The state of affairs in the Bitcoin market has been monotonous for quite some time now. With the profit-booking trend in play, BTC is currently witnessing its largest long-term HODLer capitulation. As illustrated below, the divergence between the purchase price [blue] and the selling price [pink] of such market participants has drastically widened, indicating that the newest entrants to the LTH group are capitulating, and are fearful of further downside. Bearish signs start flashing for Bitcoin Despite that, Bitcoin kickstarted May by opening above its $37k support on the monthly chart. Nonetheless, at press time, the sentiment was seen gradually flipping back to bearish. Consider this – The funding rate across exchanges was positive—favoring long traders—a couple of trading sessions back. However, at press time the FR curves on almost all platforms were seen pointing downwards, bringing to light the eroding optimism. During the four-hour frame, the signs of weakness were even starker. Bitcoin had lost three crucial moving averages [the 50 (yellow), 100 (green), and 200 (red) day] as supports. At press time, it was trading below all of them and was at the mercy of $38.5k and $37.3k. The RSI too had started treading below the neutral zone, highlighting the deficient bullish pressure. The FOMC factor Even though the two aforesaid levels [ $38.5k and $37.3k] are guarding Bitcoin at the moment, it is doubtful if they’ll be able to keep the boat afloat. Here’s why: The US Federal Reserve’s open market committee meeting is set to end on Wednesday, 4 May. The same is set to be followed by a series of announcements. A 50 basis point interest rate hike is widely expected, given the recent commentary from officials. Alongside, other rate inclines are expected to follow, to reduce inflatio Historically, the Bitcoin market has been very receptive to macro-announcements. In and around such periods, a lot of positioning and repositioning takes place, for market participants remain quite indecisive. In effect, the price doesn’t follow a stabilized trend.

So, if the rates are indeed hiked, experts expect asset prices to take a hit. In such a scenario, having long positions open could prove to be quite detrimental. However, if the FOMC announcement is positive, and well-received by market participants, then a 180 flip can be expected from Bitcoin. Thus, keeping the technicals and the FOMC factor in mind, it’d be best for low-risk appetite traders to exercise caution and observe the trend from the sidelines before entering into any position. bitcoin btc FOMC rate hike Bitcoin’s prices reached all-time highs above $40,000 less than a month after breaking $20,000 for the first time. Since the start of the most recent rally, ostensibly begun in October, its value has increased fourfold.

So for pros and newbies alike, or if you want to be the cryptocurrency expert at your next Zoom party, it’s natural to ask: Why are prices going up, and will bitcoin crash? Bitcoin (BTC) was just invented 12 years ago as a new type of electronic payment system, built atop an Internet-based computing network that no single person, company or government could control. The reality is that the cryptocurrency’s trading history is so short, with methods for valuing the asset still largely untested, that nobody really knows for sure what it should be worth now, or in the future. That hasn’t stopped digital-asset investors or even Wall Street analysts from putting out price forecasts ranging from $50,000 to $400,000 or beyond. Based on CoinDesk’s reporting, here are a few key reasons why bitcoin prices have recently rallied:

The cryptocurrency’s price is notoriously volatile, and substantial and unexpected price swings aren’t uncommon. Below is a sampling of comments from cryptocurrency analysts and other financial experts on how a pullback might look, and what might cause it.

Just don’t tell them when. In the financial world, “what’s past is prologue.” Overly rosy perspectives often set off the boom-and-bust cycles that have become all-too familiar over the past 20 years, from the dot-com bubble to the mortgage crisis.

Over the past 12 years, we’ve watched bitcoin’s BTCUSD, 1.55% evolution from netherworld currency to major institutional commodity. In that time, it has fluctuated widely, introduced as a near-valueless currency in 2009, growing in value to $19,000+ nearly nine years later, then losing 76% of its market value within a year, before beginning a steady climb in the second half of 2020 that puts its value at more than $30,000. We believe that bitcoin has matured and now is the right time to invest in this widely popular currency. Here’s why: Today, there is significantly more demand for bitcoin than there is supply. About 900 new bitcoin are mined daily, and three market participants alone — PayPal, Square, and Grayscale Bitcoin Trust — purchase considerably more than 900 bitcoin a day because of high investor demand. If this dynamic continues, and we believe it will, much higher prices lie ahead for the dominant cryptocurrency. At the same time, the risks associated with investing in bitcoin—namely the potential for theft—have been substantially diminished over the past three years, with the U.S. Office of the Comptroller of the Currency authorizing national banks to provide cryptocurrency services. Several banks have also started to provide institutional bitcoin custody services, deposit-taking, custody and fiduciary services for digital assets. What’s more, the IRS bestowed favorable tax treatment on bitcoin by treating it as property that produces capital gains and losses. And in another positive sign, PayPal rolled out bitcoin trading to its 238 million U.S. users. As a consequence of these regulatory and infrastructure developments, Wall Street has turned bullish on bitcoin. Rick Reider, BlackRock’s chief investment officer, recently commented on CNBC that bitcoin “could take the place of gold…it’s so much more functional than passing a bar of gold around.” AllianceBernstein issued a report on Nov. 30 entitled “Cryptocurrencies in asset allocation – I have changed my mind!” J.P. Morgan issued a report on Dec. 3 declaring “the adoption of bitcoin by institutional investors has only begun.” Bitcoin is now on the menu for asset allocators. It has been embraced by several legendary investors, including Paul Tudor Jones, Stanley Druckenmiller, Bill Miller and Alan Howard, and a wall of institutional money is coming. Hedge funds are starting to buy, headlined by the Tudor BVI Global Fund and One River Asset Management. Insurance companies are starting to buy, with MassMutual recently buying a $100 million starter position in bitcoin. Pension funds are starting to buy, including two Fairfax Retirement System pension funds making investments into a Morgan Creek Digital fund. Public company treasurers are starting to buy, with MicroStrategy MSTR, +0.80% and Square SQ, +3.88% account for nearly $1.5 billion in bitcoin purchases. Registered investment advisers are starting to buy, with legendary RIA founder Ric Edelman launching the RIA Digital Assets Council. The adoption floodgates are open. SkyBridge initiated a substantial position in bitcoin on behalf of our flagship funds in November and December, which, at today’s prices, is worth $200 million, and has launched the SkyBridge Bitcoin Fund, which provides mass-affluent investors with an institutional-grade vehicle to gain exposure to bitcoin. We credit our “aha” moment to Michael Saylor, the chief executive of software company MicroStrategy, who bought $1.2 billion of bitcoin in 2020. During a recent SALT Talk, Saylor made a persuasive case that bitcoin, as the undisputed winner of the cryptocurrency wars of 2017, is the dominant digital monetary network. Like Saylor, we believe that when a digital network—think Facebook, Amazon and Google—achieves a market capitalization of over $100 billion, the horse is out of the barn. Bitcoin is an evolutionary step forward for the technology of money, which has steadily progressed from barter to beads to gold to fiat currency. Bitcoin is the first store of value in the world where supply is entirely unaffected by increased demand. Some 18.5 million bitcoin have been mined so far, and by 2025, over 20 million will be in circulation. Yet there can only ever be 21 million bitcoin because of a stipulation set forth in its source code. To place that number in context, there are 42-plus million people in the world with a net worth exceeding $1 million, meaning there are twice as many millionaires today as there will ever be bitcoins in circulation. Today, the fact remains that bitcoin’s demand exceeds supply, and it is not even close. Economics 101 tells us how this calculation will work out. What more do you need to know?

That's according to Fundstrat's Tom Lee, who said in an interview with CNBC on Wednesday that he sees bitcoin surging another 300% next year. At its current price of about $29,000, a quadruple in bitcoin would put the crypto asset well above the $100,000 mark at $116,000. Driving bitcoin higher would be a similar setup to what was seen in 2017: a parabolic rally. Lee tweeted that the halvening of 2020 makes this year most similar to 2016, which also experienced a halvening. A halvening in bitcoin is when the reward for miners completing problems on the bitcoin blockchain is cut in half. 2021 will be most like 2017 in that bitcoin will likely experience a "parabolic rise," Lee tweeted. Fundstrat's digital asset strategist David Grider also raised his outlook for bitcoin in a note on Wednesday, expecting the crypto asset to hit at least $40,000 next year. "We believe the conditions remain in place for a continued rally in bitcoin and crypto more broadly over the next 6-12 months. Institutional and corporate buying, regulatory de-risking and retail stimulus demand are factors that have led to an increase in positive momentum, which we believe can continue," Grider said. But if the stock market corrects next year, the positive outlook for bitcoin may deteriorate, according to Lee. "Bitcoin acts like a risk on asset, so in the years where the S&P performs the best are also the best years for bitcoin. So I think if we have a correction in stocks then bitcoin is going to fall," Lee explained. Just two weeks after tackling $20,000, Bitcoin passes the $30,000 mark on the second day of 2021. Bitcoin (BTC) hit a fresh psychological landmark on Jan. 2 as the new year kicked off to a flying start for hodlers. BTC price wastes no time in 2021Data from Cointelegraph Markets, Coin360 and TradingView showed BTC/USD clinch $30,000 during trading on Friday.

After hitting new all-time highs of $29,700 overnight, the pair showed no signs of weakness, retesting the level several times before a final breakout occurred. The area immediately below $30,000 had proven a source of intense selling pressure throughout the past few days, a setup similar to that which Bitcoin disrupted at $20,000 just weeks ago. "If you're looking for an entry to HODL Bitcoin long term, don't nickel and dime an entry. You're not going to sweat a few thousand dollars of non-perfect entry when it's $100k,$200k,$300k in a year," popular statistician Willy Woo summarized on Friday. "The main bull phase is here. Capital inflows has gone nuts."Mixed reactions for altcoinsAmong major altcoins, performance on the day was mixed, with Ether (ETH) staying flat below $740 despite Bitcoin's latest advances. Bitcoin has just closed out one of the biggest years in its history, second only to the crypto-mania fueled retail rally of 2017. The bitcoin price has added over 300% during the last 12 months, climbing past its 2017 highs amid renewed institutional interest and the prospect of broader mainstream adoption. Now, as the bitcoin price hovers under the psychological $30,000 per bitcoin level, cryptocurrency traders and investors are looking for clues that might reveal how bitcoin will fare through 2021. "It is still quite bullish on an intermediate-term basis given that [bitcoin] just broke out to new all-time highs," Mark Newton, founder and president of Newton Advisors, told CNBC’s Trading Nation this week, pointing to charts that show the bull run might be put on pause in early 2021. "I think we have a ways to go. Near term, my cycle composite shows us peaking out in early January." MORE FOR YOUAs Bitcoin Blasts Past $25,000, Here’s Why This Investor Made The Surprise Decision To SellAs The Bitcoin Price Surges, Coinbase CEO Brian Armstrong Issues ‘Worrying’ Bitcoin And Crypto Warning‘Borderlands 3’ Needs A Mayhem 3.0 Soon To Fundamentally Change How Mayhem 2.0 WorksThe bitcoin price has come within touching distance of $30,000 this week, hitting $29,700 per bitcoin on the Luxembourg-based Bitstamp exchange before falling back slightly. Bitcoin is up four-fold from the beginning of 2020 and completed its biggest monthly gain since May 2019 in December. Bitcoin's latest bull run was sparked in October by news payments giant PayPal PYPL +1.2% would begin offering bitcoin and cryptocurrency support. It was boosted by wave of institutional interest in bitcoin and Wall Street giants including Citibank and JPMorgan JPM +1.4% making surprisingly bullish bitcoin predictions. In December, a leaked Citi report revealed one of the bank's senior analysts thinks bitcoin could potentially hit a high of $318,000 by December 2021, calling it "21st century gold." Bitcoin has built up its reputation as "digital gold" throughout 2020, finding support from investors who are wary massive government money-printing will devalue traditional currencies and trigger a wave of inflation. "Gold reached a new all-time high in 2020 and bitcoin has set a string of new peaks, more than trebling in the second half of the year to pass the $28,000 mark for the first time," Russ Mould, investment director at brokerage AJ Bell, said via email. "Some will argue that there is more to come from both gold and bitcoin, especially if governments keep piling up debts and central banks do their best to fund that borrowing through the backdoor with quantitative easing, zero interest rates and bond yield manipulation, thanks to their scarcity value relative to cash," Mould said, referencing bitcoin’s fixed supply of 21 million tokens and gold's 2% per year supply growth. Bitcoin's growing popularity is, meanwhile, expected to create further polarity between those who see bitcoin as a sound investment and those who are suspicious of its value.

"Others will argue neither gold nor bitcoin have intrinsic value, as they do not generate cash," Mould said. "Some will even argue that bitcoin is just a glorified Ponzi scheme, as new money flows in at the bottom to help the smart money that got in early bail out at the top. In 2021 investors will get their chance to pay their money and take their choice as to whether they see bitcoin and gold as stores of value, and useful portfolio diversifiers, as governments and central banks conjure money out of thin air, or more trouble than whatever they may or may not be worth." Meanwhile, the cryptocurrency community is divided over the future of many smaller cryptocurrencies. The looming threat of regulation and increased government oversight has caused consternation that less decentralized cryptocurrencies could take a hit. "Bitcoin dominance is inevitable after a tumultuous year that has seen the king of crypto surge in price from under $4,000 in March to a new all-time high of above $28,000," Paolo Ardoino, chief technology officer at Hong Kong-based and British Virgin Islands-registered cryptocurrency exchange Bitfinex, said in emailed comments. Bitcoin dominance, a measure of bitcoin's value compared to the wider cryptocurrency market, has ticked up in recent weeks but remains more-or-less flat over the last 12 months. "While a growing institutional presence has been part of the narrative of the current bull run, we may see increased retail interest in bitcoin as a form of digital gold," Ardoino added. "This could also bolster interest in the many innovative projects coming to fruition within the digital token space." The price of bitcoin (BTC) crossed $29,000 Wednesday evening for the first time ever, pushing further into record territory after hitting what had been an all-time high earlier in the day.

Associate Professor of Finance on Bitcoin rally: Blockchain technology is ‘real and effective’12/30/2020 Bitcoin is currently on its longest winning run since 2019. Bryan Routledge, Associate Professor of Finance at the Tepper School of Business, Carnegie Mellon University, joins Yahoo Finance Live to break down how Bitcoin rallied to record levels this year and the outlook for crypto in 2021.

Video Transcript- Bitcoin at a record once again. It touched above 28,000 overnight. And it has had quite a run thus far in 2020. Hasn't had the end pullback that we saw, for example, in 2017. Let's talk more about what could happen next for Bitcoin as well as for the bigger cryptocurrency complex. Brian Rutledge is joining us now. He's an Associate Professor of Finance at Carnegie Mellon University Tepper School of Business. He has written a lot about cryptocurrency, but about blockchain as well. And it's actually there, Brian, that I want to begin because as Myles my co-host has pointed out frequently, the blockchain conversation is definitely not as prominent now as it was in 2017. The focus has really come in on Bitcoin and its rise. Do you think that that's sort of a mistaken perception? Do you think that there is still-- I mean, is-- is blockchain out there? Is-- how much is it being used? And what's sort of the use case as we move forward? BRIAN RUTLEDGE: Wow. OK. Lots packed in there. I think the-- the thing-- the thing to appreciate about Bitcoin and its rise in price-- I mean, 28,000 is remarkable. 3,000 was remarkable for Bitcoin in the sense it is built on blockchain technology. And so I think the fact that you're not talking about it is, in some sense, an acknowledgment that blockchain technology is effective. So it is big dollars that are in Bitcoin that are built on this underlying-- underlying blockchain technology of competitive decentralized recordkeeping. And if you had asked me in 2013 if this was going to be viable, I certainly wouldn't have said yes. And so I think the-- some of the price of Bitcoin is a bit of a mystery in the sense of why it has quadrupled over the year. But the fact that it is what it is I think is a validation that the blockchain technology is real and effective. And then the second half of your question, I think, is, what's the sort of killer app for blockchain technology that's waiting to happen? I think that is still unanswered. And it is a very good question in the sense of, where will blockchain technology go beyond just, say, record keeping on who owns Bitcoin? - You know, Brian, the perspective that I have on Bitcoin is basically from Finance Twitter and public media, so it's everyone bragging about how smart they are because they own all these coins and they went up a lot. I'm curious how your students-- what your conversations with your students are like as it relates to the entire crypto space, what they're interested in right now. BRIAN RUTLEDGE: I mean, it is-- an awesome thing to put on your syllabus is cryptocurrency, blockchain technology. You just-- you track students. It is-- I think it's a really interesting and attractive thing for a student in the same way it's an interesting, attractive thing just in general in the sense of, it is a mashing up of economics and business with the underlying technology of cryptography and distributed computing. And so there is really interesting technology problems that are there. And then, there are really interesting business problems. And so it-- it-- it's a rich, fun topic to teach because the students are just-- they're keen. - Brian, just based-- based on your understanding of Bitcoin and its history and where it's been this year, do you think what we're seeing in terms of price action reflects that at some point in our lifetimes, Bitcoin might be a viable replacement to the dollar? BRIAN RUTLEDGE: That's a good question in the sense of, what is it people are buying Bitcoin for and the sort of speculation? But the two things that people might be thinking about-- one is it's an alternative to something like gold. And we think about-- gold is not sort of an alternative to the dollar, but people hold it in their portfolio as, say, a hedge against inflation. We don't use gold in our everyday transactions. The price of gold is much higher then the intrinsic value of gold you would find. And so people moving into cryptocurrencies or Bitcoin as a, here is something that is commodity-like that is independent of, say, the Federal Reserve, and I want to hold that as a hedge against inflation. That-- that-- that is not a-- that's a sensible argument. It's belayed a bit by the fact that the price of Bitcoin is stunningly volatile. It's orders of magnitude more volatile than the price of gold or even the stock market. And then, I think the second sort of reason that people might think about Bitcoin as something they want to own is, it is perhaps access to this blockchain technology in the sense of, I want to own a piece of this future technology. And there, I think-- you know, like all bets, it's risky. And the bet there is twofold. One would be that blockchain technology indeed will be something new and useful. And then the second part of that is that Bitcoin would be relevant in that, I don't know, blockchain-enabled future. And I guess-- when thinking about that one, if you go back to, I don't know, the internet in the 1990s and thinking about, gee, I want to-- I think this is going to be revolutionary, it was pretty hard to see where the internet was going, and harder still to pick, I don't know, Amazon over Pets.com or Netscape or somebody. - Yeah. And most people-- a lot of people didn't do that correctly, certainly. I mean, but speaking of forecasting, Brian, you received a grant from the International Institute of Forecasters for your work on forecasting. When it comes to Bitcoin price, is there any way to even do it with any degree of accuracy? BRIAN RUTLEDGE: The financial prices in general are hard to forecast in part because everybody is trying to forecast them, so the famous or book of Burton Malkiel of a random walk down Wall Street is still applicable in the sense that, for the most part, prices go up or down with almost equal probability per day. There's lots of people trying to sort of find some wedge of a signal in there to predict the price of Bitcoin. The-- the-- if you do have some-- so, no. I have no forecasting ability. If you think you have some forecasting ability, Bitcoin prices are attractive in the sense that they are just so volatile, right? And if-- if you think you can forecast something, predicting, forecasting something that's volatile lets you make a lot of money. - Yes, it does. And a lot of people certainly have done that even if their forecasts have been wrong. So we'll see what happens next year. Brian, thank you so much. Happy new year to you, and we'll see what ends up happening with those Bitcoin prices. Brian Rutledge is an Associate Professor of Finance at Carnegie Mellon's David Tepper School of Business. Thank you so much. After tearing through $27,000 for the first time ever only a few hours before, the price of bitcoin briefly surged past $28,000 Sunday morning as the leading cryptocurrency’s recent meteoric rise continues. BTC’s market value now exceeds $500 billion.

|

RSS Feed

RSS Feed