|

More people are searching for the word “Ethereum” now than ever before in its history. Google Trends reveals that the number of Google searches currently being performed for “Ethereum” is at an all-time high, eclipsing search interest during the height of the last ETH bull run. Ethereum’s previous peak in search term popularity was on Jan. 13, 2018 — the date of ETH’s all-time high of $1,432.88. Historically considered a “folk metric,” a rising Google Analytics interest score for a crypto search term is associated with positive sentiment for that particular coin/project. While it makes sense that search interest on Ethereum would peak during the run-up to a new all-time high, the same can’t be said for searches of “Bitcoin,” which remain at just 65% of its peak popularity on Dec. 23, 2017. That said, many more people are searching for “Bitcoin” rather than “Ethereum” by a ratio of approximately 5:1. An increase in popularity for various crypto search terms could potentially spawn a self-perpetuating bull run as curious investors make purchases, fueling the price upward, and thus sparking more interest, resulting a greater number of searches Google Trends also provides data corresponding to relative interest by region. Currently, the nations with the highest interest in “Ethereum” as a search term are Kosovo, North Macedonia, Slovenia, Nigeria and China.

Here are some cryptocurrency-related keywords along with their current interest expressed as a percentage of peak interest, which for most terms was in Dec. 2017 or Jan. 2018:

0 Comments

The Chicago Mercantile Exchange (CME) announced Wednesday it will launch a futures contract on ether, the world’s second-largest cryptocurrency by market value, in February 2021.

CME: Ether futures contract specifications Source: CME

Launch of Ethereum Futures Still ‘Up In The Air’ In mid-December, as CBOE’s and CME’s Bitcoin (BTC) futures offering turned one-year-old, rumors began to mount regarding a similar vehicle for Ethereum (ETH). As reported by Ethereum World News, the U.S. Commodities Futures Trading Commission, the financial regulator that holds jurisdiction over certain crypto instruments, began to look into Ether. In a public release, the somewhat crypto-friendly body wrote: The RFI [Request For Information] also seeks to understand similarities and distinctions between Ether and bitcoin, as well as Ether-specific opportunities, challenges, and risks. As this seemingly innocuous development broke, many crypto pundits and commentators began to speculate that the entity was looking to get feedback on the Ethereum project to precede a ruling on ETH-backed vehicles. While it seems that strides were made behind closed doors, a recent report from The Block claims that providers of products similar to Ethereum futures themselves are skeptical of such offerings. Speaking to the outlet in an interview, Paul Chou, chief executive of crypto investment startup LedgerX, explained that there’s only a 50/50 chance that ETH vehicles go live in 2019. Backing his quip, Chou explained that many proposals for the aforementioned product type are “premature,” just as Bitcoin exchange-traded fund (ETF) applications were just two years ago. The LedgerX chief’s sentiment was echoed by other pundits that The Block spoke to. Former CFTC advisor Jeff Bandman, the head of a cryptocurrency consultant group, explained that Ethereum’s proposed plan to integrate Proof of Stake (PoS) may complicate regulations, specifically due to the potential risks. Nelson Rosario, an attorney with hands in the proverbial crypto jars, also noted that staking may be seen as suspicious in regulators’ eyes. Likely referencing physically-held futures, Rosario explained that live staking with Ether may complicate products to high hell while confusing network developers in the process. While the prospects for ETH-backed futures in America seem ‘up in the air’, across the pond, there may be a different story. Per previous reports from us, a Hong Kong-headquartered, Roger Ver-backed up-and-coming crypto startup, now named CoinFLEX, is planning to offer physical Ether futures with up to twenty times leverage. It wasn’t divulged when the vehicle would go live, but firm founder, Mark Lamb, seemed quite optimistic, both for his firm and the future of crypto-related derivatives. In a recent interview with Bloomberg, he claimed: Crypto derivatives could become an order of magnitude larger than spot markets and the main thing that’s holding back that growth is the lack of physical delivery… Volumes are reduced because of a problem of trust when it comes to cash-settled trades. Interestingly, many analysts and researchers are unconvinced that such a product would push the value of Ether higher. In fact, in early-September of last year, Tom Lee, Fundstrat’s in-house controversial crypto commentator, claimed that the product would hurt ETH, but aid BTC. Lee remarked that Ether futures will allow speculators to weigh down on the price of ETH. Despite Ethereum Skepticism, Bitcoin ETF Hype Remains All this talk surrounding Ethereum futures comes amid a newfound hype for Bitcoin ETFs and products of similar caliber. And interestingly, while futures are seen as less demanding than ETFs, analysts have high hopes for the latter, compared to the former. Just recently, Bitwise Asset Management filed a Bitcoin ETF application to the U.S. Securities and Exchange Commission via an S-1 Form. Just days earlier, the Winklevoss Twins, the two behind one of the first, if not the first Bitcoin ETF proposal (which was denied), made it clear that they expect to see such a product through, whether it takes months, years, or even decades. And, a few days before that, Bloomberg sources claimed that Japan’s regulators were looking into allowing Bitcoin ETF proposals to be filed. Yet, these claims were quickly rebutted by official spokespeople. Regardless, this accentuates how there continues to be a discussion on the matter, even amid an extended price lull.

Ethereum’s long-anticipated Constantinople upgrade has just been delayed after a critical vulnerability was discovered in one of the planned changes.

Smart contract audit firm ChainSecurity flagged Tuesday that Ethereum Improvement Proposal (EIP) 1283, if implemented, could provide attackers a loophole in the code to steal user funds. Speaking on a call, ethereum developers, as well as developers of clients and other projects running the network, agreed to delay the hard fork – at least temporarily – while they assessed the issue. Participants included ethereum creator Vitalik Buterin, developers Hudson Jameson, Nick Johnson and Evan Van Ness, and Parity release manager Afri Schoedon, among others. A new fork date will be decided during another ethereum dev call on Friday. Discussing the vulnerability online, the project’s core developers reached the conclusion that it would take too long to fix the bug prior to the hard fork, which was expected to execute at around 04:00 UTC on Jan. 17. Called a reentrancy attack, the vulnerability essentially allows an attacker to “reenter” the same function multiple times without updating the user about the state of affairs. Under this scenario, an attacker could essentially be “withdrawing funds forever,” said Joanes Espanol, CTO of blockchain analytics firm Amberdata in a previous interview with CoinDesk. He explained: “Imagine that my contract has a function which makes a call to another contract… If I’m a hacker and I’m able to trigger function a while the previous function was still executing, I might be able to withdraw funds.” This is similar to one of the vulnerabilities found in the now-infamous DAO attack of 2016. ChainSecurity’s post explained that prior to Constantinople, storage operations on the network would cost 5,000 gas, exceeding the 2,300 gas usually sent when calling a contract using “transfer” or “send” functions. However, if the upgrade was implemented, “dirty” storage operations would cost 200 gas. An “attacker contract can use the 2300 gas stipend to manipulate the vulnerable contract’s variable successfully.” Constantinople was previously expected to activate last year, but was delayed after issues were found while launching the upgrades on the Ropsten testnet. Blockchain technology has already found its way into local government services in the United States, but Nevada particularly is proactive, the AP reported on Jan. 7.

Citing specifically the use of blockchain to issue digital marriage certificates, the publication found that two counties in the Silver State had already integrated the technology or were running trials. In total, 950 such digital certificates, which use smart contracts on the Ethereum blockchain for security, had been issued to couples residing both within and outside Nevada since April 2018. However, according to local officials, willingness to automatically accept the new format is mixed. “But some people say, ‘Nah, I don’t use email so I don’t want it,’” the AP quotes Hunter Halcomb, a Washoe County systems technician as saying. The gradual introduction of blockchain into real world scenarios continues to see mixed success in the U.S. As Halcomb noted, even the digital certificates see varied acceptance across government agencies, despite their legitimacy and even reportedly enhanced provenance over traditional paper versions. In 2017, Nevada became the first state to exempt blockchain transactions from tax obligations. Currently, various states across the country are either considering applications of blockchain or seeking to redesign laws to make its growth and that of cryptocurrency more appealing. Lawmakers in nearby Colorado are reviewing plans to exempt digital tokens from various securities laws. Follow Bitcoin soaks up most of the hype and the opprobrium heaped on cryptocurrencies, leaving its younger and smaller sibling Ethereum in the shadows. But Ethereum is anything but small. Its market capitalization was roughly US $10 billion at press time, and it has an equally whopping energy footprint. Ethereum mining consumes a quarter to half of what Bitcoin mining does, but that still means that for most of 2018 it was using roughly as much electricity as Iceland. Indeed, the typical Ethereum transaction gobbles more power than an average U.S. household uses in a day. “That’s just a huge waste of resources, even if you don’t believe that pollution and carbon dioxide are an issue. There are real consumers—real people—whose need for electricity is being displaced by this stuff,” says Vitalik Buterin, the 24-year-old Russian-Canadian computer scientist who invented Ethereum when he was just 18. Buterin plans to finally start undoing his brainchild’s energy waste in 2019. This year Buterin, the Ethereum Foundation he cofounded, and the broader open-source movement advancing the cryptocurrency all plan to field-test a long-promised overhaul of Ethereum’s code. If these developers are right, by the end of 2019 Ethereum’s new code could complete transactions using just 1 percent of the energy consumed today. Ether Evangelist: Vitalik Buterin, inventor of Ethereum, hopes to finally demonstrate the blockchain platform’s low-power format in 2019.

Ethereum’s attempted rebirth will be one of the year’s “most fascinating technologies to watch,” says Zaki Manian, who is advising the cryptocurrency upstart Cosmos. Manian says Ethereum’s development process means that multiple coders and organizations must collaborate in the open, converge on specifications, invent all of the technology to implement them, and make them work together seamlessly. “It is by far the most technically ambitious open community project that has ever been attempted,” says Manian. Like Bitcoin, Ethereum relies on a blockchain, which is a digital ledger of transactions maintained by a community of users. (It’s called a blockchain because new transactions are bundled into “blocks” of data and written onto the end of a “chain” of existing blocks that describe all prior transactions.) However, Buterin designed Ethereum to do more than securely maintain a ledger without a central authority. His vision was for Ethereum to become a global computer—one that’s decentralized, accessible to all, and essentially immune to downtime, censorship, and fraud. What gives the Ethereum blockchain such potential is its ability to store data, support decisions, and automate the distribution of value. It manages these tasks through smart contracts, programs written by users or developers in Ethereum’s custom coding language. Smart contracts have obvious business applications, but the long-term hope is that apps built from them will eventually make Ethereum the ultimate cloud- computing platform. That lofty vision clashes with Ethereum’s current reality. While there are some multimillion-dollar apps running on it, even Buterin says he suspects that Ethereum is consuming more resources than it returns in societal benefits. The problem is all that mining. Like most cryptocurrencies, Ethereum relies on a computational competition called proof of work (PoW) . In PoW, all participants race to cryptographically secure transactions and add them to the blockchain’s globally distributed ledger. It’s a winner-takes-all contest, rewarded with newly minted cryptocoins. So the more computational firepower you have, the better your chances to profit. PoW mining is difficult by design. The idea is to prevent any one entity from controlling the blockchain. For example, if a bitcoin miner’s computer system had more than half of all the mining power on the network, that miner could perpetrate frauds, such as revising long- completed transactions. Bitcoin users would have little recourse because miners are anonymous. In theory, PoW keeps mining a distributed affair. In practice, however, the development of application-specific ICs (ASICs) that accelerate mining, produced by a handful of chip fabs in China, has concentrated power over many cryptocurrencies. Ethereum took the fight against concentrated power one step further by selecting a memory-intensive PoW algorithm for mining “ether,” as its value token is known. This ether-mining algorithm penalizes the use of ASICs. What Ethereum’s PoW algorithm has not prevented, however, is explosive growth in the computing resources devoted to ether mining. The computational power directed at that task grew more than 25-fold in 2017, as the token’s value surged from $8 to $862 and mining firms built dedicated data centers full of general-purpose graphics processing units, which are well-suited to ether mining. The resultant energy demand has created a backlash from environmentalists. Utilities and communities, meanwhile, see financial risk and opportunity costs if they cater to cryptocurrency miners that gobble up cheap electricity while creating few jobs. Serving miners may require utilities to make equipment upgrades, which could become superfluous if cryptocurrency prices crash and mining operations shut down. Recent market dynamics support the utilities’ concerns. The value of ether peaked at $1,385 last January and then began a downward slide. In November it crashed below $120—low enough to erase miners’ profit margin and to prompt some to slow down or turn off mining rigs. According to a projection by the Digiconomist—a site created by Alex de Vries, a senior associate and blockchain specialist at PricewaterhouseCoopers —Ethereum’s miners likely cut their total energy consumption by more than half in less than 20 days. No surprise then that some utilities, such as Montreal-based Hydro-Québec , are setting higher electricity rates for miners. Such pushback from utilities and their regulators may further erode the security of PoW-based cryptocurrencies. Restricted access to power and rising energy costs will hinder new miners from joining the game, accelerating the concentration of mining power. As it concentrates, the risk of collusion and fraud increases. For Buterin, slashing energy use has been part of the vision from Ethereum’s beginning. Most of Ethereum’s other proponents agree. “It’s widely accepted in the Ethereum community that PoW uses far too much energy. For me it is the No. 1 priority,” says Ethereum contributor Paul Hauner, a cofounder of Australian cybersecurity and blockchain-development firm Sigma Prime. Ethereum’s plan is to replace PoW with proof of stake (PoS)—an alternative mechanism for distributed consensus that was first applied to a cryptocurrency with the launch of Peercoin in 2012. Instead of millions of processors simultaneously processing the same transactions, PoS randomly picks one to do the job. In PoS, the participants are called validators instead of miners, and the key is keeping them honest. PoS does this by requiring each validator to put up a stake—a pile of ether in Ethereum’s case—as collateral. A bigger stake earns a validator proportionately more chances at a turn, but it also means that a validator caught cheating has lots to lose. Moving to PoS will cut the energy consumed per Ethereum transaction more than a hundredfold, according to Buterin: “The PoW part is the one that’s consuming these huge amounts of electricity. The blockchain transactions themselves are not super computationally intensive. It’s just verifying digital signatures. It’s not some kind of heavy 3D-matrix map or machine learning on gigabytes of data,” he says. Slashing computational power and energy use is not just an ecological move. It also has a financial benefit, because it should reduce the rate at which fresh ether is issued to encourage validators—extra money that dilutes a currency’s value. “Because PoS validators aren’t expending all of this energy, we don’t have to reward them as much,” says Darren Langley, a senior blockchain developer with Rocket Pool, in Brisbane, Australia, which is developing an app that will assemble staking pools, paying interest to ether owners who join the pool. Moving to PoS could also boost security. Under PoS, the location of each validator’s account is known and can be destroyed if that validator breaks the rules. Vlad Zamfir, Ethereum Foundation’s lead PoS developer, likens this to the Bitcoin community gaining the power to incinerate the data centers of a miner who abuses his power. By 2015, the advantages of PoS had already convinced the Ethereum community to make the shift, and leaders such as Buterin had expected to do so in just a year or two. To make their intentions clear, Ethereum’s core developers reprogrammed their PoW code to create an exponential rise in mining difficulty. Known as the “Difficulty Bomb,” it began slowing the creation of new transaction blocks in late 2016 and was expected to bring ether mining to a grinding halt a few years thereafter. This time bomb has, however, functioned more like an alarm clock with a snooze button. In October 2017, when mining time had already nearly doubled to 30 seconds, the Ethereum team reset the clock, delaying PoW’s doomsday by about 12 months. And they will likely hit snooze again shortly. It’s not that Team Ethereum is sleeping in. In fact, Buterin says, Ethereum’s developers have already slain most of the theoretical dragons associated with PoS. But the process of turning those theoretical solutions into efficient software has been moving slower than expected. What provides hope for 2019 is a radical new plan adopted by Ethereum’s leaders in June 2018. Before then, they had anticipated building PoS into the existing Ethereum blockchain. In June, they decided to make a clean break and to build an entirely new blockchain—one that operates solely via PoS. The two-chain solution—dubbed Ethereum 2.0—makes a world of difference for Ethereum’s programmers because continuing on the original chain would have meant writing the machinery of PoS as a sophisticated set of smart contracts. Hauner, who is leading an effort called Lighthouse to build an Ethereum 2.0 software client, says Ethereum’s smart-contract language is a tough medium for writing complex code. “Writing smart contracts is a very constrained environment for computing. You can’t do complicated things on it,” he says. Just a few months after the decision to shift to Ethereum 2.0, its PoS specifications had been sketched out and over half a dozen teams were already working on software implementations using a variety of programming languages. Hauner’s group at Sigma Prime is developing its Ethereum 2.0 client using Rust, for example. He expects this app and others to be running PoS on beta networks, or “testnets,” early in 2019. Buterin says public testnets could be handling another Ethereum 2.0 innovation—chains with multiple branches to boost transaction throughput—by the end of 2019. But he warns that there could still be “unknown unknowns” lurking that could set their timeline back. As a multibillion-dollar network, Ethereum obviously has a lot to lose if it launches glitchy or insecure technology. To play on Ethereum’s PoS chain, holders of ether will have to deposit a smart contract on the original Ethereum chain that irreversibly transfers ether to the new chain. Any missteps could jeopardize the entire ecosystem of developers and projects that use Ethereum’s smart contracts. But Ethereum also has a lot to lose if it delays much longer. An array of well-capitalized projects—Cardano, Dfinity, Eosio, and Manian’s Cosmos, to name just a few—are hatching their own PoS-based blockchains. Like Ethereum, they seek to prove that high security and high efficiency are not at odds. The first to unleash the potential for blockchain applications may well become the computing platform of the future. The others will probably wither away. “This environment is naturally quite predatory,” Manian says. “There will be a single platform that survives.” Ethereum (ETH)-based chat platform Status is laying off 25 percent of its staff due to the recent cryptocurrency market decline, according to a post published Dec. 11.

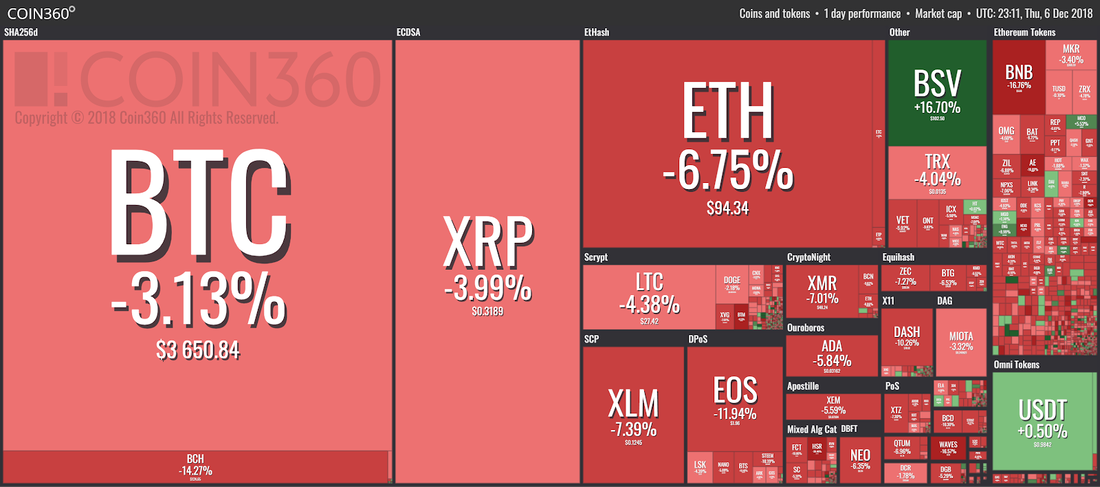

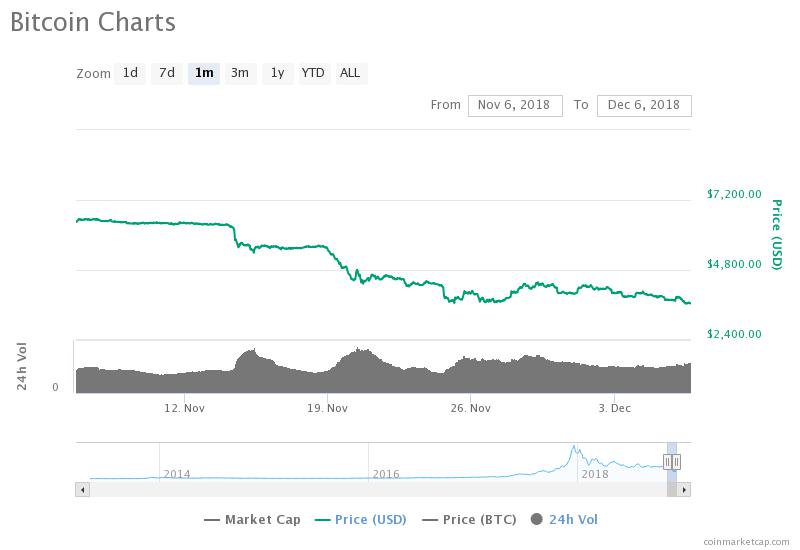

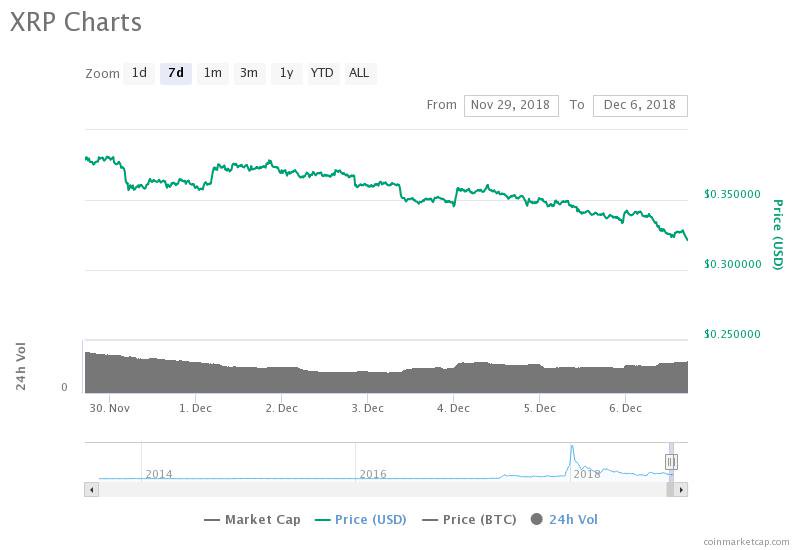

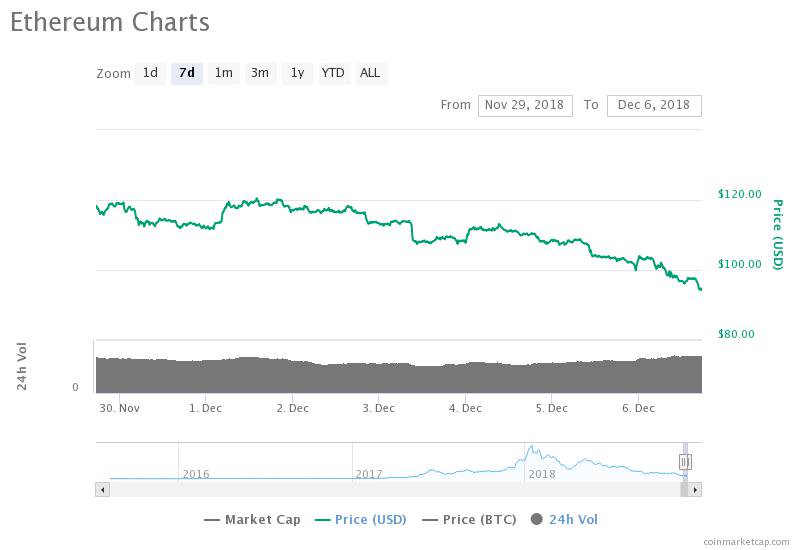

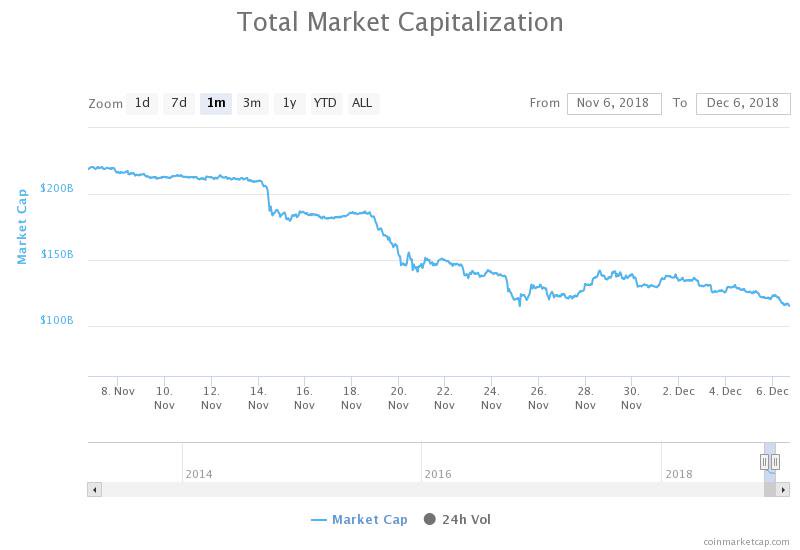

Founded in 2017 in Switzerland, Status is an open source Ethereum-based mobile app that enables its users to chat, transact, and access decentralized applications (DApps). In the announcement, the startup's co-founder Jarrad Hope said that Status is “much larger than we can sustain” in the environment of the declining market, wherein the company was not prepared for scenarios of ETH dropping over 80 percent since August. “This was compounded by not having solid banking partners due to the difficulty in opening banking accounts for crypto projects until Q2 of this year, and have been hedging since then accordingly,” the announcement further reads. According to Status, 25 percent of its staff is “non-essential” to the company’s long-term growth projects, and are therefore being laid off. Remaining employees have been asked to take a paycut and will purportedly be given a sum of Status’ native virtual currency SNT “to help offset the cut and align with the network’s success.” In order to set up a “runway measured in years,” Status is going to tap into its remaining fiat money and “large” ETH holdings. The startup has also asked remaining employees to actively contribute to the development of its two priority projects, which are to “deliver on white paper promises” and get the app to a “usable state.” In November, another cryptocurrency-based startup, Steemit, laid off more than 70 percent of its staff due to the cryptocurrency market crash, and began a structural reorganization. The recent drop in crypto markets purportedly resulted in a decrease in fiat currency returns from the company’s automated STEEM token sales. Additionally, the cost of running Steem’s nodes has increased. The crypto market experienced a harsh fall on Nov. 14, with Bitcoin (BTC) slumping from its average trading price of around $6,400 to as low as $5,506. This week, the leading coin dipped even lower, to as low as $3,199, while ETH’s lowest price point was $83.50. At press time, SNT is the 67th largest coin by market capitalization and is trading at $0.0134, down 4.41 percent on the day. The coin’s market capitalization is nearly $47 million, and its total supply is over 6.8 billion coins, according to CoinMarketCap. Thursday, Dec. 6: Cryptocurrency markets have continued yesterday’s losses, with just two of the top twenty coins seeing any gains, according to Coin360. Bitcoin (BTC) is down 3.13 percent the day, seeing a high of $3,887 and low of $3,587. At press time, the major cryptocurrency is trading around $3,656. On its weekly chart, BTC is at its lowest price point over the past seven days, down 14.4 percent, while the coin’s monthly statistics show grim 43 percent losses. The second largest virtual currency by market capitalization Ripple (XRP) is trading at $0.320 at press time, down 5.36 percent on the day. The altcoin’s market cap is around $12.7 billion, while its weekly high point was $15.3 on Nov. 30, according to CoinMarkerCap. Ethereum (ETH) have lost 7.85 percent in the last 24 hours, dipping below the $100 mark for the first time during the past month. The coin is trading around $95 as of press time. ETH’s market cap is $9.7 billion at press time. Top 10 coin Bitcoin Cash (BCH) is one of the top 20 coins, has registered major losses on the day. The altcoin is down by over 14 percent during the last 24 hours and is trading at around $112 at press time.

The Bitcoin Cash hard fork has been followed by a lawsuit filed by Florida-based United American Corp. against crypto exchanges Bitmain, Kraken, Bitcoin.com, and BCH evangelist Roger Ver, claiming that they engaged in “unfair methods of competition” that were detrimental to UnitedCorp and other stakeholders. United American Corp. claims that during the hard fork, a number of entities took control of the network using “rented hashing” to facilitate the adoption of Bitcoin ABC, while “no person or entity can be allowed to control them.” Bitcoin SV (BSV), in turn, has seen noteable daily gains of 22.55 percent, and is trading at around $107.31 at press time. BSV’s maximum supply is 21 million, while its market capitalization is around $1.8 billion at press time. Today’s major losers also include EOS and Binance Coin (BNB), which are down 14.19 percent and 17 percent respectively. As of press time, EOS is trading at $1.90 and BNB is around $5. Total market capitalization of all cryptocurrencies is around $114.4 billion at press time. On its monthly chart, total market cap has been showing a steady downtrend. According to cryptocurrency analyst Eric Thies, the crypto market may have hit a bottom in September as the price of Ethereum (ETH) declined by more than 50 percent.

Since delving below the $180 mark, ETH has since recovered to $230, likely due to the demonstration of massively oversold conditions by the market in late September. ETH Enabled ICO Bubble, Which Led to Crypto Bubble ETH/USD | BitfinexThroughout the third and fourth quarters of 2017, interest and demand for initial coin offering (ICO) projects hit an unprecedented level. Blockchain projects raised significantly more capital through token sales than from venture capital firms. TechCrunch exclusively reported that ICOs raised 3.5x more capital than VC-backed startups in the blockchain sector. Jason Rowley wrote: “Over the past 14 months, blockchain and related startups have raised nearly $1.3 billion in traditional venture capital rounds worldwide. But for the ICOs Crunchbase has captured, nearly $4.5 billion was raised via ICOs.” Thies stated that the massive growth of the ICO sector contributed to the mid-term rally of the crypto market as it achieved an all-time high valuation of nearly $900 billion. He theorized: “Bitcoin’s run in the end of 2017 was fueled by a massive ICO (ERC20) bubble and therefore indirectly fueled via ETH. .Meaning that ETH capitulating in early September was significant to ending the bear market. We were all looking in the wrong place, expecting BTC to do it.” Bitcoin has declined from $12,000 to $6,000 in early February amidst a bear market, and Thies stated that the end of the capitulation of Bitcoin was when the dominant cryptocurrency consistently started to demonstrate a high level of stability at the $6,000 mark. BTC/USD | Bitfinex“BTC parabolic continuation into mid-December was due in-part to the $BCH fork from August. Those with high amounts of BTC now had freeplay money to throw at whatever ICO was on the come up. BCH has also capitulated, while we were once again looking elsewhere. The third factor is $USDT and the enormous influx of liquidity coming into the market via exchanges, etc.,” he added. Since then, Bitcoin, Ethereum, and the rest of the cryptocurrency market have stabilized in a low price range, which could allow the market to collectively initiate a short-term rally. Many Experts Believe Crypto Has Hit a BottomBillionaire investor Mike Novogratz famously stated in early September that Bitcoin has bottomed out at $6,000. ShapeShift creator and CEO Erik Voorhees emphasized that while the bear market is not over, it is a viable period for investors to accumulate because it is difficult for BTC to decline below its current level. Technical indicators have suggested that the market is bear biased, with Bitcoin demonstrating its lowest yearly volume over the past seven days. But, given the positive developments in the cryptocurrency sector and the stability BTC has shown throughout the past two months since early August, it is entirely possible that the bottom of the crypto market has already been established. A new partnership will soon enable ethereum users to attach their addresses to a top-level internet domain name, making it easier to remember the identifiers associated with their assets, wallets and services.

The Ethereum Name Service (ENS), which allows ethereum users to replace long addresses with "human readable names" attached to a .eth domain, has partnered with Minds + Machines Group (MMX), a company that owns and operates "top-level domains" within the internet's Domain Name System (DNS) (others include .com or .uk, for example). Announced on Friday, the collaboration means ethereum users will be able to register their addresses with MMX's soon to be launched .luxe domain, which stands for "lets u xchange easily," offering a more user-friendly way to access the blockchain's assets and services like dapps and smart contracts. Likewise, MMX said the .luxe addresses will allow "names to resolve over the internet in the normal way for email or web-based traffic," enabling users to conduct "traditional internet activity" with the same address used for their ethereum assets and services. "We're very excited to be helping advance integration between existing DNS-based name services and the Ethereum Name Service, improving usability for blockchain applications and users," ENS lead developer Nick Johnson said in a statement. He added in an email that the "natively 'blockchain enabled'" .luxe domain will offer "more choices of domain and of trust model" for ethereum users, and that the partnership "improves integration between the legacy DNS space and blockchain technologies." MMX is confident that sufficient demand exists for .luxe, and pointed to ENS' success as evidence. "We already know from ethereum's test in its .eth zone that there is a real proven demand for word-based identifiers that are blockchain enabled," CEO Toby Hall said in the statement. Launched in 2017, ENS features "an automated registrar that allows anyone to register domain names ending in '.eth'" via an auction. As previously reported by CoinDesk, identifiers foundation.eth and exchange.eth were claimed for about $27,000 in ETH and $609,000 in ETH respectively in 2017. MMX has not yet launched .luxe, and plans to hold a "limited registration period" in October for ENS users to claim their equivalent .luxe names. It plans to offer .luxe names to the public starting on October 30. |

Archives

January 2021

Categories |

RSS Feed

RSS Feed