|

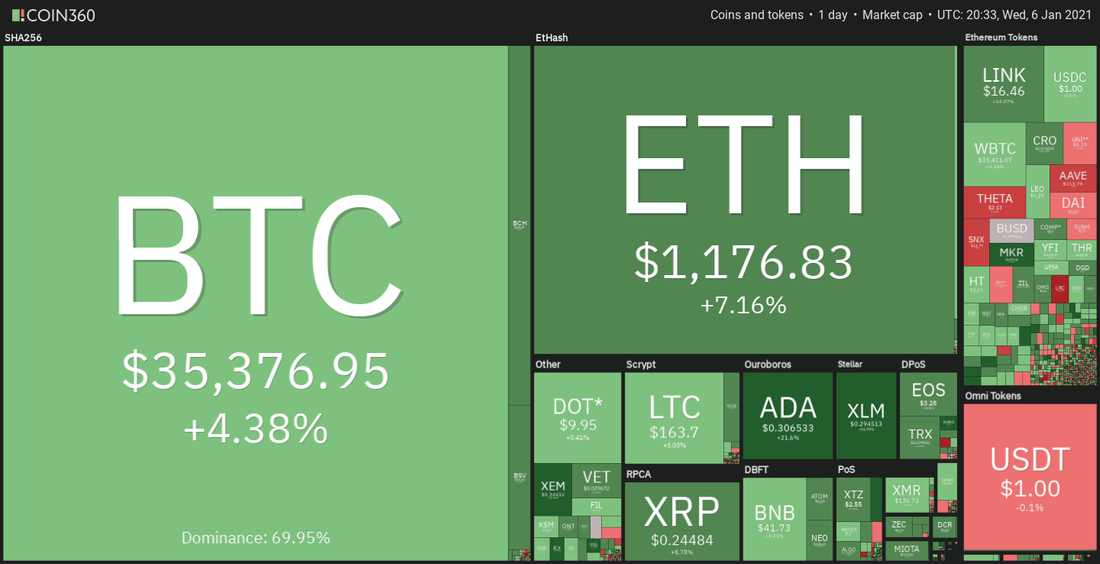

Aggressive buying by institutional investors is one of the main reasons for the current Bitcoin (BTC) bull run. Some investors expressed their intent to hold their positions for a few years, but it is also prudent to note that many of these investors have recently developed a love for Bitcoin and their conviction to HODL may not resemble that of the early Bitcoin whales. The current bull market could also differ from the last as institutional investors simply cannot hold on to their positions if Bitcoin unexpectedly enters a sharp correction. These fund managers will have to face angry clients if Bitcoin's performance wanes, thus it's important to keep a level head when considering the lofty price estimates being thrown out by analysts. Bitpay’s chief commercial officer Sonny Singh said in an interview with Bloomberg that if Bitcoin’s rally continues, the institutional investors may be tempted to lock in their gains and are unlikely to HODL for the long term. If that happens, the markets may have to deal with a huge amount of selling, which could result in a sharp fall unless new institutional investors or long-term Bitcoin whales step in and buy. A few metrics such as rising futures open interest and a high funding rate suggest that traders are taking aggressive bullish bets on Bitcoin’s rally continuing. As has occurred in the past, a sharp downturn in Bitcoin price could result in leveraged players facing a massive long liquidation. Therefore, it only makes sense that at this juncture, traders exercise caution and use proper money management principles to protect their paper profits. While Bitcoin’s rally toward $36,000 may have slowed down, several altcoins are skyrocketing. Let’s study the charts of the top-10 cryptocurrencies to determine the possible target levels on the upside. The next target objective on the upside is $37,000 and if that level is scaled, the BTC/USD pair could rise to $45,000. However, the relative strength index (RSI) remains in overbought territory indicating the risk of a correction. The first support on the downside is the 20-day exponential moving average ($28,213). If the pair rebounds off this support, it will suggest that traders continue to buy the dips and that could keep the uptrend intact. Conversely, if the price breaks below the 20-day EMA, it could result in panic selling that could sink the pair to the 50-day simple moving average ($22,285). ETH/USDEther (ETH) has resumed the uptrend today as the bulls have pushed the price above the Jan. 4 intraday high at $1,156.456. However, the RSI above 88 suggests that the biggest altcoin is overbought in the short term. If the price does not sustain above $1,156.456, the ETH/USD pair could consolidate in a tight range for a few days before attempting the next trending move. Conversely, if the pair sustains above $1,156.456, it will suggest that the melt-up is likely to continue. In such a case, the pair may rally to $1,260 and then to $1,420. The pair will signal a possible change in trend if the price turns down and plummets below the $840.93 support. XRP/USDWhile most major altcoins have been surging, XRP has been languishing near its recent lows, suggesting that traders are not aggressively buying at the current level The consolidation also suggests that the bears are taking it easy. This lack of interest from the bulls and the bears could extend the range-bound action for a few more days.

The next leg of the down move could start if the bears sink the price below the $0.169 support. Such a move could trigger panic selling that may result in a decline to $0.10. On the contrary, a break above the 20-day EMA ($0.30) will be the first sign of strength and the recovery could pick up steam above $0.385.

1 Comment

8/27/2023 09:04:38 am

I really enjoyed your blog posts, thank you

Reply

Leave a Reply. |

Authoranyone can contribute. Archives

May 2022

Categories |

RSS Feed

RSS Feed