|

First and foremost, Shiba Inu is built on the Ethereum blockchain and is solely an ERC-20 token. Ethereum allows other tokens to run and operate on their platforms and charge gas fees for transactions. The transactions include buying and selling a particular token of your choice on the ETH network.

However, the Ethereum network is plagued with high gas fees due to network congestion and investors need to shell more money to complete their transactions. Therefore, the layer-2 solution comes to the rescue. Tokens can build their layer-2 solution on top of the Ethereum network and surpass its high gas fees. The point to be noted is that the layer-2 solution is not a standalone blockchain but runs on top of the Ethereum blockchain. If implemented, Shibarium will be a layer-2 network for all transactions and will not depend on the ETH network. In other words, SHIB will have its blockchain, which is the layer-2 solution Shibarium. Shibarium is expected to provide users with a reduction in gas fees and will be an in-house platform for transactions. This makes users save money and spend more on investments rather than paying high gas fees. Article By: Vinod Dsouza

0 Comments

Shiba Inu has a lot of developments up its sleeve this year which includes the full launch of ShibaSwap 2.0, SHIB the Metaverse, a partnership with PlaySide Games along with play-2-earn blockchain game. In addition, the most-awaited release of them all is Shibarium and investors are eager to know about Shibarium’s launch date. However, the lead developer of ShibaSwap, Shytoshi Kusama dropped a hint about Shibarium’s release by responding to the million-dollar question. The iconic phrase ‘When Robinhood?’ has now turned into ‘When Shibarium?’ among Shiba Inu investors. The community is riled up and is eager to know when will the layer-2 solution released. Finally, Shytoshi paid heed to the ‘When Shibarium’ brigade on social media and responded to the question. Shytoshi tweeted about Welly’s NFT today and a user asked him “When SHIBARIUM Sir?” Shytoshi minced no words and replied immediately to the user saying, “ACTUALLY pretty soon.” He also added, “Look for documentation very soon.” So there you go! As per Shytoshi’s own words, Shibarium will be released “pretty soon.” Investors will get the see the “documentation very soon.” He mentioned the word “soon” twice in the same tweet suggesting that it could be well around the corner. Nonetheless, Shytoshi has not given out a tentative release date for Shibarium’s launch. We will have to wait and watch for an official confirmation from the team regarding Shibarium’s release date. Even Shiba Inu’s top influencer, Milkshake tweeted a thread highlighting the importance of layer-2 solutions on the Ethereum blockchain. “Ethereum layer-2 solutions have some serious potential to change the blockchain landscape for the better,” she tweeted. Check out her entire thread of tweets below. Article by: Vinod Dsouza

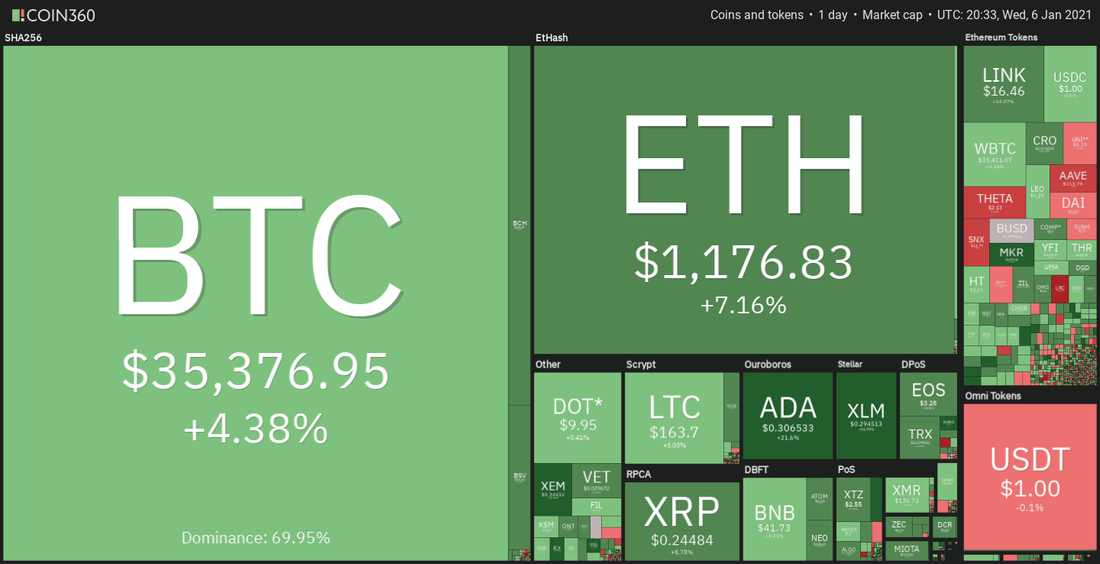

BCH/USD The bulls did not allow Bitcoin Cash (BCH) to plummet back below the $370 breakout level on Jan. 4 and 5. This shows accumulation by traders at lower levels. The bulls are currently attempting to resume the uptrend If the bulls can push the price above $467.67, the BCH/USD pair may rally to the stiff overhead resistance at $515.35. The previous two rallies had reversed direction from the $497 to $515.35 resistance zone. Thus this zone is likely to attract aggressive selling by the bears. However, if the bulls can absorb the selling and drive the price above $515.35, it may signal the start of a new bull run. On the contrary, if the price turns down from $467.67, the pair may consolidate between $370 and $467.67 for a few days. XLM/USD Stellar Lumens (XLM) has picked up momentum in the past three days. The altcoin broke above the descending channel on Jan. 05 and soared today, pushing the price above the $0.35 overhead resistance. However, the long wick on the day’s candlestick suggests profit booking above $0.35. The bears will now try to pull the price back below $0.2864. If they succeed, the XLM/USD pair may enter a minor correction. Conversely, if the bulls flip $0.2864 to support, the pair may resume its uptrend. If the price breaks above $0.391, the rally could extend to $0.50. LINK/USD Chainlink (LINK) bounced off the 20-day EMA ($13) on Jan. 4 and the 50-day SMA ($13.07) on Jan. 5, which shows strong buying on dips. The moving averages are on the verge of a bullish crossover, suggesting buyers are in control. If the bulls can sustain the LINK/USD pair above $16.39, the rally could extend to $20.1111. The bears are likely to defend this resistance aggressively. However, if the bulls do not give up much ground, the possibility of a break above $20.1111 increases and the next target objective on the upside is $25. This bullish view will invalidate if the price turns down from the current levels or the overhead resistance and breaks below the $13.28 support. Such a move will suggest a lack of demand at higher levels. BNB/USD Binance Coin (BNB) made a long-legged Doji candlestick pattern on Jan. 4 and followed it up with an inside day candlestick pattern on Jan. 5 that had a long tail. This suggests that the bears tried to pull the price down but the bulls purchased at lower levels. If buyers can drive the price above $43.2039, the BNB/USD pair may resume the uptrend and rally to $50. The upsloping moving averages and the RSI in the overbought territory suggest that the path of least resistance is to the upside.

On the other hand, if the pair again turns down from the overhead resistance level and breaks below $38, it will suggest that the bears have overpowered the bulls. That could result in a correction to $32. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision. XRP/USD While most major altcoins have been surging, XRP has been languishing near its recent lows, suggesting that traders are not aggressively buying at the current levels. The consolidation also suggests that the bears are taking it easy. This lack of interest from the bulls and the bears could extend the range-bound action for a few more days. The next leg of the down move could start if the bears sink the price below the $0.169 support. Such a move could trigger panic selling that may result in a decline to $0.10. On the contrary, a break above the 20-day EMA ($0.30) will be the first sign of strength and the recovery could pick up steam above $0.385. LTC/USD After the large range day on Jan. 4, Litecoin (LTC) formed an inside day candlestick pattern on Jan. 5, which showed indecision among the bulls and the bears. The uncertainty has resolved to the upside and the bulls are currently attempting to resume the uptrend. If the bulls can propel the price above $173.3312, the LTC/USD pair could rally to $180 and then to $200. However, if the price turns down from $173.3312, then the pair could drop to $140 and remain range-bound between these two levels for a few days. A breakdown below the $140 support and the 20-day EMA ($130) may shift the advantage in favor of the bears. ADA/USD Cardano (ADA) is currently in a strong uptrend that has a target objective of $0.40. If this level is scaled, the altcoin could even rally to $0.50. However, the sharp rally since Jan. 3 has pushed the RSI deep into the overbought territory. History suggests that whenever the RSI rises above 80, the ADA/USD pair has witnessed a minor correction or consolidation. Therefore, traders may prepare for a minor pullback in the next few days. If the bulls do not give up much ground and the pair rebounds off the 38.2% Fibonacci retracement level at $0.2757469, it will suggest that traders are not booking profits in a hurry. The bulls could then attempt to resume the uptrend. Conversely, if the bears pull the price below the 50% Fibonacci retracement level at $0.2552813, it will suggest aggressive profit booking at higher levels and such a move could deepen the correction or keep the pair range-bound for a few days. DOT/USD Polkadot (DOT) recovered from $8.70 on Jan. 4, just above the 38.2% Fibonacci retracement level at $8.4507. This shallow correction suggests traders are aggressively buying on every minor dip. If the bulls can thrust the price above $10.5169, the DOT/USD pair could pick up momentum and rally to $12.39 and then to $15.

However, if the price turns down from $10.5169, the pair may drop to $8.70 and remain range-bound between these two levels for a few days. A consolidation near the overhead resistance is a positive sign and increases the possibility of the resumption of the uptrend. This positive view will invalidate if the bears sink the price below $8.70. Such a move could pull the price down to the 20-day EMA ($7.59). Aggressive buying by institutional investors is one of the main reasons for the current Bitcoin (BTC) bull run. Some investors expressed their intent to hold their positions for a few years, but it is also prudent to note that many of these investors have recently developed a love for Bitcoin and their conviction to HODL may not resemble that of the early Bitcoin whales. The current bull market could also differ from the last as institutional investors simply cannot hold on to their positions if Bitcoin unexpectedly enters a sharp correction. These fund managers will have to face angry clients if Bitcoin's performance wanes, thus it's important to keep a level head when considering the lofty price estimates being thrown out by analysts. Bitpay’s chief commercial officer Sonny Singh said in an interview with Bloomberg that if Bitcoin’s rally continues, the institutional investors may be tempted to lock in their gains and are unlikely to HODL for the long term. If that happens, the markets may have to deal with a huge amount of selling, which could result in a sharp fall unless new institutional investors or long-term Bitcoin whales step in and buy. A few metrics such as rising futures open interest and a high funding rate suggest that traders are taking aggressive bullish bets on Bitcoin’s rally continuing. As has occurred in the past, a sharp downturn in Bitcoin price could result in leveraged players facing a massive long liquidation. Therefore, it only makes sense that at this juncture, traders exercise caution and use proper money management principles to protect their paper profits. While Bitcoin’s rally toward $36,000 may have slowed down, several altcoins are skyrocketing. Let’s study the charts of the top-10 cryptocurrencies to determine the possible target levels on the upside. The next target objective on the upside is $37,000 and if that level is scaled, the BTC/USD pair could rise to $45,000. However, the relative strength index (RSI) remains in overbought territory indicating the risk of a correction. The first support on the downside is the 20-day exponential moving average ($28,213). If the pair rebounds off this support, it will suggest that traders continue to buy the dips and that could keep the uptrend intact. Conversely, if the price breaks below the 20-day EMA, it could result in panic selling that could sink the pair to the 50-day simple moving average ($22,285). ETH/USDEther (ETH) has resumed the uptrend today as the bulls have pushed the price above the Jan. 4 intraday high at $1,156.456. However, the RSI above 88 suggests that the biggest altcoin is overbought in the short term. If the price does not sustain above $1,156.456, the ETH/USD pair could consolidate in a tight range for a few days before attempting the next trending move. Conversely, if the pair sustains above $1,156.456, it will suggest that the melt-up is likely to continue. In such a case, the pair may rally to $1,260 and then to $1,420. The pair will signal a possible change in trend if the price turns down and plummets below the $840.93 support. XRP/USDWhile most major altcoins have been surging, XRP has been languishing near its recent lows, suggesting that traders are not aggressively buying at the current level The consolidation also suggests that the bears are taking it easy. This lack of interest from the bulls and the bears could extend the range-bound action for a few more days.

The next leg of the down move could start if the bears sink the price below the $0.169 support. Such a move could trigger panic selling that may result in a decline to $0.10. On the contrary, a break above the 20-day EMA ($0.30) will be the first sign of strength and the recovery could pick up steam above $0.385. Bitcoin’s surge to $23,800 triggered strong rallies in large-cap altcoins like Litecoin and Dogecoin. Litecoin (LTC) and Dogecoin (DOGE) are rallying strongly as Bitcoin (BTC) fights to stay above $23,800. Many analysts say the surge in large-cap altcoins is directly connected to Bitcoin's price action and historical data shows the two tend to move in tandem when BTC goes through bull and bear cycles. As altcoins begin to show signs of newfound momentum, traders are becoming even more confident in the strength of BTC’s trend. Throughout December, altcoins stagnated against Bitcoin, particularly as BTC struggled to break out of the $18,000 to $19,400 range but this was in an environment plagued by low volume. At the time, the cryptocurrency market’s volume was on the decline as Bitcoin continuously rejected a $19,400. As such, most of the volume went towards BTC and the altcoin market was temporarily deprived of trading activity. LTC/USDT 4-hour chart. Source: TradingView.comBitcoin's break above $20,000 reignited interest in Litecoin and DogecoinHistorically, after a major Bitcoin rally, altcoins that existed in 2011 to 2014 tend to surge. These cryptocurrencies include the likes of Litecoin, Dogecoin, and XRP.

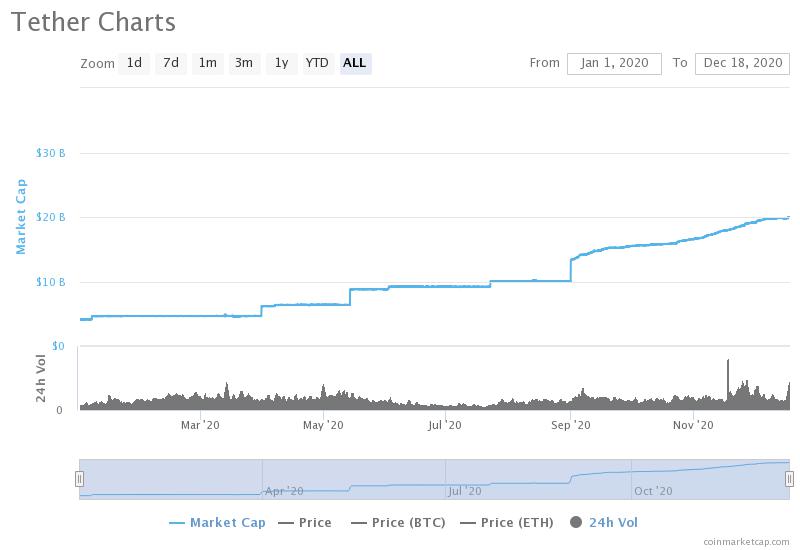

One of the major reasons behind this altcoin rally is volume. Traders like to pump up altcoins, causing the volume to spike within a short period, and fuelimassive volatility. Since these cryptocurrencies have significant historical relevance, when a rally starts, their momentum typically lasts longer than other obscure, smaller-cap altcoins. Litecoin, as an example, rallied by over 57% in the past 7 days. In the same period, Bitcoin rose by 34%, despite surpassing $23,800 on major exchanges. One positive trend analysts have spotted is that altcoins are not seeing extreme volatility as they did in 2017. A pseudonymous trader called MoonOverlord said: “One thing that never happened on this run was people panic dumping their $ALTS everytime $BTC moved 5% In 2017. I swear to god you’d look up, bang, alts would be -25% on a 4% BTC move it was awful. Tether and stables really didn’t even exist so you had to be $btc OR $alts.”Are fundamentals driving the current surge?According to Qiao Wang, a quant trader and DeFi researcher, Litecoin is not necessarily 'digital silver' in the same way analysts view Bitcoin as 'digital gold'. Since its launch, the go-to argument in favor of Litecoin was that it could act like silver if Bitcoin becomes gold 2.0. Wang said: “If you are new to crypto, bought BTC, and are wondering which cryptoasset is silver to BTC’s gold. It’s not LTC. It’s ETH. The other day Paul Tudor Jones used an interesting analogy from the metals world to categorize cryptoassets. There are precious crypto. And there are industrial cryptos. BTC is precious. ETH is industrial. LTC is neither.”Litecoin has various strong fundamental factors that could cause the market sentiment around it to improve. For instance, the Litecoin team is enabling MimbleWimble, a privacy solution initially designed for Bitcoin. However, these fundamental factors are not sufficient enough to fuel a 57% rally in a week. The primary reason behind the abrupt rally of large-cap altcoins is likely a volume play by high-net-worth investors and traders looking to make a quick buck in the aftermath of a Bitcoin rally. A record high for the largest stablecoin comes as Bitcoin cools around its own highest-ever levels. Tether (USDT), the largest cryptocurrency stablecoin, has passed a $20 billion market cap for the first time. According to data confirmed by the company on Dec. 18, Tether is now a $20 billion asset and the fourth-largest cryptocurrency by market cap. Tether market cap doubles since September"Tether has just surpassed a $20B market capitalization!" an official Twitter update reads. "This fantastic milestone is another confirmation for Tether maintaining its number one spot as the most liquid, stable and trusted currency!"Tether's market cap has been increasing at an almost record pace throughout the past quarter, passing $10 billion just three months ago. "BAM!" CTO Paolo Ardoino responded to the news. Tether (USDT) market cap year-to-date chart. Source: CoinMarketCapRegular minting of new tokens has proven controversial in the past, as some researchers claim that it artificially boosts Bitcoin (BTC) price growth instead of merely providing liquidity incentives. Ongoing legal problems for iFinex, owner of both Tether and exchange Bitfinex, have added to suspicions.

Nonetheless, appetite for Tether as the go-to entry and exit point for other cryptocurrencies and DeFi tokens has only accelerated this year, making USDT far and away the stablecoin asset of choice.

Now that Bitcoin has begun to cool off from its bullish rally from yearly bear market lows, as the price of the leading cryptocurrency stabilizes and consolidates, the pause presents an opportunity for altcoins such as Ethereum and Ripple, to recover ground lost to Bitcoin on each trading pair’s ratio.

As most altcoins have reached a historic average drawdown, and all signs are pointing to an altcoin season on the horizon as profit from Bitcoin is taken and invested into other cryptocurrencies for additional returns. Those who lived through past altcoin and Bitcoin bear cycles are sharing their past learnings with the crypto community, offering up tips on how to maximize profits during the next alt season.

Bitcoin Analyst: How to Spot an Alt-Season Before it Begins

Following Bitcoin’s highly-publicized, media-fueled frenzy at the tail end of the 2017 crypto market bull run, the entire crypto market and all of its individual cryptocurrencies feel in value, ranging from 85% to 99.9% in losses. Related Reading | Altcoin Trader: Alt Bitcoin Bear Cycle Almost Over, 600% Gains During Bull Cycle Expected As these cryptocurrencies have found their bottom in terms of USD, a short-lived alt season had materialized in early 2019 that saw many altcoins doubling in USD value. Most altcoins had outperformed Bitcoin, especially Litecoin which appeared to lead the crypto rally ahead of its halving. The tightly correlated relationship between altcoins and Bitcoin helped carry Bitcoin out of the depths of the bear market to the current highs. However, following Bitcoin breaking above $4,200, altcoins began an inverse correlation with Bitcoin, instead falling in value relative to BTC while Bitcoin soared, only further growing Bitcoin dominance.

A break in Bitcoin dominance is the 4th signal in one cryptocurrency analyst’s checklist for the conditions to create an alt season. This step happens after Bitcoin rallies, and money begins to flow into large cap altcoins like Ethereum and Ripple – the number two and three cryptos respectively.

After Ethereum breaks above the 200 EMA, which happened in recent days, that fall in Bitcoin dominance should begin. That’s when money will begin to flow from large caps to mid- and low-cap altcoins. Knowing this order of events and flow of capital from Bitcoin into large caps, then into mid- and low-caps can be added to any trading strategy to maximize profits. Remember to Realize Profits on Crypto Gains During Bull Runs Should crypto traders find themselves in the midst of a full blown alt season, crypto analyst Panama Crypto suggests taking profits on the way up, while also leaving a “moon bag” reserved for the off chance one crypto significantly takes off.

The best advice the trader gives, is a reminder that if a “life-changing amount of profit” is ever gained, to realize profits and “run.”

Related Reading | Crypto Analysts Call For the Death of Altcoins, But It Could Be a Lucrative Buy Signal Many cryptocurrency investors at the height of the last bull run saw their portfolios reach values they never dreamed of, but greed and fear of missing out caused many to miss their opportunity to realize profits, and were forced to hold through the longest bear market on record. It’s worth noting that profits are never actually profits until realized, and the crypto is cashed out into a fiat currency. JP Morgan bank recently announced the upcoming release of a digital coin for faster transactions between customers, thus raising fears of XRP fans Contents JP Morgan to foray into digital assets JPM Coin is crypto – Forget about it At the end of last week, U.Today reported that the JP Morgan banking behemoth announced the upcoming beta launch of its own digital coin dubbed simply and originally JPM Coin. Numerous news outlets rushed to assume that this is ‘the empire striking back’ at the rebellious XRP, which dreams of leaving traditional bank transfers way behind. Now Forbes dismisses these panic-smelling assumptions, saying that the newly-made JPM Coin is no crypto at all in the narrow sense of the word. JP Morgan to foray into digital assets Jamie Dimon from JP Morgan has been a long-time critic of Bitcoin and the whole crypto industry, calling it a bubble. Still, the bank has decided to take advantage of the technology that promises to transfer payments with the speed of light. Nevertheless, the author of the Forbes article insists that the digital token that JP Morgan plans to test in the short term is anything but cryptocurrency. The original material published by CNBC says that the JPM Coin intends to be used for quick payments – the speed will be comparable to those provided by smart contracts, leaving behind the conventional wire payments, which in the era of blockchain looks as old as the hills. JPM Coin will also be backed by US dollars, making the asset more stable compared to regular crypto – the principle of stablecoins. JPM Coin is crypto – Forget about it

However, reminds the Forbes writer, the bank plans to use the coin for internal transfers only – for its corporate clients, large corporations, transacting securities, etc. Another option is that JPM Coin will replace the USD that the bank’s subsidiaries store in their vaults. However, it will not be used on any public networks, unlike BTC, ETH or the aforementioned XRP, for instance. Besides, JPM Coin will be operating on the Quorum blockchain, created by the bank, which means that any entity using the newly-created token will have to be approved by JP Morgan. This is also very much different from the way ‘regular’ crypto coins work. Thus, some experts believe the JPM Coin, which seems to have already become a little controversial in the crypto world, will be just another digital coin, not crypto. As an example, the head of the Coin Center research platform said that the difference will be the same as between the Internet, free and open to any participant, and AOL, a closed permissioned network. It seems like the currently hyped coin of JP Morgan will be just another electronic payment system. Analysts at JP Morgan have predicted that Bitcoin (BTC) could fall below $1,260, while banks will not benefit from blockchain for at least three to five years, Reuters reported on Jan. 24.

According to Reuters, analysts from the major global investment bank think that the true value of cryptos is still unproven, and that they only make sense in a hypothetical “dystopian” event, wherein investors have lost faith in major traditional assets like gold and the U.S. dollar. The analysts stated in a report: “Even in extreme scenarios such as a recession or financial crises, there are more liquid and less-complicated instruments for transacting, investing and hedging [than cryptocurrencies].” JP Morgan also said that institutional involvement in the crypto market has slumped over the past six months, with individual traders making up the majority of the market. In its crypto report, the company claimed that using crypto for payments will remain “challenged,” adding that the firm was unable to find any major retailers that accepted crypto in 2018. JP Morgan’s analysts have further suggested that Bitcoin is likely to drop to around $2,400, and could even fall below $1,260 if the current bear market persists. At press time, the biggest cryptocurrency is trading at $3,595, down around 1.7 over the past week, according to data from CoinMarketCap. While JP Morgan forecasted that “widely-hyped” blockchain technology will not make any real difference for banks at least three to five years, the investment bank still concluded that distributed ledger technology (DLT) has potential to cut costs for global banks and digitize various complex processes. JPMorgan CEO Jamie Dimon is vocally critical of cryptocurrencies, including Bitcoin, which he called a “fraud” in September 2017. While previously stating that he does not “really give a sh*t” about Bitcoin, he admits blockchain’s potential, saying, “Blockchain is real, it’s technology, but Bitcoin is not the same as a fiat currency.” |

Authoranyone can contribute. Archives

May 2022

Categories |

RSS Feed

RSS Feed