|

On the 27th September 2020 at 06:01 UTC Block 1,920,000 created the 66 millionth Litecoin, marking another milestone on the network. There are now less than 18 million Litecoin to be mined. The last Litecoin is estimated to be mined around 2142 due to the deflationary nature of the network.

According to data from blockchair the 46.44 KB block was mined by litecoinpool.org and contained 45 transactions (43 of which were segwit type transactions) with 284 inputs and 91 outputs moving Ł990.321271384** **($45,930) (with an average coin age of 19.51 days) over the network. The current network inflation rate according to litecoinblockhalf.com is 4.13% which equates to ~7,200 new Litecoin mined each day and the current network hashrate is 275TH/s up 51% since the 65 millionth Litecoin.

0 Comments

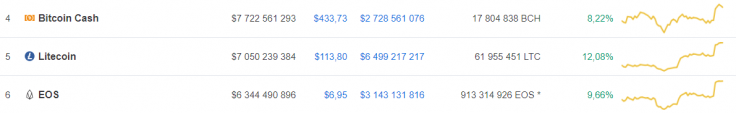

In 2019 a great number of LTC onchain metrics stopped 📊⛔growing, showing a major halt in support and user interest in this platform; in May, the 📊❗situation has changed Contents Litecoin (LTC) is the top gainer on the top 10 list Litecoin is recovering its positions As opposed to the start of the year, when onchain metrics on BitInfoCharts showed a major decrease in user interest in Litecoin, interest has begun rising once again since the beginning of May. Litecoin (LTC) is the top gainer on the top 10 list On Sunday, Bitcoin’s price began surging along with the rest of the market. This morning Litecoin showed a 10-percent rise. At press time, the coin is showing an even more powerful increase – slightly over 12 percent – which makes it the top gaining asset on the top 10 crypto list. On Saturday, U.Today reported that the Litecoin community is looking forward to the LTC halving which is due in August this year. This event, when miners’ awards per every new block will be cut by half, making LTC more scarce, is expected to put the coin’s price way up on charts. There was also a negative event having to do with LTC, when a user paid 200 LTC as a transaction fee for transferring slightly less than 9 LTC, but it did not affect the asset’s price. Another reason for LTC’s present price rise may be the return of user interest. Litecoin is recovering its positions

Litecoin.com reports that even though the growth of interest in the network does not match the market value, it could be a delay in response. Still, whether the metric figures will return to the mean figures in the end will be seen later on. Among those metrics is the USD value, which suddenly surged over $1.6 bln on May 16, as well as the Average Tx value and the amount of LTC addresses. The number of daily LTC transactions has also increased – from 20,000 to 27,000. As per Litecoin.com, the LTC price has now gotten much further away than current metrics should allow, so unless these two come to match each other soon, the LTC price may prove unstable and go back down. Litecoin was one of the earliest spinoffs of Bitcoin which came into existence in October 2011 and since then the coin has stayed pretty identical to Bitcoin. Just like the Bitcoin, Litecoin too would be undergoing the mining reward halving process in August 2019 and every stakeholder needs to be prepared for the event as to what could be the probable consequences. Binance Research explains Litecoin’s block profitability will be cut in half in the span of 5 minutes

In crypto world, halving is a fixed event when the block rewards cut into half and the profitability from a block is reduced to 50%. For Litecoin, its chain’s block rewards for mining are perpetually reduced by one half every 840,000 blocks. With the way, the current block generation time is set to ~2.5 minutes this event is occurring is scheduled to happen every four years. Litecoin’s current block reward is set at 25 litecoin per block and will subsequently decrease to 12.5 litecoin per block around August 6th (at exactly block 1,680,000) Litecoin has had just one block halving in August 2015 when the price of the coin increased from around 1.5 USD (3 months before halving) to over 3 USD post-halving, with a peak of 7 USD in mid-July 2015 while the hashrate dropped by roughly 15% around the event, before quickly rebounding in the two weeks following the halving. Litecoin price revisited the $99.00-100.00 resistance area recently before correcting lower. LTC is trading nicely above the key $82.00 support it is likely to bounce back versus USD and bitcoin. Litecoin price retreated once again after testing the $99.00-100.00 resistance area. LTC is currently following a declining channel with resistance at $91.20 on the 2-hours chart. The price could retest the $84.00 or $82.00 support before a fresh rise towards $100.00 Litecoin Price Analysis (LTC to USD) This week, there were mostly corrective moves in bitcoin, Ethereum, ripple, litecoin, bitcoin cash and EOS. Earlier, LTC price revisited the all-important $99.00-100.00 resistance area, where sellers emerged and protected an upside break. Looking at the 2-hours chart of LTC/USD, the pair rallied significantly after it broke the $60.00 resistance area. It even traded past the $80.00 resistance area.

There were sharp gains above the $80.00 level and the 25 simple moving average (2-hours). The price even traded close to the all-important $99.00-100.00 resistance area. Later, there was a downside correction to $78.00 before the price bounced back towards the $99.00 level. The last swing high was formed at $98.90 before the price started a downside correction. It moved below the $92.00 level and the 50% Fib retracement level of the recent upside from the $78.32 low to $98.90 high. However, the $84.00 support and the 61.8% Fib retracement level of the recent upside from the $78.32 low to $98.90 high acted as a strong support. At the outset, the price is following a declining channel with resistance at $91.20 on the same chart. An upside break above the channel and the $92.00 level may open the doors for a fresh increase towards the $100.00 resistance, above which litecoin price could climb towards the $115.00 level. Alternatively, LTC could decline further towards the $84.00 or even $82.00 support area in the short term before resuming its upside. Litecoin must stay above the $82.00 level to avoid a risk of a downside break towards the $75.00 level.

After an incredibly positive week for Litecoin (LTC), it has been able to continue its upwards price surge today and is one of the few major cryptocurrencies that has surged during an overall quiet trading session in the crypto markets.

Today’s upwards move has brought LTC to the top of its resistance region, and a break above this level could lead to a significantly further price surge. Litecoin Price Surges During Quiet Trading Session At the time of writing, Litecoin (LTC) is trading up over 7% at its current price of $46.8. LTC is up significantly from its weekly lows of $32, which were set earlier last week before the cryptocurrency began climbing. Instinct, a popular cryptocurrency trader on Twitter, spoke about LTC’s recent price surge, noting that it is now pushing up against another resistance level. “$LTC showing no signs of slowing down. Pumping on a Sunday morning straight to the top of this 3D resistance level… Very happy with my long from avg ~.093 on Mex. Want to add but not until I see some type of retest after a S/R flip. Looking quite impulsive now,” he explained.

$LTC showing no signs of slowing down. Pumping on a Sunday morning straight to the top of this 3D resistance level.

Very happy with my long from avg ~.093 on Mex. Want to add but not until I see some type of retest after a S/R flip. Looking quite impulsive now! pic.twitter.com/htqFMBPomH Litecoin (LTC) founder Charlie Lee has fired community debate with a tweet alleging that “some self-proclaimed Bitcoin Maximalists are actually Bitcoin Extremists.” Lee’s Jan. 6 post argued that: “Some self-proclaimed Bitcoin Maximalists are actually Bitcoin Extremists. They think all other coins are scams and will go to zero. Maximalists think Bitcoin is and will remain the dominant cryptocurrency but there is room for altcoins to exist and even do well.” Lee also opened a Twitter survey, which has drawn over 24,300 votes as of press time and is due to expire in 6 hours, inviting users to identify as either a “Bitcoin Extremist,” “Bitcoin Maximalist,” “Altcoin Maximalist,” or “Nocoiner.” At press time, 9 percent have identified as Bitcoin “extremists,” 48 percent as Bitcoin “maximalists,” 32 percent as altcoin “maximalists,” and 11 percent as “nocoiners.” Lee’s remarks provoked a series of quick-witted responses — both dissenting and affirmative — including one from crypto industry figure Jameson Lopp, who quipped, “Bitcoin Supremacists, please. Extremists has a negative connotation,” adding “I identify as a Segregated Witness.” Mindful of Lee’s provocation, Ragnar Lifthrasir, founder of the International Blockchain Real Estate Association (IBREA), told Lee he was on “the path to wrong-think,” and that using the jargon of extremism was little more than a smear of anyone whose “opinion differs from Charlie’s.” Lee’s comments also provoked debates over whether Bitcoin “maximalism,” is little more than a marketing term allegedly coined by altcoin founders, as well as over Bitcoin’s prevailing brand dominance. Some commentators responded — without proclaiming any allegiances — that ultimately it will be the free market and tangible use cases that will separate the successful projects in a sector of proliferating cryptocurrencies. As of press time, the share of Bitcoin’s market capitalization in the overall crypto market cap is at 51.8 percent, according to CoinMarketCap data.

On the cusp of the new year, tokenization protocol Stellar’s co-founder and CTO Jed McCaleb — who is also one of the founders of now-defunct Japanese Bitcoin exchange Mt. Gox, as well as a co-founder of Ripple (XRP) — provocatively claimed that “ninety percent of [crypto] projects are B.S,” adding he was “looking forward to that changing” in 2019. McCaleb excluded Bitcoin, Ethereum (ETH), Stellar Lumens (XLM) — and presumably XRP — from his criticisms. On 13th December, Coingate, a popular cryptocurrency exchange for trading Bitcoin [BTC] and altcoins announced on Twitter that the Lightning Network of Litecoin is finally ready for deployment. Furthermore, CoinGate has offered itself as a platform for the activation to take place. In the original tweet by the exchange, the company wrote:

“@litecoin community, we bear some exciting news! Our #Litecoin #LightningNetwork is ready to be deployed and will soon be live on CoinGate! Keep up with the news as we’re getting closer! Here’s a little sneak peek @LTCFoundation @SatoshiLite @starkness!” On this, Charlie Lee, the Father of Litecoin and a veteran computer scientist cheered: “Even Litecoin will soon have more than 1000 merchants accepting LN payments! 🚀 Thanks @CoinGatecom!” From time to time, Charlie Lee has projected that the project that fills him with enthusiasm in the cryptocurrency space is the Lightning Network. For instance, in a recent interview with CNBC, the techie revealed that he is the “most excited about” the LN. According to him, the Lightning Network is a second-layer solution for payments going through Bitcoin and Litecoin. He also believes that the network is getting stronger over the years wherein SegWit was also activated last year. Another distinct view held by the Litecoin creator is that the concept and mechanism of LN is in sync with the vision projected by Satoshi Nakamoto in Bitcoin’s whitepaper titled “A Peer-to-Peer Electronic Cash System”. In another interview, Lee had said that the payments on the Lightning Network are peer-to-peer and can work even when the parties or peers participating are not connected to the Internet. A Twitter handle named Bitcoin Opinions – Litecoin’s Cousin on the announcement wrote: “Don’t say “We bear news”!! 😡 That’s the evil B-word!!! Why not just “have news”, all right?” Supernova, a cryptocurrency enthusiast and a blockchain space follower commented: “That’s the kind of answer what precisely causes the current price effect of good news” Litecoin [LTC] gets a boost in adoption as HTC’s Exodus 1 phone adds cryptocurrency support12/6/2018 Charlie Lee, the creator of Litecoin, announced earlier that he would be speaking at the at Slush 2018 event in Helsinki on December 6, 2018, and talk about the HTC Exodus 1 phone that has integrated cryptocurrencies like Litecoin [LTC] and Bitcoin [BTC]. Lee always envisioned cryptocurrencies to become the go-to currencies and aimed his creation [Litecoin] to have cheaper fees and faster transactions. In the event, Lee spoke with HTC’s Decentralized Chief Officer Phill Chen and announced that HTC Exodus 1 will be supporting Litecoin and other cryptocurrencies. Charlie Lee, the creator of Litecoin, announced earlier that he would be speaking at the at Slush 2018 event in Helsinki on December 6, 2018, and talk about the HTC Exodus 1 phone that has integrated cryptocurrencies like Litecoin [LTC] and Bitcoin [BTC]. Lee always envisioned cryptocurrencies to become the go-to currencies and aimed his creation [Litecoin] to have cheaper fees and faster transactions. In the event, Lee spoke with HTC’s Decentralized Chief Officer Phill Chen and announced that HTC Exodus 1 will be supporting Litecoin and other cryptocurrencies. The early access to the Exodus 1 phone will have an option to buy it with Litecoin [LTC], Bitcoin [BTC] or Ethereum [ETH] on the website. In addition to the above, the phone has a new storage method that utilizes social key recovery mechanism if the device is lost or stolen. Zion is an integrated wallet that comes with the phone to store Bitcoin, Litecoin, Ethereum and various ERC-20, and ERC-721 tokens. Lee is also joining the HTC Exodus team as a consultant, and during the event he stated: “I’m happy that the much awaited HTC ‘EXODUS 1’ can now be purchased with Litecoin. Ever since cryptocurrency was created, my vision for Litecoin was always to increase the distribution of the currency and use it a foundation for secure transactions worldwide, with the Exodus 1, project HTC is expanding crypto technology to the mobile phone and doing so in a way that protects user’s information and wallets.” Phill Chen said that the users of the phone have total control over their private keys and added: “Only when users have full ownership of their own keys, can we enact true decentralization, a vital first step toward protecting users. We see this as a stepping stone to how people will carry their own digital-assets and digital identities in their pockets, in the very way we carry phones today.” |

Archives

December 2020

Categories |

RSS Feed

RSS Feed