|

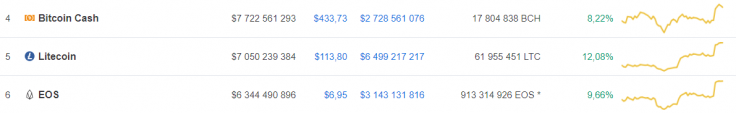

In 2019 a great number of LTC onchain metrics stopped 📊⛔growing, showing a major halt in support and user interest in this platform; in May, the 📊❗situation has changed Contents Litecoin (LTC) is the top gainer on the top 10 list Litecoin is recovering its positions As opposed to the start of the year, when onchain metrics on BitInfoCharts showed a major decrease in user interest in Litecoin, interest has begun rising once again since the beginning of May. Litecoin (LTC) is the top gainer on the top 10 list On Sunday, Bitcoin’s price began surging along with the rest of the market. This morning Litecoin showed a 10-percent rise. At press time, the coin is showing an even more powerful increase – slightly over 12 percent – which makes it the top gaining asset on the top 10 crypto list. On Saturday, U.Today reported that the Litecoin community is looking forward to the LTC halving which is due in August this year. This event, when miners’ awards per every new block will be cut by half, making LTC more scarce, is expected to put the coin’s price way up on charts. There was also a negative event having to do with LTC, when a user paid 200 LTC as a transaction fee for transferring slightly less than 9 LTC, but it did not affect the asset’s price. Another reason for LTC’s present price rise may be the return of user interest. Litecoin is recovering its positions

Litecoin.com reports that even though the growth of interest in the network does not match the market value, it could be a delay in response. Still, whether the metric figures will return to the mean figures in the end will be seen later on. Among those metrics is the USD value, which suddenly surged over $1.6 bln on May 16, as well as the Average Tx value and the amount of LTC addresses. The number of daily LTC transactions has also increased – from 20,000 to 27,000. As per Litecoin.com, the LTC price has now gotten much further away than current metrics should allow, so unless these two come to match each other soon, the LTC price may prove unstable and go back down.

0 Comments

Litecoin was one of the earliest spinoffs of Bitcoin which came into existence in October 2011 and since then the coin has stayed pretty identical to Bitcoin. Just like the Bitcoin, Litecoin too would be undergoing the mining reward halving process in August 2019 and every stakeholder needs to be prepared for the event as to what could be the probable consequences. Binance Research explains Litecoin’s block profitability will be cut in half in the span of 5 minutes

In crypto world, halving is a fixed event when the block rewards cut into half and the profitability from a block is reduced to 50%. For Litecoin, its chain’s block rewards for mining are perpetually reduced by one half every 840,000 blocks. With the way, the current block generation time is set to ~2.5 minutes this event is occurring is scheduled to happen every four years. Litecoin’s current block reward is set at 25 litecoin per block and will subsequently decrease to 12.5 litecoin per block around August 6th (at exactly block 1,680,000) Litecoin has had just one block halving in August 2015 when the price of the coin increased from around 1.5 USD (3 months before halving) to over 3 USD post-halving, with a peak of 7 USD in mid-July 2015 while the hashrate dropped by roughly 15% around the event, before quickly rebounding in the two weeks following the halving. |

Archives

December 2020

Categories |

RSS Feed

RSS Feed