|

By CCN.com: In the last 48 hours, despite the withdrawal of the Chicago Board Options Exchange (CBOE) and VanEck Bitcoin exchange-traded fund (ETF), the Bitcoin price has increased from $3,511 to $3,657 by nearly two percent.

Although the lack of a major price movement following a highly anticipated event like the VanEck ETF withdrawal demonstrated a low level of trading activity in the global crypto market, traders expect the volatility in Bitcoin markets to increase in the upcoming weeks. View image on Twitter

Will More Volatility be Beneficial to Bitcoin?

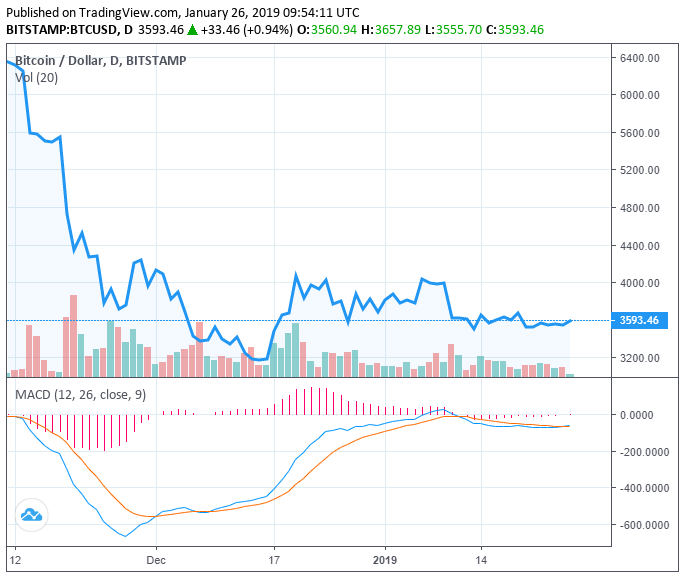

Since January 11, for more than two weeks, the Bitcoin price has remained stable in a low and tight price range between $3,500 to $4,000, unable to break out of key resistance levels nor fall below crucial support levels. Currently, there are strong cases to be made for both bears and bulls in the cryptocurrency market. The consistent lower highs Bitcoin has recorded over the past several weeks show low momentum for the dominant cryptocurrency. As one technical analyst put it: 15-day consolidation continues. Lower highs and equal lows do not inspire confidence for bulls. Gaps shown in the crosshairs are where I expect price to eventually move when a decisive move occurs below or above the red/green boxes. Volatility incoming.

Given the tendency of the Bitcoin price to demonstrate volatility following a period of extended stability, traders generally see the price of BTC experiencing wild price movements in the first half of February. But, it remains uncertain whether Bitcoin will be able to initiate a meaningful upside movement above key resistance levels like $4,000.

A prominent cryptocurrency trader with an online alias “Crypto Rand” stated that as of now, most technical and fundamental indicators of Bitcoin point toward a bearish short-term outlook. However, depending on the performance of the asset by the week’s end, the trader emphasized that the asset may begin demonstrating a slightly bullish bias in the short-term. “If BTC keeps moving in the horizontal range, it will find the falling wedge resistance in the next hours and there, we will see if we have a breakout or a drop down. If the 4-hour candles close with the current structure, I would lean slightly bullish in the short-term. But, we cannot forget that we are still on a full downtrend of volume and the daily structure remains bearish,” the trader explained. Don’t Expect Bitcoin to Escape Bear Market Anytime Soon Historically, following every major correction or a bear market, Bitcoin has tended to take a longer time to recover and achieve a new all-time high. The 2017 bull run of crypto was primarily fueled by retail traders and individual investors, supported by an unprecedented amount of mainstream media coverage and demand for the asset class. View image on Twitter

As large as the bull market was two years ago, investors including Vinny Lingham have suggested that the cryptocurrency market could require an extended recovery period to potential rebound to previous all-time high levels.

Earlier this week, Ethereum (ETH) co-creator and Cardano (ADA) founder Charles Hoskinson stated that the cryptocurrency market may take 11 years to fully recover and that both investors and businesses have to be ready for it. At the Crypto Finance Conference, Hoskinson said: It might take 11 years for us [the crypto industry] to recover back to where we were in 2017, but we will be a dramatically different ecosystem at that point. We’ll have millions, perhaps even billions of users. We will be in many consumer products, be easy to use, [even] grandma can use it. A lot of the hard stuff will have been figured out. Like if somebody dies, how do we get their private keys, how do we handle taxes, all of the regulation will be done. While the expectations of the long-term performance of Bitcoin and major crypto assets vary, in the short-term, many investors expect Bitcoin to experience a high level of volatility.

0 Comments

Galaxy, a popular cryptocurrency analyst on Twitter, spoke about this possibility in a recent tweet, drawing a striking parallel between the two markets.

“We’re approaching the…mark which ended the 2015 bear market and if history repeats itself, we’re moving towards several months of accumulation and a new bull cycle starting mid-late 2019,” he noted while referencing a chart that shows the 2014 bear market which lasted until 2015,” Galaxy told his followers, also noting that the “future lies in the study of the past.”

If this theory turns out to be even remotely accurate, Bitcoin could see a long bout of sideways trading before skyrocketing back towards, or possibly above, its previously established all-time-highs.

he past year has been long and difficult for everyone involved in the cryptocurrency industry, and the markets are now reaching a point that will mark the longest ever Bitcoin (BTC) price correction in the cryptocurrency’s wild, albeit brief, history.

For investors who have been riding the markets ever since Bitcoin hit nearly $20,000 in late-2017, they will soon be able to say that they survived the longest-ever crypto market correction, which may someday be seen as a badge of honor that separates the true believers in the technology from the speculators. Bitcoin (BTC) To Break Correction Record in Early February Currently, the longest ever crypto bear market was seen between November of 2013 and January of 2015, where Bitcoin’s price climbed to highs of over $1,100 before crashing to lows of $178. Although this nearly 85% drop was significant, it’s no secret that Bitcoin quickly recovered from this and surged almost continually until December of 2017 when BTC reached highs of over $19,000. The aforementioned drop between late-2013 and early-2015 lasted a total of approximately 410 days before Bitcoin finally established a long-term bottom and began to recover much of its losses. The current BTC bear market is just a matter of days away from becoming the longest in its history. Josh Rager, a popular cryptocurrency analyst on Twitter, spoke about the current length of the bear market as compared to that which began in 2013, saying: “$BTC correction record: On Feb 2nd, we are likely to break the record for longest Bitcoin correction: 410 days (from Nov 2013 to lowest price at Jan 2015)… Very soon, you will be able to say that you survived the longest crypto market correction in $BTC history.”

Bitcoin is currently trading sideways, which is leading the crypto markets to experience a mixed trading session following yesterday’s volatility. Ethereum is currently one of the worst performing altcoins as it has failed to post a strong recovery following yesterday’s drop that was caused by its highly-anticipated Constantinople hard fork being delayed.

Although the crypto markets are trading off of their recent lows, analysts still expect there to be further losses in the near future. Bitcoin Drops Slightly Bitcoin has dropped slightly today, and technical analysis may signal that further losses are right around the corner. At the time of writing, Bitcoin is trading down less than 1% at its current price of $3,650. Yesterday, Bitcoin fell into the low $3,600 region, but did not drop into the $3,500 region where some buying support exists. While speaking to MarketWatch, Jani Ziedens of the Cracked Market blog noted that the lack of a significant bounce in the mid-$3,000s signals that Bitcoin is not currently oversold, which means it could see lower lows before moving higher. “Bitcoin continues to struggle and is in the mid-$3k’s. If prices were oversold, we would have bounced by now. This lethargic base tells us that demand is still incredibly weak and this selloff still hasn’t found a bottom,” he noted. DonAlt, a popular cryptocurrency analyst on Twitter, echoed a similar sentiment to Ziedens, saying that he is not looking to trade Bitcoin within its current range, which is between approximately $3,300 and $4,400 according to a chart he references. “$BTC not so daily update: Chilling in the lower part of the current trading range after having put in a few consecutive lower highs… As long as we stay below the POC I’ll most likely stay hedged… I’m personally not interested in trading this trading range,” he explained. Crypto Market Drop Led by Ethereum Ethereum is currently the worst performing altcoin today, as it failed to post a strong recovery after yesterday’s announcement that its highly anticipated Constantinople hard fork event had been delayed due to a security vulnerability that was discovered. At the time of writing, Ethereum is trading down 2.3% at its current price of $124.73. Although Ethereum has not yet posted any major recovery from yesterday’s drop, it is still trading up from its 24-hour lows of $120. Earlier today, Ethereum rose to highs of $127, but it failed to maintain its upwards momentum and has since settled back down towards its current price levels. Today, XRP is trading up marginally at its current price of $0.331. Yesterday, XRP fell to lows of $0.324, from which it has recovered slightly. XRP is still currently down from its daily highs of $0.335. EOS has risen slightly today and is currently trading up just under 2% at its current price of $2.46. EOS is up from its 24-hour lows of $2.38, which were set earlier this morning amidst a widespread market drop that most altcoins have since recovered from. On January 13, the crypto market initiated an intense sell-off as the Bitcoin price fell below the $3,500 mark. The weakness in the short-term price trend of BTC led the market to demonstrate volatility on the downside. More than $5 billion was wiped out of the crypto market and major assets like Ethereum recorded a six percent drop. Where is Bitcoin Headed? Generally, both analysts and traders expect Bitcoin to fall to the low $3,000 region in the days to come. Some have suggested that a strong buy wall below the $3,000 mark may allow the dominant cryptocurrency to recover, implying that a 10 percent fall remains a possibility. Bitcoin Price Could Fall Toward $3,000 In the short-term, Cred, a cryptocurrency technical analyst, said that BTC could test the $3,430 support level first. Depending on the movement of the asset at $3,430, the asset could initiate a corrective rally or continue a steep drop to low $3,000. “I am interested in the $3,430 level. It’s the HTF (M1/W1/D1) low that price blew through without a retest,” the analyst said. Hsaka, a cryptocurrency trader, echoed the sentiment of Cred, adding: “$3,430 is the next level of interest for me on the daily. Won’t be blindly punting a long there, but will watch for PA to develop on the LTFs.” Will Growing Trading Volume Buttress Market? In the last 12 hours, the daily volume of the cryptocurrency market has recovered from around $13 billion to $16 billion, by 23 percent.

The volume of Bitcoin has increased from $4 billion to $5.1 billion, demonstrating a fairly large jump in trading activity in a short period of time. The resistance in the $3,400 to $3,500 range may prevent an abrupt fall by a large margin in the upcoming days. On January 13, when the volume of Bitcoin was hovering at just over $4 billion, analysts expressed concerns in regard to the lack of sell pressure on the market. Often, if the price of an asset falls substantially on the day, the volume spikes as sell orders are filed across major exchanges. However, on Sunday, Bitcoin recorded a three percent drop with low volume, essentially free falling without high sell-pressure. The growing volume of the cryptocurrency market could alleviate some of the pressure major crypto assets have faced on the day. Crypto Forecast Still Gloomy While cryptocurrencies are not likely to experience a large downward movement in the next 24 to 48 hours, the market still remains gloomy. As Bitcoin failed to break out of $3,600, Hsaka said that previous lows are likely to be retested, in the $3,400 region. “Clear rejection on LTFs. Confluent with a HTF S/R flip. Retest of the previous low (white level) seems likely to me,” the trader said. Most of the worst performing cryptocurrencies in the past 24 hours have been tokens and low market cap cryptocurrencies, and small digital assets are expected to perform poorly in the short-term. Cryptocurrencies had a wild 2018, tumbling well below some of the record highs seen toward the end of 2017. Bitcoin, once worth almost $20,000, plunged last year, closing out 2018 at a price below $4,000. Other major virtual currencies, including XRP and ether, also fell steeply. Analysts and executives in the industry are increasingly pointing to a fairly new development that could reinvigorate the space: putting securities like stocks and bonds on the blockchain. So-called security tokens are becoming a new buzzword in crypto. The term is part of a phenomenon in the industry known as "tokenization" — turning real-world assets into digital tokens. In the case of security tokens, tradable assets like equity and fixed income are transformed into digital assets that use blockchain technology, the virtual ledger of activity that underpins cryptocurrencies like bitcoin. Security tokens had been talked about for some time, but now one firm is looking to put them to the test. On Monday, DX.Exchange, an Estonia-based crypto firm, launched a trading platform that lets investors buy shares of popular Nasdaq-listed companies, including Apple, Tesla, Facebook and Netflix, indirectly through security tokens. Each token is backed by one share of the company traders want to invest in and entitles them to the same cash dividends. "The crypto community has been talking about security tokens for well over a year now without much progress, so we think the impact will be huge," Amedeo Moscato, DX's chief operating officer, told CNBC by email over the weekend. "By tokenizing stocks of some of the biggest publicly-traded companies like Google, Amazon, Facebook and more, we are opening an untapped market of millions of old and new traders around the globe cutting out the middleman." Investors will be able to trade the digital stocks round-the-clock, even after markets close, DX says. "The ability to trade around the clock, with a range of currencies, offers investors both convenience and liquidity," Dan Doney, co-founder and chief executive of fintech firm Securrency told CNBC by email over the weekend. But Doney questioned whether DX's exchange was sound on the regulatory front. "We're unsure and even skeptical of DX.Exchange's model because we don't think that it's acceptable to list tokenized shares of a company without shareholder consent," he said. "However, we do think that the model can meet regulatory standards if executed properly." DX stressed that its digital stocks are classed as derivatives — with the underlying asset being equity of 10 Nasdaq-listed firms — and that its platform is regulated under the European Union's Mifid II directive. Mifid II, a set of reforms to EU investment services regulation, aims to protect investors and increase transparency and confidence in the industry post-crisis. Cyprus-licensed firm MPS MarketPlace Securities is holding the stocks in a segregated account. DX built the platform on top of Nasdaq's Matching Engine technology, which is used across more than 70 international markets. Experts are pointing to the model as one that could provide a solid form of investment for traders — versus cryptocurrencies like bitcoin, which have proven at times to be highly volatile — as well as a new potential source of fundraising for start-ups and large firms alike. 'STO' New security tokens can be issued and sold to investors, similar to how new digital tokens are sold through a crowdfunding method known as an initial coin offering (ICO). This is what's known as a security token offering (STO). ICOs were a source of much controversy in the crypto sphere in both 2017 and 2018, with China and South Korea banning the practice and the U.S. Securities and Exchange Commission rapping a number of ventures and founders over alleged illegal activities. One supposed cryptocurrency start-up called Giza made off with more than $2 million through a fake ICO scam, a CNBC investigation last year showed. Dubious as the murky world of ICOs is, the funding method at one point eclipsed early-stage venture capital funding. ICO projects raked in almost $6.6 billion in 2017 and $21.5 billion in 2018, according to data provided by ICO listing site CoinSchedule. The difference with STOs, experts say, is that security tokens are asset-backed and fall within regulatory parameters. "Security tokens use blockchain to allow for efficient transactions like cryptocurrencies, but are different in all other ways," Securrency's Doney said. "(They) emphasize regulatory compliance, automated regulatory reporting, and represent share interest in value-producing assets. This ultimately provides stable value versus the volatility of crypto." Crowdfunding site Indiegogo delved into the world of STOs last year, hosting a platform that let investors indirectly own shares of a luxury ski resort by buying security tokens. That token sale brought in $18 million, according to VentureBeat. Security tokens and STOs have been compared to "stablecoins," cryptocurrencies pegged 1:1 to government-backed currencies to avoid the volatility typically seen in the cryptocurrency market. Stablecoins are seen as another potential area for growth in the crypto industry. Goldman Sachs-backed fintech start-up Circle launched a stablecoin pegged to the U.S. dollar last year, and Chief Executive Jeremy Allaire has told CNBC he thinks "all fiat currency will be crypto" one day. "Cryptocurrencies and STOs will continue to evolve, and digital stocks are another step in that process," Daniel Skowronski, DX's chief executive, told CNBC by email. STOs to 'ramp into the market' by mid-2019

Advocates also say that security tokens could reduce the cost of listing a company on the stock market and that they will make it easier to trade less liquid assets like private equity. And though it may be early days, one expert thinks the trend of tokenizing securities will become a major theme by mid-2019. "In terms of timing, we hear that mid-2019 is the time-frame when most STOs will be able to ramp into the market," Lex Soklin, partner and global director of fintech strategy at Autonomous Research, told CNBC by email. "Given a longer regulatory approval process for these assets (rather than none for ICOs), entrepreneurs have a slower path to market. But perhaps a more stable one." Some even believe that, eventually, everything from artwork to real estate will be transformed into digital tokens. "Over the next decade, we could very well see the tokenization of the entire financial markets," Mati Greenspan, senior market analyst at eToro, said in a note last week. "Essentially, anything that has value and can be traded can also be represented as a digital token and traded on a blockchain." CoinfloorEX, a unit of the United Kingdom cryptocurrency exchange Coinfloor, has been reorganized to offer trading of physical Bitcoin futures on the Asian market. The CEO of the company has revealed this in an interview with Bloomberg on Monday, Jan. 7. The rebranded CoinFLEX — short for Coin Futures and Lending Exchange — is reportedly owned by a consortium that includes Roger Ver, an early Bitcoin (BTC) entrepreneur and the supporter of the most recent controversial Bitcoin Cash (BCH) hard fork. The consortium behind CoinFLEX also includes another early BTC investor Mike Komaransky, United States investment banking firm Dragonfly Capital, a parent company of U.K. crypto platform CoinShares and others. According to Bloomberg, the new venture will be based in Hong Kong and headed by Mark Lamb, Coinfloor’s co-founder. It will offer Bitcoin, Bitcoin Cash and Ethereum futures contracts to retail investors based in Asia starting in February. In the interview with Bloomberg, Lamb said that all of the company’s futures will be physically delivered. As soon as a contract expires, the customers will be given the underlying cryptocurrency instead of a cash payment. Bloomberg highlights this as an important distinction in the “largely unregulated crypto markets.” In August 2018, the operator of the New York Stock Exchange (NYSE), the Intercontinental Exchange (ICE) announced the launch of Bakkt, it’s own platform for Bitcoin futures contracts trading.

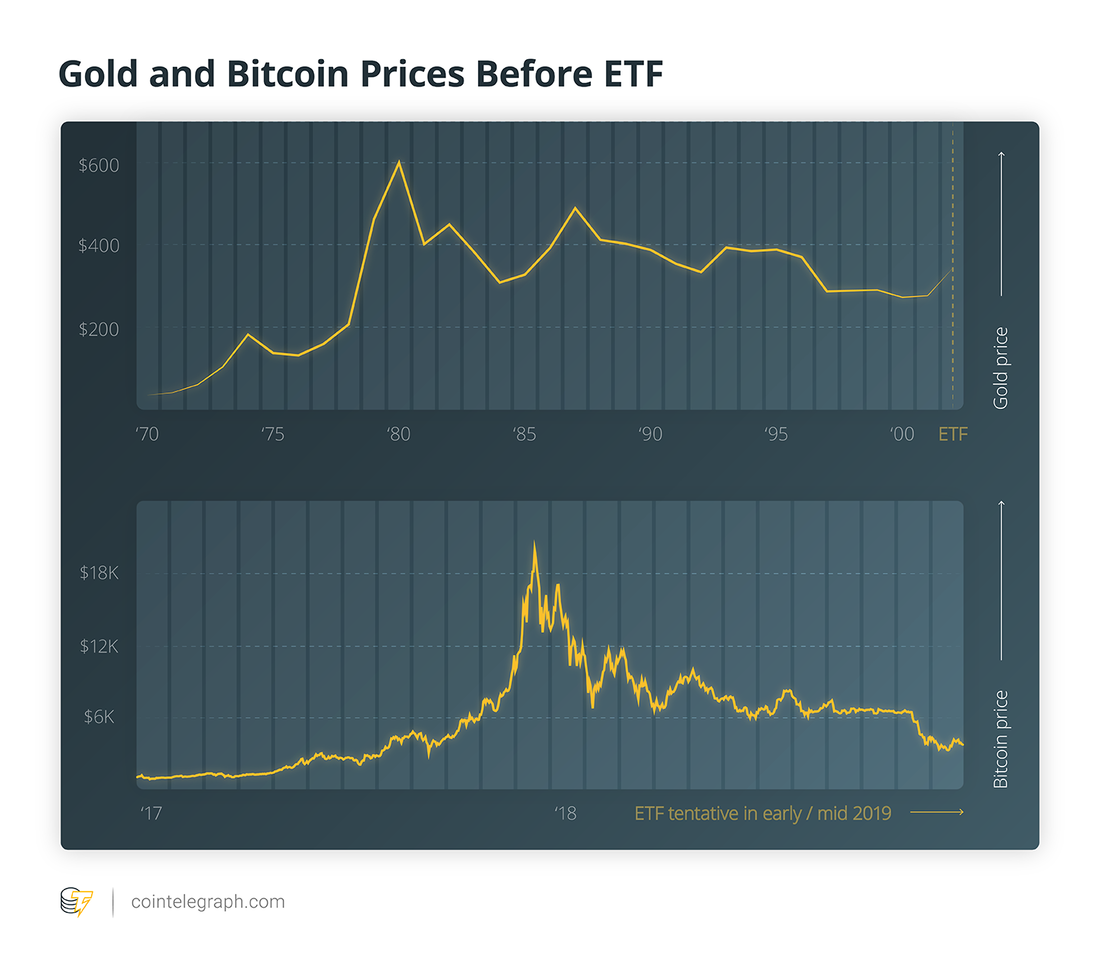

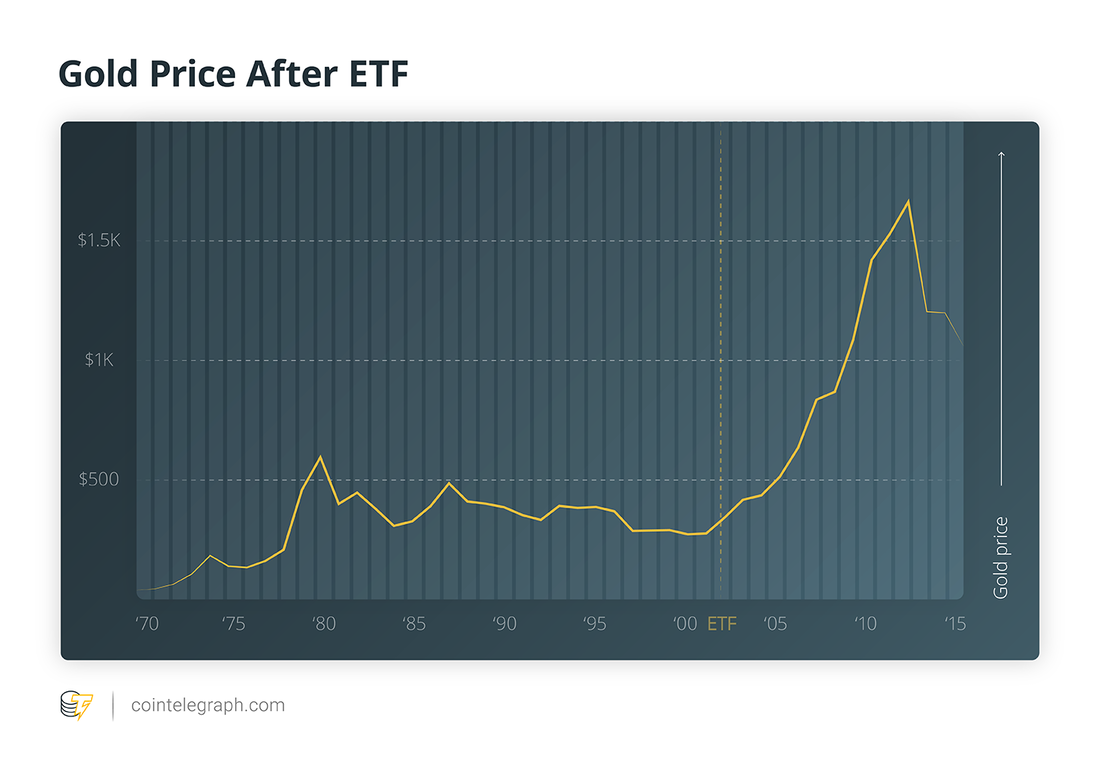

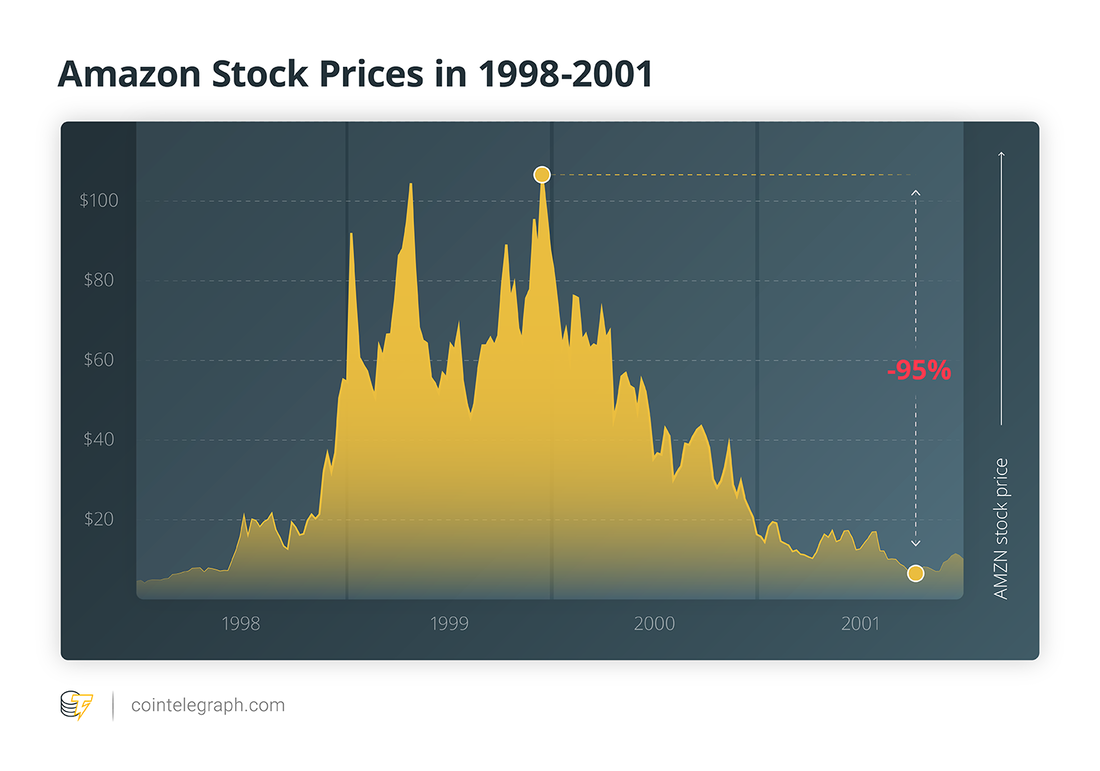

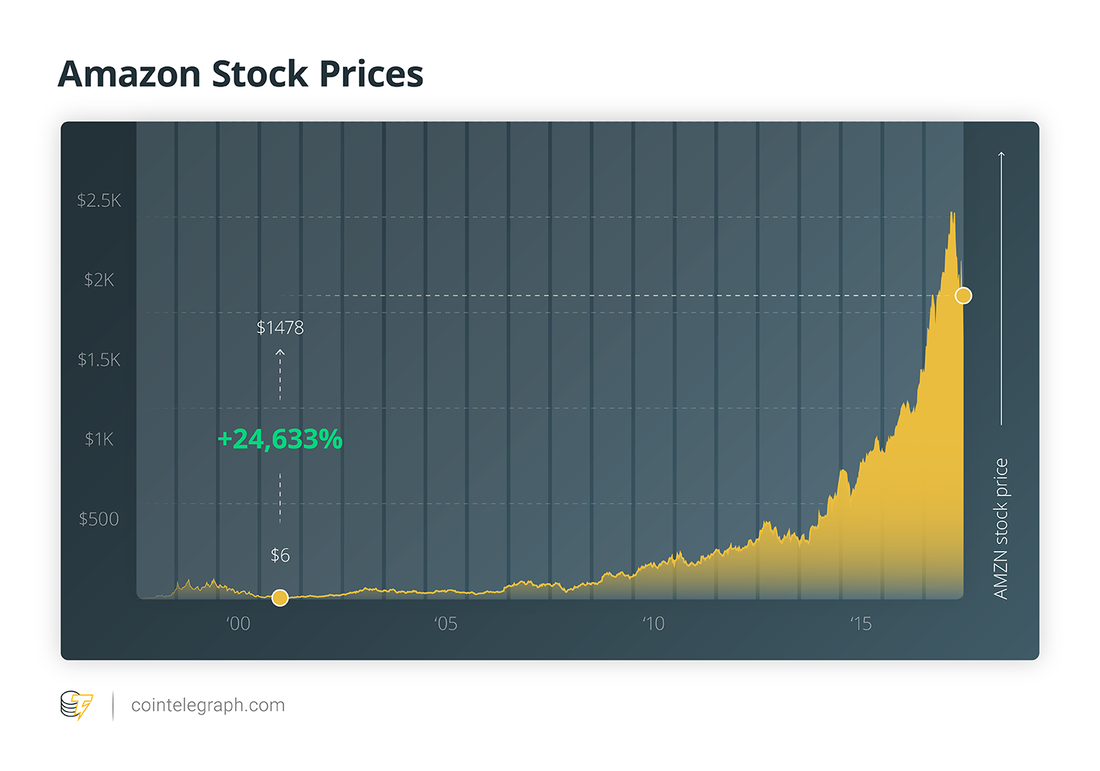

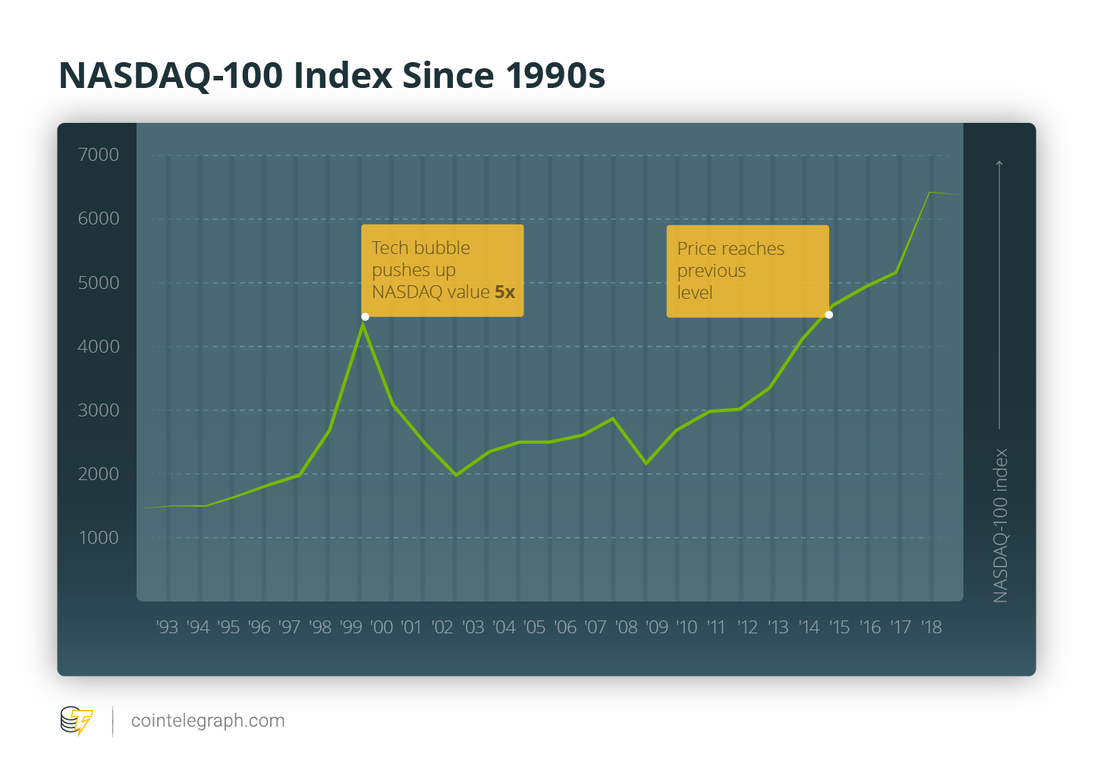

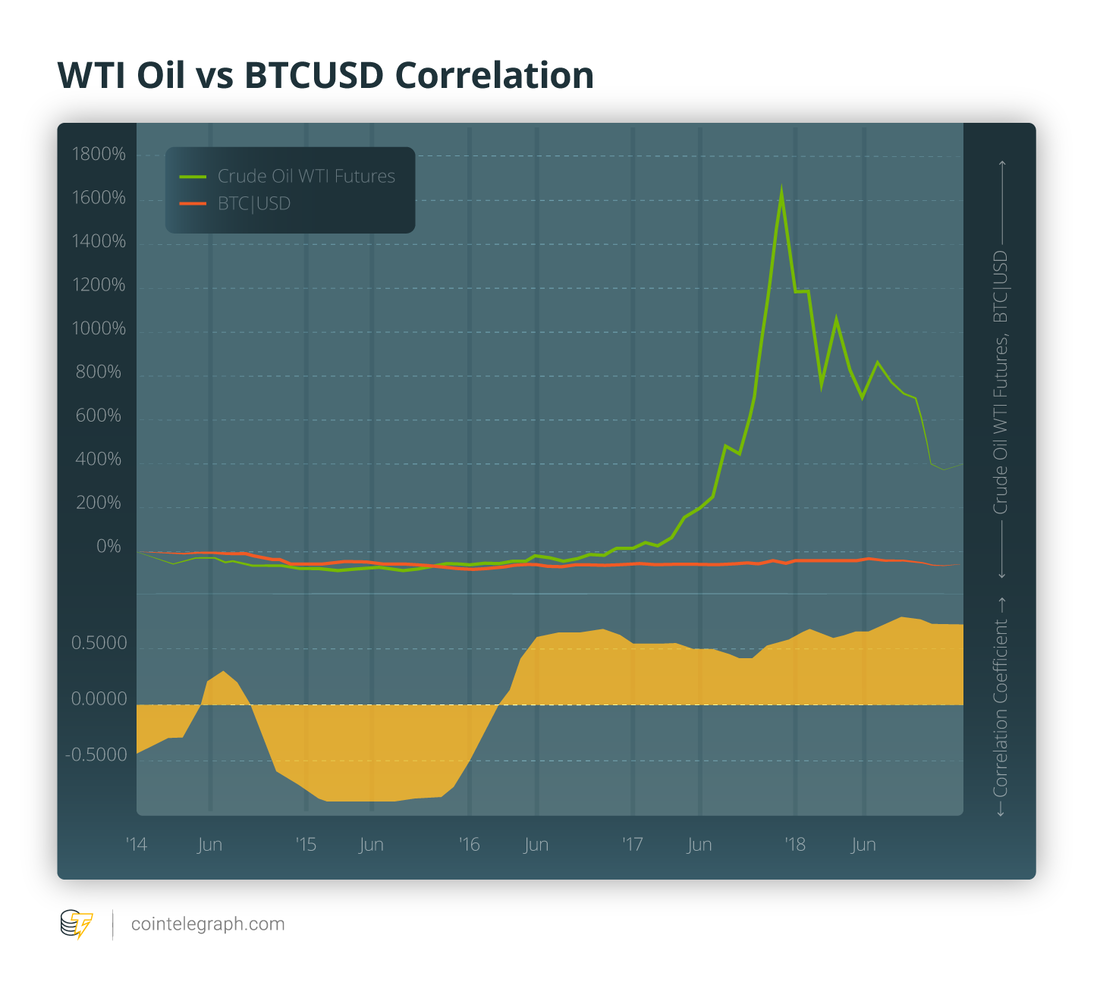

The company has recently closed its first funding round, raising $182.5 million from 12 partners and investors, and is expected to launch its platform in early 2019, as soon as it gets approval from the U.S. Commodity Futures Trading Commission (CFTC). In October 2018, reports emerged that Coinfloor has laid off the majority of its approximately 40 employees as part of an ongoing business restructuring. The exchange’s CEO Obi Nwosu then commented that the company was going through some "staff changes and redundancies." The Bitcoin Network Turns 10The marking of the 10th anniversary of Bitcoin’s block 0 is, however, not to be confused with the Bitcoin whitepaper’s 10thbirthday which was commemorated last year on October 31 in remembrance of the day the whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” was released. As CCN reported earlier, Seychelles-based bitcoin exchange, BitMEX, has marked the day by placing an ad on the front page of the British daily The Times with the message “Thanks Satoshi. We owe you one. Happy 10th Birthday, Bitcoin.” That’s Clever…BitMEX’s purchase of ad space in The Times is not random, as on the day that the genesis block was mined, Bitcoin’s creator, Satoshi Nakamoto, embedded a headline that had graced the paper on that day reading: “Chancellor on brink of second bailout for banks.” This was at the height of the global financial crisis when major financial institutions, especially in the United States and Europe, were being bailed out. The headline was in reference to the plans by the then-Chancellor of the Exchequer in the United Kingdom, Alistair Darling, to bail out British banks for the second time. Notably, the global financial crisis is understood to have inspired Nakamoto to develop an alternative currency which would not be debased by governments and which would not require trust to be placed in a centralized institution. This was made clear in a forum post he published on February 11, 2009: The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. History Repeating Itself?Incidentally, just as there was gloomy economic news this day ten years ago in The Times, the same seems to have repeated itself on the day BitMEX’s ad has graced the paper’s front page. The headline story, for instance, calls attention to student debt, which has for some time now raised concerns that just like the sub-prime mortgages triggered the financial crisis of 2008/2009, educational loans could also lead the world into another financial crisis. Additionally, The Times also featured a story suggesting that the world could be heading into an economic growth slowdown after iPhone maker Apple revised its guidance for the first quarter downwards due to weakening sales in China. Bitcoin has been among the most fascinating tradable assets to watch over the last year. From reaching dazzling new heights to its most recent tumble to fresh one-year lows, the cryptocurrency market has been nothing short of exciting when attempting to characterize its volatile ebb and flow. Amid the growing chorus of enthusiasts, activists and investors calling for greater adoption — and more importantly, the launch of new financial instruments designed to give the budding new asset class greater exposure — Bitcoin prices have become a bellwether for the market. While still difficult to nail down an exact characterization of cryptocurrency and how it fits within the modern financial paradigm — whether a currency, digital asset or a commodity — by evaluating the price action in the context of its more established analogues, it becomes apparent that Bitcoin and its peers have reached significant milestones. By analyzing the characteristics of Bitcoin’s ascent in tandem with commodities like gold and oil or technology stocks that managed to survive the last tech bubble, it is easier to clarify Bitcoin’s position within the context of past performance and how that may relate to the coin’s outlook. Is the run up really that unprecedented? Or instead, is price performance more of a self-fulfilling prophecy that is bound to experience periods of accumulation, consolidation and distribution akin to rotation evident in other, more established asset classes? We took a side-by-side look to see what types of clues can be gleaned in this historical price context and how Bitcoin stacks up when ranking performance. Digital gold The fact that it has existed for 10 years — despite drawing the ire of regulators, experiencing several exchange hacks, and devolving into a scaling stalemate — Bitcoin is a modern marvel. Many have compared it with gold and have even assigned Bitcoin the moniker “digital gold” — and in some ways, this assessment is accurate. Where gold and Bitcoin are similar lies in the properties of scarcity and inputs required to “mine” (the minting of new assets). They’re uncontrolled by a single entity and extremely difficult to counterfeit. Their downsides are also alike, with limited fungibility despite their generally accepted value and with both being used as haven assets during times of market uncertainty. When comparing Bitcoin and gold’s charts (top and bottom), there are also similarities. For example, both assets began without having exchange-traded funds (ETFs), with Bitcoin still lacking one. The chart below shows gold before physically backed ETFs were introduced around 15 years ago. Despite their differing timelines, there are noteworthy similarities when comparing Bitcoin’s pre-ETF chart. It makes perfect sense given that the advances of modern technology accelerate the same chart curves for Bitcoin, whereas gold’s market matured over a series of decades. Furthermore, it suggests that a physically backed ETF contract would do the same for Bitcoin as it once did for gold. After the first gold-backed ETF by ETF Securities hit the market in March 2003 — and later, when the GLD ETF was introduced — prices increased to nearly $1,600 from a low of $332. These developments also improved price discovery and liquidity for the gold market while inviting more widespread retail participation. An ETF launch might lead the next Bitcoin bull run, just as it once did to gold. Currently, exposing one’s capital to BTC is reminiscent of investing in gold in the 1980s and 1990s, which favored specialists who knew how to obtain and store it physically. As both are considered to be a haven asset, and in terms of transaction volume, gold is gradually being usurped by its digital peer, the correlation between these two assets may be more divergent in the future. Investors increasingly choose Bitcoin and crypto over gold in times of turbulence, and Bitcoin transaction volumes recently surpassed gold for the first time ever. According to the London Bullion Market (LBMA), gold is anticipated to clear $446 billion in settled OTC trades during 2018 while Bitcoin has already recorded $850 billion in transaction volume this year. Can crypto sync with tech stocks? Another potential muse for cryptocurrency and Bitcoin could be the tech sector, and it may be an even better control group, given that their utilities align well. Bitcoin currently accounts for slightly over 51 percent of the total cryptocurrency market capitalization. However, looking at one coin is akin to missing the forest for the trees, with a significant contribution coming from other novel coins and solutions that have since entered the fray, including ICOs. Blockchain represents to businesses what the internet was in 1995 — a better medium for reaching consumers. The expectation that the internet would accelerate the way business is done saw internet-adjacent companies experience a price explosion that is now known as the dot-com bubble. Some mundane companies enjoyed skyrocketing share prices just for launching a website, similar to how novel crypto startups suddenly found themselves managing eight-figure token economies in late 2017. In both cases, excitement over the disruptive potential of the underlying technology obscured individual use cases, but the consequential crash brought meritocracy back to the market. The post-bubble lull for tech stocks didn’t mean that the internet was a bust, it just meant that optimism and speculation outpaced innovation. Moreover, it made room for outstanding tech companies to rise above the noise. Amazon, for instance, represents one of the biggest success stories and performances of all time. Yet, shares collapsed 95 percent during the dot-com boom to as little as $6.00 per share. A portfolio with just $1,000 of Amazon stock purchased in September 2001 would be worth around $225,000 today. The same story also played out for other one-time occupants of the share price trenches like Oracle, Adobe, SanDisk and others. The crypto bubble popping would help separate the winners from the losers. The next time prices reach previous levels, it could be on the backs of companies that leverage blockchain to deliver tangible, real-world value. Does that mean the entire market will rise? For stocks it did. Just look at the NASDAQ-100 chart below: Crypto of cause might generate the same interest and value that it once did — but this isn’t the question. Would Bitcoin — the unofficial barometer of the market — reach its peak price again just as NASDAQ did? This is inconclusive. Bitcoin has value individually, but also functions as a gateway for fiat to enter into the greater crypto space. However, if blockchain will create compliant fiat gateways and fundraising methods in the future, Bitcoin and cryptocurrency prices could decouple from the value delivered by blockchain. In this case, its chart might slowly grind down to zero as the power of blockchain escapes the confines of its existing fundraising model. Bitcoin the commodity? The formal definition of a commodity is a standardized, basic good that is used in commerce and is interchangeable in nature in terms of its physical attributes. While, in principle, this is the notion underlying the commodities market, there are nevertheless shades of grey in reality. Take crude oil, for instance. Although there are two major contracts (West Texas Intermediate and Brent), there are multiple grades which vary by location of extraction, density and other important differentiators. Nevertheless, it is widely considered interchangeable despite these inherent subtleties. In the context of interchangeability, Bitcoin definitely fits the bill of a commodity. Furthermore, Bitcoin shares the distinction of mining when comparing how energy products are extracted, thanks to the process of unlocking new coins and appending new blocks to the blockchain. However, this is largely where the commodity comparison ends, especially when viewed in the context of demand and how it impacts mining. While both oil and Bitcoin can be looked upon as finite resources that face scarcity — whether natural or artificial — oil suffers from depletion while Bitcoin faces no such constriction. If anything, the one element that links these disparate commodities is the demand conditions and how that impacts price. Oil producers can ramp production up or down when prices rise or fall, with profitability shrinking when prices are low and margins expanding during times of high prices. Similarly, Bitcoin attracts more miners at a higher price point versus a lower price point. The main differentiator is the difficulty by which each of these tasks is accomplished, and to a higher degree of utility. Oil powers the planet in one form or another by providing energy generation, whereas the use cases for Bitcoin remain limited in terms of applicability (though they grow alongside the ecosystem). While one powers the global economy, the other uses power to sustain itself as the mode of value transfer for and between blockchain ideas. However, the relationship does underline the sensitivity of prices to demand and how it changes the supply-side fundamentals. Looking strictly at a performance perspective, though, despite oil’s more practical nature (generating the electricity and power needed to move our modern economy), Bitcoin’s longer-term performance casts a long shadow over oil prices during the last five years, when cryptocurrency trading picked up momentum and entered more mainstream discourse. While the correlation coefficient displays a changing, but generally positive relationship between the two instruments, it is anything but consistent. During the period, Bitcoin priced in U.S. dollars rose by 250.33 percent, easily outpacing the 51.10 percent decline experienced by oil prices over the same time frame.

While the outlook presents more questions than answers, interpreting these queries within a historical context does shed some light on the potential outcome scenarios, as enthusiasts and investors alike evaluate the next steps for crypto. |

RSS Feed

RSS Feed