|

The Japan Virtual Currency Exchange Association (JVCEA) will obligate its member exchanges to place limits on the trading activity of some clients, Cointelegraph Japan reports today, July 28.

The self-regulatory body has reportedly established a policy of to require its member crypto exchanges to place maximum limits on the volumes traded by the exchanges’ customers. The move reportedly aims to prevent investors with “small assets” from suffering heavy losses and facing problems with basic daily expenses. The report does not specifically define “small assets,” nor does it specify the exact limits to be placed. According to the report, member crypto exchanges will be able to choose from two options for how they establish trading limits. The first option proposes a universal ceiling that implies establishing one fixed maximum limit for all “small asset” traders. The second option suggests a more individual approach by setting different limits for different customers depending on various factors such as their investment experience, income, the value of their assets, and age. The JVCEA has also reportedly suggested trading activity limitations for minors, requiring an adult’s confirmation as a measure against money laundering. Earlier this week, the JVCEA announced its intentions to put limits on its member exchanges’ margin trading, reportedly with the same intention of preventing customers from significant losses caused by highly volatile crypto markets. The JVCEA was formed in early March, with 16 crypto exchanges teaming up to develop and coordinate rules and policies for ensuring security standards for trading cryptocurrencies. The group’s formation came following the January hack of Japan-based crypto exchange Coincheck, with losses totalling more than $534 mln. The association is reportedly set to regulate the market in conjunction with the local Financial Services Agency (FSA), which has been restructured recently in order improve its handling of fintech-related areas, including cryptocurrencies. crypto krypto news crypto krypto news crypto krypto news crypto krypto news crypto krypto news crypto krypto news

0 Comments

Since 2017, SEC has turned down at least three bitcoin ETF applications (including the Winklevoss twins on two occasions) from different groups citing specific reasons for such denials. This has not stopped the surfacing of new applications. Just last month three groups that have been turned down before (CBOE, VanEcK and SolidX) returned with revised applications.

This latest development has reignited the influx of opinions and predictions to how necessary the ETF is to bitcoin and the possible effects of any form of approval of such. While some experts do not see the necessity of an ETF for bitcoin, others believe that is will be a major catalyst for the next big move and possible establishment of the cryptocurrency in the mainstream. Here are the opinions of a few experts who told CCN how much they believe an ETF will affect the development of bitcoin. An Interesting IdeaFounder of Netcoins, Michael Vogel sees the possibility of a bitcoin ETF as “an interesting idea” even though he does not think that such is crucial to bitcoin’s long term success. According to Vogel, many see an ETF approval as another step forward to legitimizing bitcoin in the eyes of Wall Street and the world of traditional finance because it would ultimately put bitcoin (as a trading instrument) in the hands of conventional traders. However, he believes that it would also denote a significant step forward in terms of the comfort level that regulators display around cryptocurrency, given the extreme hesitancy around past ETF applications. “A large ETF would likely have a significant impact on bitcoin prices as well, not just due to trading volume but simply because of the volume of bitcoin that it would remove from the liquid trading market (because the BTC would need to be permanently held by the ETF corporation)”. Absolutely Not Necessary bitcoin ETFs could attract more attention from Wall Street and retail investors alike, but some experts say they aren’t necessary to the asset’s long-term success.Another expert who aired her view on the developing event is the founder of Trezor and business strategy advisor for crypto companies, Alena Vranova. In Vranova’s opinion, an ETF is absolutely not necessary for the development of bitcoin. However, she notes that it will open doors to a substantial mass of new investors who believe that some kind of regulatory approval makes bitcoin legitimate. Vranova indicates that in the short-term, bitcoin will benefit from a positive publicity and the price will probably skyrocket, even as she advised hodlers to ensure the security of their coins. She said: “Everyone who wants to hodl on, please make sure your bitcoin is safe against hackers, because their interest will skyrocket too. I’d recommend to abandon any custodian service, set up some of the proven hardware wallets (TREZOR or Ledger), set up a non-custodian multisig wallet (such as CASA) and read Pamela Morgan’s book on crypto asset inheritance.” Nothing SpectacularFor Dana Coe, Partner at CryptoCrest, an ETF is simply any fund (mutual, hedge, whatever)traded on a listed exchange. He explains that ETFs are mostly trading SEC- or CFTC-regulated assets and, right now, many or most cryptos are neither. Consequently, a fund trading them would have to register its shareholders’ interests in the fund as securities but the traded assets are unregulated. This may add to the reticence of the SEC to allow such a thing. Coe continued by noting that as far as the importance of an ETF to bitcoin, what would really be a good way around is for funds that use large broker-dealers to sell membership interests in whatever fund type they have. So it wouldn’t be an ETF, but the funds themselves could have their membership interests be bought through Vanguard or similar. “In the end that’s how it works anyway – difference being they aren’t listed on an exchange,” concluded Coe. While the ecosystem awaits the new September appointment by SEC in making a decision on the ETF applications, investors and other bitcoin users will continue to ponder on both the long- and short-term effects that may arise. No matter the outcome, the increase in awareness and interest in bitcoin is becoming more certain. Also, with the various development across the entire blockchain ecosystem, improved robustness and industrial stability is becoming more obvious.  Bitcoin's (BTC) sharp recovery from two-week lows has raised the odds of a stronger rally towards $6,400, technical studies indicate. As of writing, the leading cryptocurrency is changing hands at $6,245 on Bitfinex. BTC was expected to drop below $6,000 in the last 24 hours as the bears were on the offensive following an inverted flag breakdown. However, the intraday oversold conditions likely put a floor under bitcoin prices at the two-week low of $6,080, helping it chart a solid rebound to $6,283 (today's high). While it is too early to call a bullish reversal, the change of fortune has saved the day for the BTC bulls. Moreover, the probability of BTC's price charting a picture-perfect inverse head-and-shoulders bullish reversal pattern would have dropped sharply had BTC found acceptance below $6,000. Further, the sharp recovery from $6,080 to $6,283 has opened the doors to re-test of $6,400, the price chart analysis indicates. The above chart shows BTC created a falling wedge pattern over the last four days, as represented by lower highs and lower lows. Prices crossed the wedge resistance yesterday with strength (backed by a pick up in volume), signaling the pullback from Monday's high of $6,820 has ended. The falling wedge breakout also validated the bear-to-bull trend change as indicated by the bullish price-relative strength index divergence (higher low on the RSI). So, BTC will likely find acceptance above the immediate resistance $6,270 (50-hour moving average) and rise towards the descending 100-hour MA, currently located at $6,404. While the hourly chart as adopted a bullish bias, the daily chart is still biased to the bears, so the bulls are cautioned against being too ambitious. The 5-day and 10-day MA are trending south, implying a bearish bias. The relative strength index (RSI) is holding below 50.00, indicating the bears are in control.

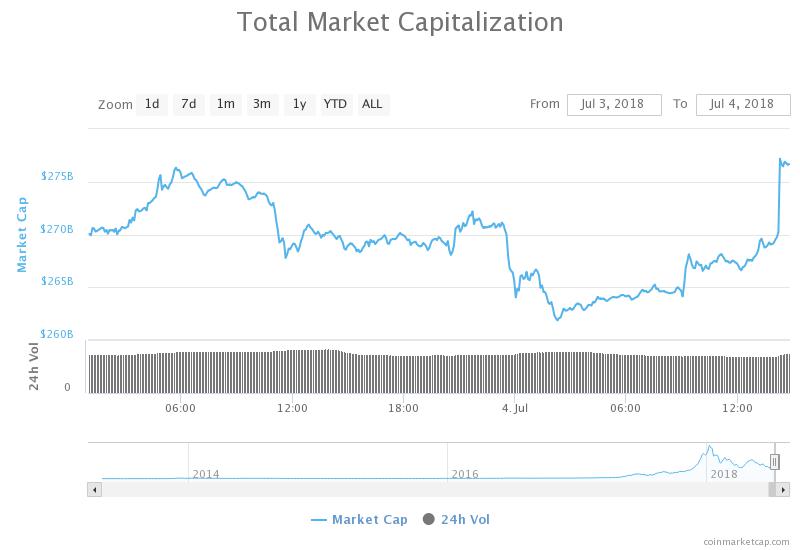

ViewBTC could attack the $6,400 mark, but further gains are ruled out for now as the descending (bearish) 5-day MA and 10-day MA are located at $6,366 and $6,500, respectively. That said, if BTC manages to close (as per UTC) today above 10-day MA, then the doors would open for a re-test of the Monday's high of $6,820. Bearish scenario: A failure to produce a significant move higher despite the bullish price RSI divergence and the falling wedge breakout would shift risk in favor of a drop to a recent low of $5,755. The downside move will likely gather pace if BTC fails to hold above $6,080 (previous day's high) over the weekend.  The cryptocurrency market cap has risen from $263 billion to $276 billion in as little as six hours with Bitcoin seeing a 1.97 percent increase over the last 24 hours with a price rise of over $350 this morning according to Coinmarketcap.com. The market cap hasn’t seen this price level since June 22, 2018, signifying an overall consolidation. Meanwhile, Ethereum is up 1.84 percent, XRP is up 1.22 percent, Bitcoin Cash has seen a 3.09 percent increase and EOS is up 3.89 percent with the only coin seeing losses in the top ten being Cardano which is down 0.7 percent. The biggest gains in the top 100 were seen by Ethos with a price spike of over 80 percent, with the next highest being Electroneum at 20 percent and Kyber Network at 19.8 percent. The biggest losses among the top 100 currencies were WAX, down 12.9 percent, and Veritaseum, down 8.53 percent. The market trend is in keeping with Fundstrat analyst Robert Sluymer’s prediction that Bitcoin would see a price consolidation, pointing out that the $6,300 mark for Bitcoin would be an important line of resistance for the market overall. Sluymer stated that Bitcoin had bottomed out near $7,000 and that if the $6,300 line held that the market would continue to build the momentum required for a significant price breakout with $7,800 being the next price hurdle for Bitcoin and the market as a whole. “The next thing that has to happen is to see bitcoin actually rally through the downtrend,” he said. “We use the 15-day moving average. It’s very simplistic, but it’s a pretty good proxy across most markets. [$7,800] will be the next hurdle for it to get through.” The current uptrend may not be correlated with current news events in the crypto space, as despite Binance freezing trading temporarily and India confirming a banking ban on cryptocurrencies the consolidation continues, suggesting that the trend is simply a natural progression following the relatively severe pullback seen in recent days. However, there was also more bullish news in the space today with strict Japanese FSA considering laxer regulations that would allow classification of cryptocurrencies as a financial product which may allow crypto to gain more mainstream market exposure, along with the Maltese government passing three cryptocurrency bills to continue establishing the nation as a cryptocurrency and blockchain hub. The next few days in the market will prove telling – if the upward momentum increases we may finally see a more sustainable price increase than that seen in December of last year when Bitcoin skyrocketed briefly to $20,000 before plunging back down to earth. A more gradual and sustainable price increase may well allow Bitcoin to develop strong lines of support that will allow the market to grow along with the new mainstream recognition and institutional investment now seen in the space. |

RSS Feed

RSS Feed