|

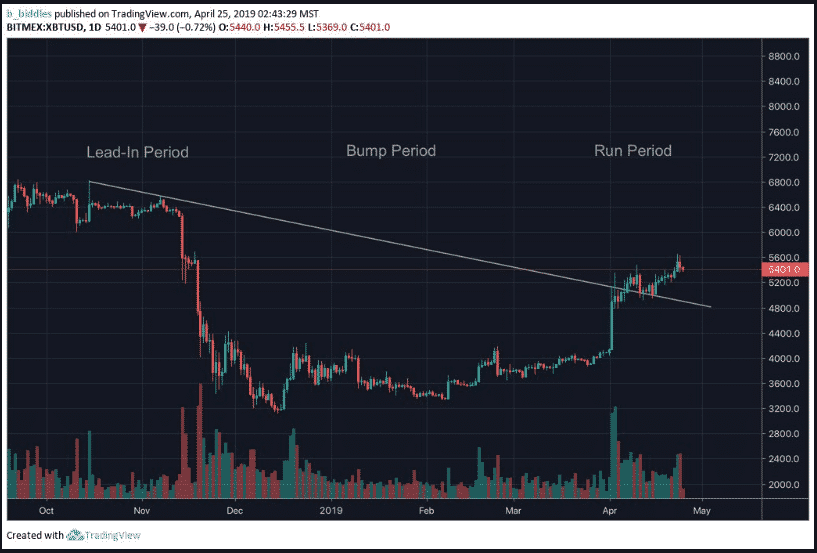

Bitcoin pulled back to the ‘no-trade zone’ or ‘resistance zone’ as seemed to have pulled back from the break-away from the ascending triangle on 22nd April 2019 above $5600. While most traders believe with high probabilistic certainty that the ‘bottom is in’, the bears and bulls still seem to be in a tussle. The price of Bitcoin 12: 30 hours UTC on 25th April 2019 is $5494. It is trading 0.37% higher on a daily scale. The Bear Argument Tone Vays still suggests that the bullish move at the beginning of the month is a bull trap and the bear market isn’t over. On the weekly chart, he mentioned that “we were not able to hold the (200-Day) moving average. Hence, the consolidation continues between the 200-Day and 50-Day moving average.” According to the 4-hour chart and 12-hour chart, Vays suggested that sequential candlestick principals pointed towards an obvious pullback. He expects “A short term correction most likely leading to a long term correction…” Bulls Maintain their Conviction As well While Tone Vays belonged to the class of bears, bulls like B.Biddles haven’t changed their perception either. According to a recent tweet by B.Biddles, “$BTC Okay, checking in on the ascending triangle… Looks like we closed above it, then retraced back into the resistance range. Not seeing anything to do here. Still holding my long w/ avg. entry $5212.” BTC/USD 1-Day Chart (Pull Back to the no-trade zone) Moreover, BTC seemed to pull back to the parallel channel above $5000 and $5450 leaving the traders uncertain. B.Biddles, however, stands with his earlier analysis of the BARR (Bump and Run Reversal) bottom pattern which suggests we have entered the Run side. Further, the principals of BARR align with the ‘back and fill trading‘ mentioned by Bitcoin [BTC] futures trader Jeff Kiburg. Therefore, the expectations of the market still seem to be split between the bull and the bear. Reportedly, the volume of Bitcoin Futures on CME is considerable which will expire for the month on Friday, 26th April 2019. Hence, it might have a huge effect on the price as the shorts will probably close to a net loss. Do you think the rally will continue or the bears are right? Please share your views with us.

0 Comments

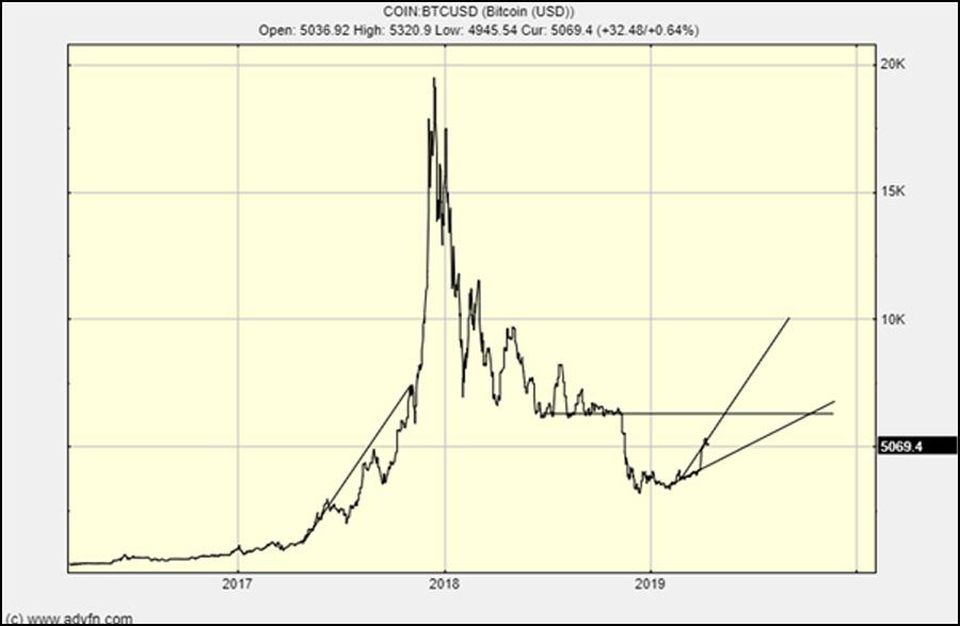

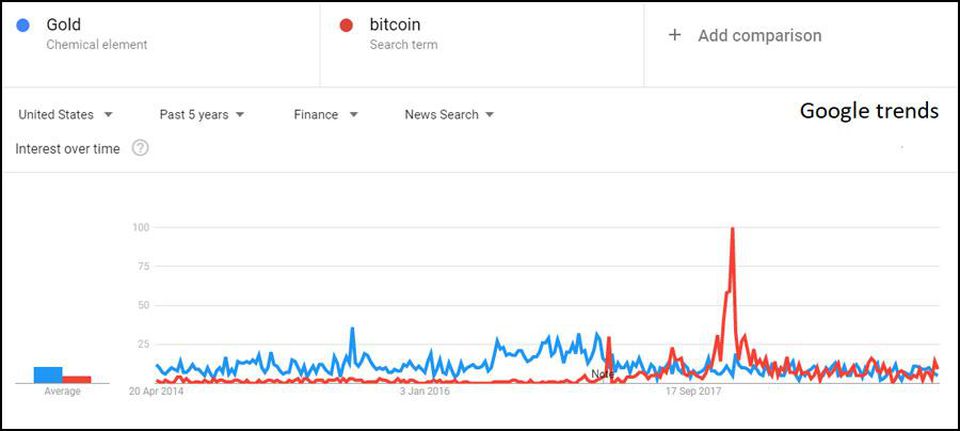

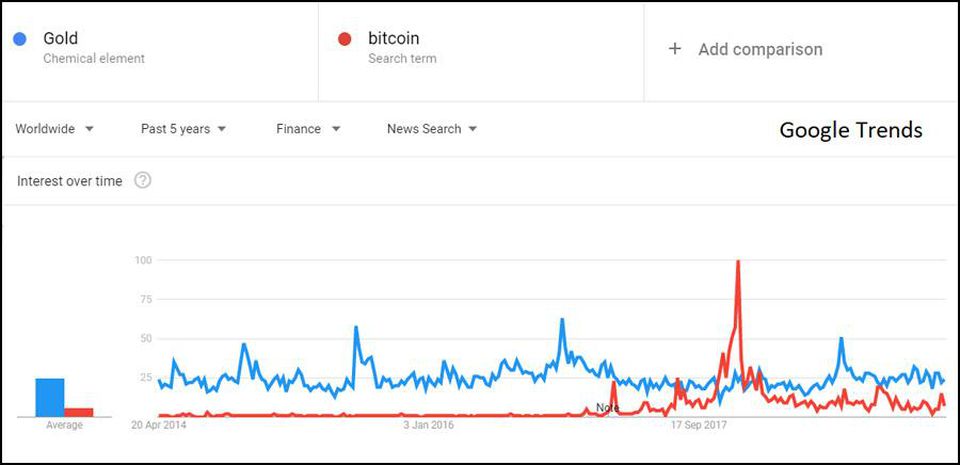

I always write about this basic idea when it comes to any investing: which way is the market going, up or down? If you know, you are in great shape; if you don’t, you should not be playing at all. This is the question on bitcoin. All last year I was saying, “It’s going down, hopefully to about $2,500.” It hit the low $3,000s. Now bitcoin is going up and I will be saying “It’s going up.” I think it will hit $6,000 soon and go on to $10,000. At $10,000 I will look to recalibrate. For now the crypto winter is over. Here is the chart: This is a simple chart with some guidelines and there is a clear pathway upwards. There is apparently a lot of China interest in crypto right now, with tether selling at a premium. This makes sense if the market considers a yuan dollar depreciation on the cards. Tether has been shown to be resilient, even if it is still a controversial coin. It remains a good place to stash capital from short-term moves, be that from bitcoin volatility or ‘fiat’ privations. Money flowing into stablecoins is going to lift bitcoin because fundamentally money flowing into crypto is what sustains and raises prices. Bitcoin and altcoins have to have positive money flow because they are "mined" and have their monetary bases expanded with every block. For bitcoin $9 million of new money must enter every day to match new supply. It's not that straight forward because if miners hodl on to some or all of their bitcoin, less money needs to enter on a daily basis to prop up the price. In the end, however, supply and demand creates the price and for new supply to be matched at current levels, more than $3.3 billion dollars has to flow into bitcoin to make it go up. That might seem a lot but it is not when you see the scale of modern markets. Gold production is $140 billion, so that’s the amount of fiat that most come into the system to keep its price around $1,300 an ounce. Both assets have about the same emission as a percentage; the difference being the market cap of gold is about $5 trillion and bitcoin is $0.09 trillion. Gold is the global asset to hedge against risk and investors are incredibly interested in it. It is a mainstream asset dwarfing equities and other assets in the mind of the man in the street as an "investment." When you drill down into mindshare, when you look at interest in the financial news, you can see what looks like bitcoin eating into the interest in gold, at least in the U.S. If you look at the global picture this trend can’t be seen as clearly and when you appreciate global interest in gold is driven by countries with low tech penetration it suggests that as time passes, bitcoin and crypto will increasingly share the flight capital/risk asset crown with gold. Even if bitcoin takes 20% of that market, bitcoin will be through its previous $20,000 high. That is without bitcoin continuing to be used for transactions or any other emergent use case or situation.

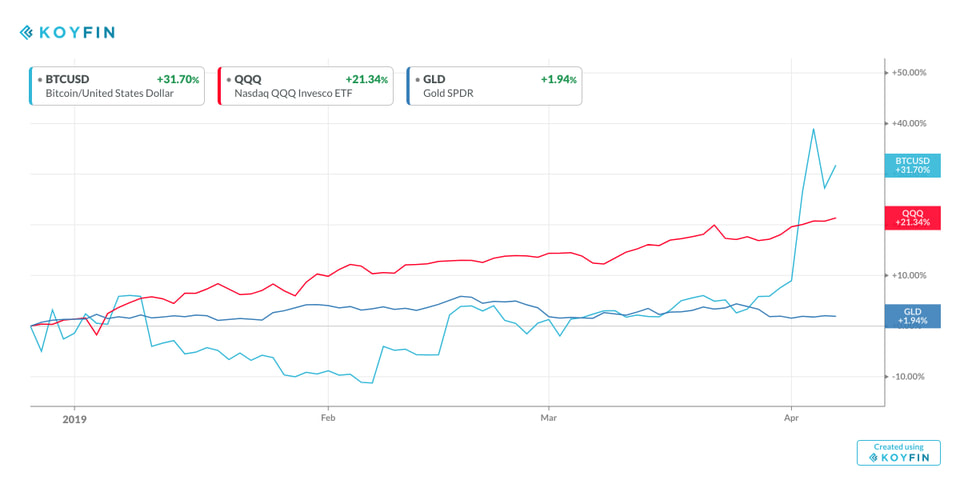

Bitcoin winter is over, the price is going up, the only question is how high. For now $6,000 is an easy target and $10,000 a coin this year is not such a hard target. I’m still accumulating. Investors, traders, and speculators are jumping into the Bitcoin and cryptocurrency markets again, sending prices soaring across the board. Over the last seven days, Bitcoin has gained 25.74%, Ethereum 18.76%, Ripple 16.12%, and Litecoin 53.20%--see table 1. The rally was extended across the cryptocurrency markets, with 94 out of the top 100 cryptocurrencies gaining in price-see table 2. Table 1 7d Price Change For Major Cryptocurrencies Cryptocurrency %7d Bitcoin 25.74 Ethereum 18.76 Ripple 16.12 Litecoin 53.20 Source: Coinmarketcap.com 4/7/19 at 11 a.m. YOU MAY ALSO LIKE Table 2 Number of Cryptocurrencies That Advanced/Declined In The Top 100 Ranks Cryptocurrencies Advance/Decline Number Advance 6 Decline 94 Source: Coinmarketcap.com 4/7/19 at 11 a.m The recent Bitcoin rally has left left stocks, bonds, and the yellow metal in the dust, so far, in 2019-see chart. Bitcoin Beats Stocks, Bonds, and Gold YTD KOYFIN

What could explain the rally? Several factors. One of them is the renewed interest by big money. “The recent surge in Bitcoin has been sparked by a large buy order – rumored to be around $100 million – that sent BTC straight through technical resistance ($4,235) that had been in place since the start of December 2018,” says Nicholas Cawley from the DailyFX team.” “The lack of volatility in Bitcoin over the last few weeks has kept prices in-check, and low volume markets are always more susceptible to sharp moves than more liquid markets.” Kirill Bensonoff, a technology advisor, agrees. “The surge was obviously fueled by a very large order, in the tens of millions of dollars,” says Bensonoff. “This is another sign that institutional players are coming into the market.” Then there’s the prospect of lower interest rates, which turns risk on again for all sorts of speculative investments. And there are the “market technicals.” Market volumes are up 3 to 4 times normal turnover, exacerbating the sharp rally,” observes Cawley. “In addition to the clean break of resistance, the move also broke through the 200-day moving average around $4,650 with ease, enabling the rally to continue.” How far will the rally go? Will Bitcoin ever reach the $20,000 mark again? It all depends on whether regulators will approve financial instruments that allow for broad investor participation in the cryptocurrency markets, like Electronically Trading Funds (ETFs), according to Bensonoff. “For Bitcoin to hit $20,000 in 2019, we would need a major catalyst, and I believe the only one with this much force would be ETF approval,” says Bensonoff. “Without it, we are looking at a $10,000 best case scenario.” While it’s unclear whether which of the two scenarios will come true, one thing is clear: volatility will continue in the cryptocurrency markets, creating new winners and losers. [Ed. note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment. Disclosure: I don't own any Bitcoin.] No one seems to know what to do about bitcoin. Since its genesis, regulators and courts around the world have struggled with whether to and how to regulate it. Depending on where you are in the United States, for instance, it either is or is not illegal to sell your bitcoin for cash without a state license. That’s because depending on where you are, bitcoin is either money or it isn’t, and selling bitcoin is either money transmission or it’s not. And in some places, it may be, but no one has decided. So, you need a license to sell your bitcoin… unless you don’t. As a first-generation member of the rapidly emerging crypto legal community, I have seen how regulatory inconsistencies increase the cost of innovation and drive businesses from jurisdictions that lack clear guidance or take a hostile view of the blockchain and virtual currency industry. Following the Third District Court of Appeal’s Florida v. Espinoza decision, Florida now does both. As explained below, this is due to a widespread and fundamental misunderstanding of the very nature of bitcoin. Espinoza says bitcoin is a payment instrument The recent appellate opinion decided that selling bitcoin requires a Florida money service business license, overruling the trial court’s order that dismissed criminal charges against Mitchell Espinoza who was alleged to be operating an unlicensed money service business by selling bitcoin. The trial court dismissed the charges, concluding that bitcoin was not a “payment instrument” under Florida law, and that selling bitcoin was not money transmission. The Third District disagreed with both of these conclusions, holding that bitcoin is a “payment instrument” because the Court had evidence that individuals were willing to accept bitcoin in exchange for goods and services. The Court cited no technical authorities regarding the development, uses or structure of Bitcoin for non-financial purposes, but instead focused on the fact that Bitcoin could be used as a means to convey value. The Court compared the language of Florida’s Money Transmitter Act (Ch. 560, Fla. Stat.) to that of the federal law and, based on its reading of the plain text of Florida’s law found that it did not expressly require that a third party be included in a transaction for that transaction to constitute money transmission. Accordingly, the Court found, selling one’s own bitcoin constitutes “money transmission,” which requires a license, a written compliance protocol, and extensive record keeping. Not only is this decision at odds with the Federal view of what constitutes a money service business, it also contradicts guidance from the state regulator, Florida’s Office of Financial Regulation, which stated in a declaratory statement in re: Cryptobase that parties who buy and sell their own bitcoin do not need to obtain a money transmission license. It also demonstrates a fundamental misunderstanding of what Bitcoin is and how it is developing into a robust network supporting a variety of use cases, including non-financial uses. Bitcoin is not money. It does money Bitcoin lacks several fundamental characteristics that we recognize as required for something to be “money.” It is not centrally backed or technically fungible. Despite this (and likely because the word “coin” appears in its name), it is often described as “digital money” or “digital gold.” In actuality, Bitcoin is neither of these things. It is a worldwide global network of computers that allows participants to authenticate data without first obtaining permission from a centralized authority. The first application of that network just happens to be something like money. The global network is called Bitcoin with a capital “B” and the public ledger that records and validates data entries on the network is called the Bitcoin blockchain. Prior to Bitcoin, secure peer-to-peer electronic transactions of data were impossible because digital information is easy to copy; digital representations of value could be copied and spent twice. Bitcoin solves this issue by using cryptographic tools, in a game theory based system that incentivizes participants that invest computational energy to validate new data by paying a reward for this work. That internal network reward mechanism is confusingly called bitcoin (with a lower-case “b.”) Without bitcoins to incentivize mining, Satoshi’s network could not work. First, because users who wish to add or change data tracked on Bitcoin’s blockchain need to pay fees in bitcoin, there is a cost to add new data and therefore the Bitcoin network is unlikely to be flooded with phony or low- value transactions (essentially preventing a denial of service type attack). Second, because miners that invest their resources to validate changes to the blockchain must be trusted to act honestly, and not certify false data, the bitcoin reward provides a monetary incentive to participants to only accept valid transactions.

The Third District’s decision and what Florida should do about It The Third District’s opinion focuses exclusively on bitcoin’s financial uses. However, their analysis ignores other uses of the Bitcoin network, including as a censorship-resistant publication network, a time-stamping tool, a document authenticator, a smart contract platform (using RSK Rootstock) with broad application across many industries, and the ability to facilitate forms of micro-communications (utilizing Bitcoin’s lightning network) that are not otherwise technologically possible. Each of these non-financial uses requires a user to easily obtain bitcoin to participate in both the financial and non-financial activities facilitated by the Bitcoin network. By ignoring the State’s existing policy of permitting individuals to sell their digital property without obtaining a money services business license, the Court has transformed Florida from one of the more innovation-friendly states for the blockchain and virtual currency industry into one of the least. By not recognizing the value and developing uses of the Bitcoin network, the Court essentially made it cost-preclusive to start a business that helps to grow or facilitate the still-developing uses of Bitcoin’s global decentralized network and created higher burdens for parties who wish to transact on the Bitcoin network. The State’s desire to prevent unlawful behavior is well founded, but it should be overly cautious when endorsing overbroad or technologically restrictive policies. The Third District Court of Appeal’s decision is at odds with Florida’s Office of Financial Regulation and its proper understanding of the many aspects — both non-financial and financial — of the Bitcoin network. Fortunately, a new bill has been introduced before the Florida House that would form a working group to advise the State, among other things, of how to regulate bitcoin. However, a legislative solution may take months or years. In the meantime, it is imperative that regulators and courts take the time to understand the Bitcoin network’s applications beyond its use as value so they do not let Florida fall behind. Zhu Fa, co-founder of Poolin, a Chinese-based crypto mining pool, predicted that the Bitcoin (BTC) price could hit 5 million Chinese yuan ($738,000 (USD), crypto news outlet 8BTC reported on Feb.11.

While Zhu noted that “it now feels more like a bear market,” he reportedly predicted that in the next bull run, prices will be 10–20 times higher than previous ones. Zhu also noted that massive prices spikes like the one that resulted in the $20,000 per BTC high in 2017, will not always exist, adding that the next bull run could be the last. Predictions from experts in various aspects of the crypto space have ranged from bullish to extremely bearish. During a blockchain event in April 2018, investment tycoon Tim Draper forecasted that by 2022 the price of Bitcoin could reach $250,000. Earlier this week, Barry Silbert, CEO and founder of Digital Currency Group and Grayscale Investments, said that the value of most digital tokens “will go to zero." He added that, "Almost every [initial coin offering] ICO was just an attempt to raise money but there was no use for the underlying token." Zhu’s mining pool, Poolin, has 10.45 percent of global network share, according to BTC.com. The current bear market has hit cryptocurrency miners hard. Some mining companies in China have started selling off hardware by the kilogram. Earlier today, United Kingdom-based cryptocurrency miner Argo Blockchain announced it was refocusing its business in order to cut costs. Argo is terminating its Mining-as-a-Service (MaaS) operations by April, which purportedly could cut costs by as much as 35 percent. PALO ALTO, Calif. — Last year around this time, a toy called a cryptokitty sold for $170,000. A real estate agent remade himself as CoinDaddy, producing cryptocurrency-themed music videos. The man behind a company called Ripple became for a moment richer than Mark Zuckerberg. Kids barely out of high school were buying Lamborghinis because of a crypto meme. Experts went on CNBC to say Bitcoin was going to reach $100,000 per coin. For a few sweet months of 2018, all of Silicon Valley was wrapped up in frenzied easy money and a fantasy of remaking the world order with cryptocurrencies and a related technology called the blockchain. A flood of joy hit the Bay Area. The New York Times ran with the trend in an article with the headline “Everyone Is Getting Hilariously Rich and You’re Not.” It was temporarily true. And just as the American public had been given every possible blockchain explainer that could be written, the whole thing collapsed. The bubble popped. Today the price of Bitcoin — $19,783 last December — is $3,810. Litecoin was $366 a coin; it’s now $30. Ethereum was $1,400 in January; today it’s $130. One recent crypto holiday party offered “broken Lambo dreams and an open bar to drown your sorrows in.”

This December closes out cryptocurrency’s most exciting year, ending in a terrible, sober headache of a winter. Those still chipping away at crypto dreams insist that this is all a good thing because only the serious ones, the true crypto believers, remain. “It’s painful to lose money, but it’s a necessary step,” said Robert Neivert, an investor with the venture capital firm 500 Startups. “2018 was about moving from hype to product.” This year, the blockchain industry — a subset of the cryptocurrency industry that would very much like to live on its own — went through a Cambrian explosion. But first, an explanation of the blockchain: A blockchain is a relatively new kind of database that was initially introduced with Bitcoin. It is not the digital currency. It is the underlying technology that helps manage the currency. Most important, it is decentralized so no one person, government or business controls it. Blockchain became a solution for everything — blockchain for journalism, for pot, for dentists. At the kernel of it all was real technological progress and a growing understanding that this decentralized technology could transform financial systems. But the excitement spun out of control. Even adding the word “blockchain” made stock soar. When Long Island Iced Tea Company changed its name to Long Blockchain Company, its stock went up 500 percent in a day. Scammers flooded the space, launching dubious new investment schemes called “initial coin offerings.” The computing power needed to “mine” a Bitcoin or other cryptocurrency is now sometimes costing more than that coin is worth. Mines — actually, they are electricity-needy data centers — are shutting down. Images of electronics piled up on street corners are going viral. As demand for Bitcoin has dwindled, Bitcoin’s algorithm has adjusted and the coin has become easier to mine. But this is actually good, crypto experts argue. “The fact that miners are shutting down and difficulty is decreasing is a feature, not a bug, of bitcoin’s design,” the venture capitalist Arianna Simpson wrote on Twitter. Some in the cryptocurrency business would just like the world to know that there are still people working on it. Julian Spediacci, a cryptocurrency investor in San Francisco with his twin brother, James, said he would like people to know that he is still alive and identifies as a HODLer, or someone who is not selling despite market fluctuations. A lot of people are reaching out, and they want to find out what happened to us, and if we’re still alive, so it’d be great to clarify that there are a lot of OG HODLers,” Mr. Spediacci said, using language common in the crypto industry to indicate he would remain an investor. I think we’re nearing a bottom,” his brother said. Some of the friends they made have left town. The meetups are quieter. The most recent video from the community’s primary musical voice, CoinDaddy, né Arya Bahmanyar, is set to the tune of Beatles hit “Yesterday.” But the Spediacci brothers continue. They say they are starting a new hedge fund. And that weekend there would be a holiday party at a new blockchain incubator, Starfish, run by Alicia Ferratusco. An incubator is a space where a group of start-ups work together, in this case working on blockchain technology. “It’s called Starfish because when you cut off the leg of the starfish, it can grow back,” Julian Spediacci said. Not everyone is struggling in the downturn. For lawyers, it is a new gold rush. “Now that the market dropped, everyone is getting sued,” said Chante Eliaszadeh, a law student and the president of a blockchain law club called Blockchain at Berkeley Law. She said the legal scene is pretty exciting right now. As the Securities and Exchange Commission cracks down, some scammers are trying to escape to Bali or Malta, where regulations are more lax. At one holiday party in Palo Alto this year, the theme was “real.” Organizers had pasted the motto — “Real People, Real Money, Real Deals” — on the walls, on boards, on slide shows and handouts. Moderating a panel was Radhika Iyengar-Emens, a founding partner at a venture firm that specializes in cryptocurrency and blockchain start-ups called StarChain Ventures. “I think we’re going to see a lot of real use cases,” Ms. Iyengar-Emens said. “And these guys will be here for those very real use cases.” A use case would be a regular consumer’s being able to use a cryptocurrency to do something other than make a speculative investment. The audience sat in folding white chairs. The snacks were Ritz Bits. “What is QuarkChain?” QuarkChain’s founder and chief executive, Qi Zhou, asked the audience. “Next generation blockchain.” Kerry Washington, a member of the Litecoin Foundation, which promotes Litecoins, gave a presentation about the year, in which the coin lost more than 90 percent of its value. He talked about a big Litecoin summit this year, which on one slide he specified cost a quarter-million dollars. There, guests could buy candy with Litecoins. This showed everyone how useful Litecoin could be, he said. The trouble was always that we already have something that lets us buy candy. An ad played for something called Bitrue, a wallet. It was just a half-dozen people looking straight at the camera saying: “I trust Bitrue.” And then Curtis Wang, the chief executive of Bitrue, stood up to announce a very special offer. He could promise investors a 10 percent annual percentage yield. There was scattered applause in the crowd. Someone in the audience raised a hand and asked whether that was even legal to offer. |

RSS Feed

RSS Feed