|

PALO ALTO, Calif. — Last year around this time, a toy called a cryptokitty sold for $170,000. A real estate agent remade himself as CoinDaddy, producing cryptocurrency-themed music videos. The man behind a company called Ripple became for a moment richer than Mark Zuckerberg. Kids barely out of high school were buying Lamborghinis because of a crypto meme. Experts went on CNBC to say Bitcoin was going to reach $100,000 per coin. For a few sweet months of 2018, all of Silicon Valley was wrapped up in frenzied easy money and a fantasy of remaking the world order with cryptocurrencies and a related technology called the blockchain. A flood of joy hit the Bay Area. The New York Times ran with the trend in an article with the headline “Everyone Is Getting Hilariously Rich and You’re Not.” It was temporarily true. And just as the American public had been given every possible blockchain explainer that could be written, the whole thing collapsed. The bubble popped. Today the price of Bitcoin — $19,783 last December — is $3,810. Litecoin was $366 a coin; it’s now $30. Ethereum was $1,400 in January; today it’s $130. One recent crypto holiday party offered “broken Lambo dreams and an open bar to drown your sorrows in.”

This December closes out cryptocurrency’s most exciting year, ending in a terrible, sober headache of a winter. Those still chipping away at crypto dreams insist that this is all a good thing because only the serious ones, the true crypto believers, remain. “It’s painful to lose money, but it’s a necessary step,” said Robert Neivert, an investor with the venture capital firm 500 Startups. “2018 was about moving from hype to product.” This year, the blockchain industry — a subset of the cryptocurrency industry that would very much like to live on its own — went through a Cambrian explosion. But first, an explanation of the blockchain: A blockchain is a relatively new kind of database that was initially introduced with Bitcoin. It is not the digital currency. It is the underlying technology that helps manage the currency. Most important, it is decentralized so no one person, government or business controls it. Blockchain became a solution for everything — blockchain for journalism, for pot, for dentists. At the kernel of it all was real technological progress and a growing understanding that this decentralized technology could transform financial systems. But the excitement spun out of control. Even adding the word “blockchain” made stock soar. When Long Island Iced Tea Company changed its name to Long Blockchain Company, its stock went up 500 percent in a day. Scammers flooded the space, launching dubious new investment schemes called “initial coin offerings.” The computing power needed to “mine” a Bitcoin or other cryptocurrency is now sometimes costing more than that coin is worth. Mines — actually, they are electricity-needy data centers — are shutting down. Images of electronics piled up on street corners are going viral. As demand for Bitcoin has dwindled, Bitcoin’s algorithm has adjusted and the coin has become easier to mine. But this is actually good, crypto experts argue. “The fact that miners are shutting down and difficulty is decreasing is a feature, not a bug, of bitcoin’s design,” the venture capitalist Arianna Simpson wrote on Twitter. Some in the cryptocurrency business would just like the world to know that there are still people working on it. Julian Spediacci, a cryptocurrency investor in San Francisco with his twin brother, James, said he would like people to know that he is still alive and identifies as a HODLer, or someone who is not selling despite market fluctuations. A lot of people are reaching out, and they want to find out what happened to us, and if we’re still alive, so it’d be great to clarify that there are a lot of OG HODLers,” Mr. Spediacci said, using language common in the crypto industry to indicate he would remain an investor. I think we’re nearing a bottom,” his brother said. Some of the friends they made have left town. The meetups are quieter. The most recent video from the community’s primary musical voice, CoinDaddy, né Arya Bahmanyar, is set to the tune of Beatles hit “Yesterday.” But the Spediacci brothers continue. They say they are starting a new hedge fund. And that weekend there would be a holiday party at a new blockchain incubator, Starfish, run by Alicia Ferratusco. An incubator is a space where a group of start-ups work together, in this case working on blockchain technology. “It’s called Starfish because when you cut off the leg of the starfish, it can grow back,” Julian Spediacci said. Not everyone is struggling in the downturn. For lawyers, it is a new gold rush. “Now that the market dropped, everyone is getting sued,” said Chante Eliaszadeh, a law student and the president of a blockchain law club called Blockchain at Berkeley Law. She said the legal scene is pretty exciting right now. As the Securities and Exchange Commission cracks down, some scammers are trying to escape to Bali or Malta, where regulations are more lax. At one holiday party in Palo Alto this year, the theme was “real.” Organizers had pasted the motto — “Real People, Real Money, Real Deals” — on the walls, on boards, on slide shows and handouts. Moderating a panel was Radhika Iyengar-Emens, a founding partner at a venture firm that specializes in cryptocurrency and blockchain start-ups called StarChain Ventures. “I think we’re going to see a lot of real use cases,” Ms. Iyengar-Emens said. “And these guys will be here for those very real use cases.” A use case would be a regular consumer’s being able to use a cryptocurrency to do something other than make a speculative investment. The audience sat in folding white chairs. The snacks were Ritz Bits. “What is QuarkChain?” QuarkChain’s founder and chief executive, Qi Zhou, asked the audience. “Next generation blockchain.” Kerry Washington, a member of the Litecoin Foundation, which promotes Litecoins, gave a presentation about the year, in which the coin lost more than 90 percent of its value. He talked about a big Litecoin summit this year, which on one slide he specified cost a quarter-million dollars. There, guests could buy candy with Litecoins. This showed everyone how useful Litecoin could be, he said. The trouble was always that we already have something that lets us buy candy. An ad played for something called Bitrue, a wallet. It was just a half-dozen people looking straight at the camera saying: “I trust Bitrue.” And then Curtis Wang, the chief executive of Bitrue, stood up to announce a very special offer. He could promise investors a 10 percent annual percentage yield. There was scattered applause in the crowd. Someone in the audience raised a hand and asked whether that was even legal to offer.

0 Comments

Bitcoin: Why the Bear Market May be Over Bitcoin (BTC-USD) has been in the midst of a tumultuous bear market for roughly a year now. The world’s best known digital asset topped out at about 19,500 late last year, and had declined by 84% to a low of $3,170 in recent days. However, since then Bitcoin has amassed an impressive rally, registering five consecutive up days and gaining 30% in the process. Bitcoin 1-Year Bitcoin is now trading around $4,000, and could be in the opening stages of its next bull market. It appears that the period of maximum negativity and pessimism concerning Bitcoin has passed, and the next bull cycle could elevate Bitcoin’s price to fresh, new all-time highs over the next several years. Why the Bear Market May be Over Bitcoin’s decline has been epic this year, as the digital currency gave up nearly 85% of its value. However, the declines seem so epic primarily because this is the first time a Bitcoin bear market has been in the spotlight in the mainstream media and the general public. The truth is that Bitcoin has been through several bull/bear cycles in which the digital asset had appreciated considerably, only to deflate by 80% – 90%. In the past 24 hours, the crypto market recorded a loss of over $7 billion as its valuation dropped from $134 billion to $127 billion. The Bitcoin price declined below the $4,000 mark after surging to $4,100, struggling to maintain its newly found momentum. As the Bitcoin price dropped from $4,162 to $3,780 and demonstrated a 9 percent decline in value, most major crypto assets in the likes of Ripple (XRP) and Bitcoin Cash (BCH) recorded larger drops in the range of 15 to 25 percent. From its weekly peak, the Bitcoin Cash price fell from $239 to $180, by just over 24 percent. A minor correction was expected for the majority of assets in the global crypto market due to the large gains they recorded throughout the past week. Where is Bitcoin Heading? Last week, when Bitcoin achieved a new yearly low at $3,100, a strong buy wall was created on major fiat-to-cryptocurrency exchanges Coinbase and Bitstamp. Existing investors saw a buying opportunity in the tight range from $3,000 to $3,500. As the high buy wall started to accumulate the dominant cryptocurrency, Bitcoin experienced a corrective rally and fueled other crypto assets in the market to increase in price. Bitcoin Cash, in particular, showed a strong upward movement, tripling its value from $75 to $239 within a five-day span. A technical analyst with the online alias “Hsaka” explained that the $3,910 mark was tested as a resistance level and the failure to overcome it led the price of Bitcoin to drop below the $3,800. The analyst wrote: “Expecting a bounce into a lower high off this white level. If $3,910 is retested as resistance, high odds that was the local top and we’ll begin unraveling soon. If this is heading down soon, I’d ideally want to see it reject off the $3,890 level. Otherwise, might just chop around on the weekend and break down on Monday.” The volume of Bitcoin has also substantially declined from around $8 billion to $5.9 billion. The decline in the volume of the asset was expected as the cryptocurrency market tends to see a drop in trading activity during the weekend. Expect Less Trading Activity and Price Action As the Christmas season nears, the cryptocurrency market is likely to see its volume drop, which could lead to less intense buy walls but also relieve sell pressure on major assets. On December 20, a cryptocurrency trader known as DonAlt said that the bear market is not over just yet and that it is not the time to start accumulating, adding that the market is merely showing volatility in a low price range. “By the way, this is not the place to start buying. A full year bear market doesn’t just go away like this, it’ll take time. Even if BTC goes to $4,270 I’ll only be looking to short/close longs. We’re still in a bear market, BTC is just rightfully punishing late bears,” the trader said. Two members of the Rothschild family are credited, perhaps incorrectly, with the (in)famous quote regarding investing: “When there is blood in the street” (James in the mid-19th century and Nathan, after the battle of Waterloo). The family has been one of the richest in the world for over 200 years, so there’s something to be said for following the advice of its members… In the crypto space, therefore, the question becomes, Is there enough blood in the streets now that it’s the time to buy? I would argue no. Or, more precisely, not quite yet. The basis for this conclusion is the past behavior of bitcoin (which, for the purposes of this article, I will use as a proxy for the entire crypto market – fully aware of the fact that it’s not perfect in that role, but only reasonably good). The data set used is all related to bitcoin drops of 80 percent or more. That’s because there is a very interesting aspect to historical BTC performance: There are no peak-to-valley drops between 57 percent and 82 percent over its trading history. Thus, it becomes quite easy to narrow the data down (since a drop of 50 percent is fundamentally and qualitatively different from a drop of more than 80 percent). This leaves us with four instances: a bit too few in an ideal world, but enough, in some cases, to reach some rather definite conclusions. The four drops are: Of course, the last one is not yet over. Note that the current bear market has, to date, barely exceeded the third largest. To reach second place, BTC would have to drop to $2,553. To take first place, BTC would have to fall back to $1,239. If we analyze the drops more closely, some interesting facts emerge. For instance, the average number of days between peak and valley is 233, or about 8 months. (The average would be 10 months without the unusual 2013 drop, which saw a peak-to-valley duration of two days.) This reinforces the conclusion that another bottom is probably close in terms of timing. Then, once crypto markets hit bottom, how long does a recovery generally take? We see those data below: So, with quite a range, the average time for the price to double from the bottom is four months. The average time to reach the prior peak is one year and four months, or one year from the bottom doubling. Once that peak is reached, however, the time for the peak to double is a remarkable two months – and the range of the data is quite small: from one to three months. Conclusion: once enough momentum to reach the prior peak has been achieved, it consistently keeps going very strongly. As we can see, the range of dates to reach and double the peak is far less than the range to double the bottom. Again, the sample is small, but the trend is clear. However, it’s also clear that the time required for all three metrics is increasing over time; thus, it may well take longer to hit each level this time around. Are we at the bottom?Further analysis is required to determine this. Let’s call it “spike analysis.” BTC virtually always reaches a peak and puts in a bottom with a spike. In other words, there is not a nice round hill at the top and a gently sloping down-and-up valley at the bottom. Bitcoin’s tops and bottoms are more violent. And that “violence” can be measured. For the first peak from the first table above, we have some statistical data, but no good graph as 2011 graphs are not generally available. However, regardless of the data source, the wick is enormous, up to 40 percent from the immediately surrounding prices. For the November 2011 valley, the graph is quite interesting. The drop, while it does not look dramatic because of the tremendous jump (about 500 percent) shortly thereafter, was actually nearly 10 percent with an almost immediate recovery. The total drop was also the largest drop in bitcoin history in percentage terms at 93.6 percent. The next peak, in April 2013 was even more dramatic, with a jump of 25-40 perecent depending on what one chooses as the starting point. Stunningly, the next valley was put in two days later. (For those of you who, as I, lived through this, you will remember that this sudden spike and drop were directly related to the Cyprus debt crisis.)

(Please note that I am not addressing in any detail the various exogenous events which may have driven the crypto peaks and/or valleys. In addition to Cyprus in 2013, you had PBOC/MtGox in late 2013 and early 2014, the futures market-fueled rise in late 2017, ICO and general crypto regulation in 2018, etc. Good fuel for another article, but too much to address here.) Again, depending on what one chooses as a baseline, the drop here was about 20 perecent. (It should also be noted that this drop may be viewed as a double or even triple bottom, but as it was put in over a very short period of time, the analysis still holds.) This is now the fourth largest drop in BTC history, having just been displaced by the current one. The next peak was later that same year, in November. This peak is a bit of an anomaly for two reasons: first, the spike was only about an 8 percent increase and, second, there was a clear double top – although, again, over a very short period of time. The next valley was just over one year later, in January 2015. This time the drop was about 15 percent and was very clear. The total peak-to-valley drop, at 86.9 percent, remains the second-largest in bitcoin history. The final peak, and almost certainly the best known, was in December of last year. This was roughly a 12 percent peak and was extremely clear. Finally, we look at the current price chart. We can see that there was a large drop from 6,000, but there has been nothing like a “violent” bottom put in – in fact, the opposite is true. When capitulation? Of course, a “violent bottom” is simply another way of saying “capitulation.” That concept has become so well known that many people, including authors of articles similar to this, are asking “have we seen capitulation yet?” (My favorite recent quote in this regard is “point of apparent capitulation” – which appeared about $1,000 ago.) Here is my thought on capitulation: it will be obvious to nearly everyone when it happens. If lots of people are asking whether “that move down” was capitulation or not, it wasn’t. So ,where will the bottom be? In my opinion, there is a relatively small chance of putting in a bottom around $2,800. However, I suspect that the odds are higher that the BTC price will test $2,000 within a month or two. Even if I’m correct, however, that would only move this drop to second place of all time. One further point I would like to make is to address the question which “crypto folk” never ask, but which “fiat folk” do: Can the Bitcoin price drop to zero? I remember almost six years ago when I first heard of bitcoin and cryptocurrencies. I wasn’t convinced they would survive. After a year or so, survival wasn’t an issue, but scale and importance were. Now, it seems clear to me that crypto trading tokens (so I’m deliberately excluding blockchain applications which do not rely on “cryptocurrencies” that trade) and bitcoin are here to stay and that they will eventually play a non-trivial role in the financial system. Without going into a long explanation, there is simply too much infrastructure that has been and is being developed, too many people with too much “skin in the game,” and too many advantages for the trading token ecosystem to utterly collapse. The conclusion: a new bottom is nigh upon us, but not quite here yet. Or said another way, there is not yet enough blood running in the crypto streets to simply start buy bitcoin and other tokens which trade. From an investment standpoint, however, while it’s not the time to buy, it is the time to invest. It’s obviously impossible to time the bottom exactly, so one must be positioned to invest now to maximize the benefit of the reversal. How to do that? Select a long-short investment vehicle (which the Rothschilds did not have) and invest now. I’m quite certain you won’t have to wait long for the next bull run to begin and, in the meantime, such a vehicle can make money on the balance of the drop. Jeremy Allaire, co-founder of crypto finance company Circle, told CNBC in an interview Friday, Dec. 14, that Bitcoin (BTC) will be worth “a great deal more” than it is now. When asked about the Bitcoin price in three years, Allaire told Squawk Box host Andrew Ross Sorkin that he does not make “significant price predictions,” while adding, “I think it is certainly going to be worth a great deal more that it is today.” Allaire also stated that while Bitcoin is attractive as a non-state store of value, a slew of other tokens will enter the space, and the bases of their valuations will be diverse. He further explained: “I do not think it's a winner-take-all [situation]. We have the phrase ‘the tokenization of everything,’ and we think cryptographic tokens are going to represent every form of financial asset in the world. There will be millions of them in years.”

Allaire claimed that the crypto sphere needs clearer regulation, while noting that the United States already has “more regulatory clarity than almost any other market in the world.” The Circle co-founder cited the need for clarification of whether crypto assets are currencies or commodities, and which crypto assets should qualify as securities. Furthermore, he believes the industry needs to define whether it needs rules for secondary trading of digital securities or a “kind of commodity spot market supervision for the crypto space.” Earlier this week, major crypto bull and co-founder of Fundstrat Global Advisors Tom Lee claimed that the fair value of Bitcoin is “significantly” higher than its current price and should be somewhere between $13,800 and $14,800. Moreover, he still thinks that the fair value of Bitcoin could reach $150,000 after it has been more widely adopted. As for crypto adoption, a commissioner of the U.S. Securities and Exchange Commission (SEC) Hester Peirce, dubbed “Crypto Mom” by the community for her pro-crypto stance, thinks that the process might take a long time. She urged the public not to ‘hold its breath,’ waiting for a Bitcoin ETF, as it could be “20 years away from now or it could be tomorrow.” In what is becoming a disturbingly common occurrence, the bitcoin price on Friday set yet another fresh yearly low, slinking below the $3,200 mark for the first time in 2018. The flagship cryptocurrency’s move below $3,200 came shortly after 16:10 UTC, following an unsuccessful breakout attempt earlier in the week. As of the time of writing the bitcoin price was trading at $3,187 on Bitstamp after briefly dipping as far as $3,171. The total cryptocurrency market, meanwhile, had seen its valuation slip to $102 billion — or roughly 37 percent of the size of bitcoin’s singular market cap on this date last year. There were, of course, laughable attempts at explaining today’s sluggish performance, including at least one that connected it to the report that bomb hoaxers had attempted to extort crypto payments from unwitting victims located across the globe.

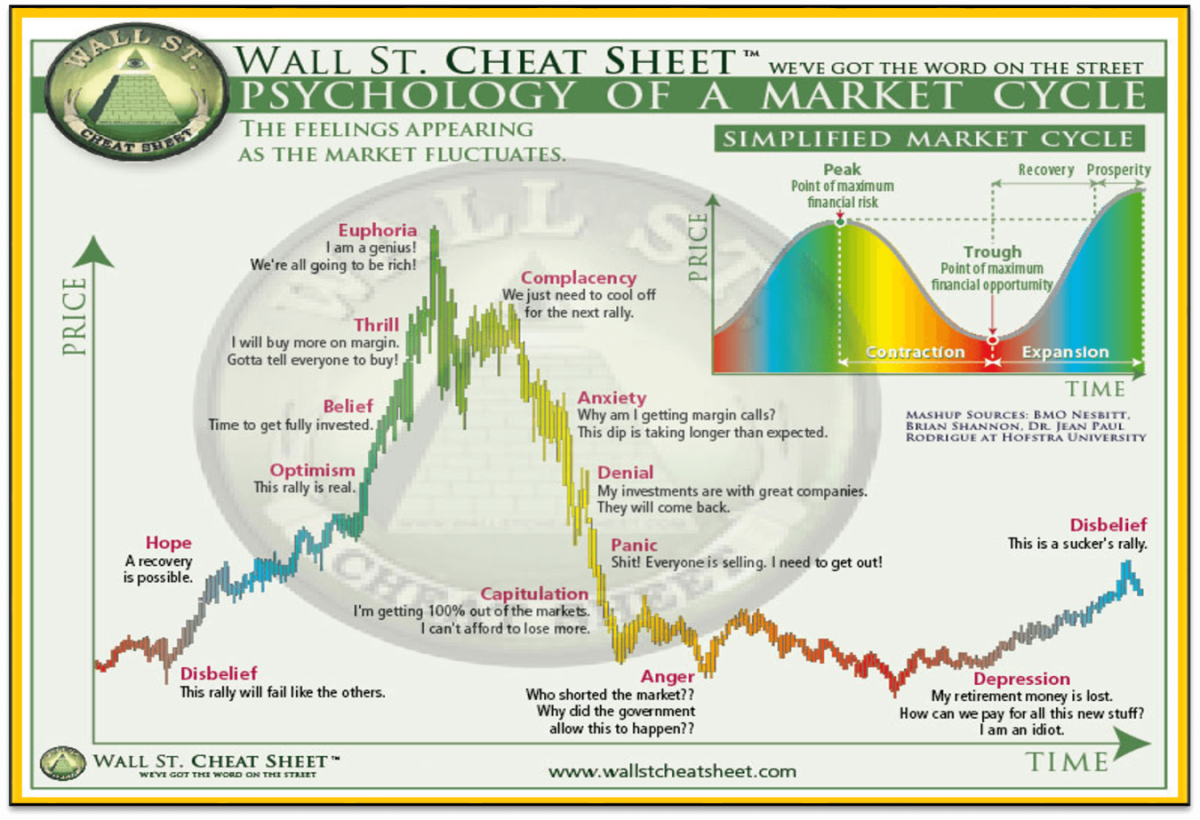

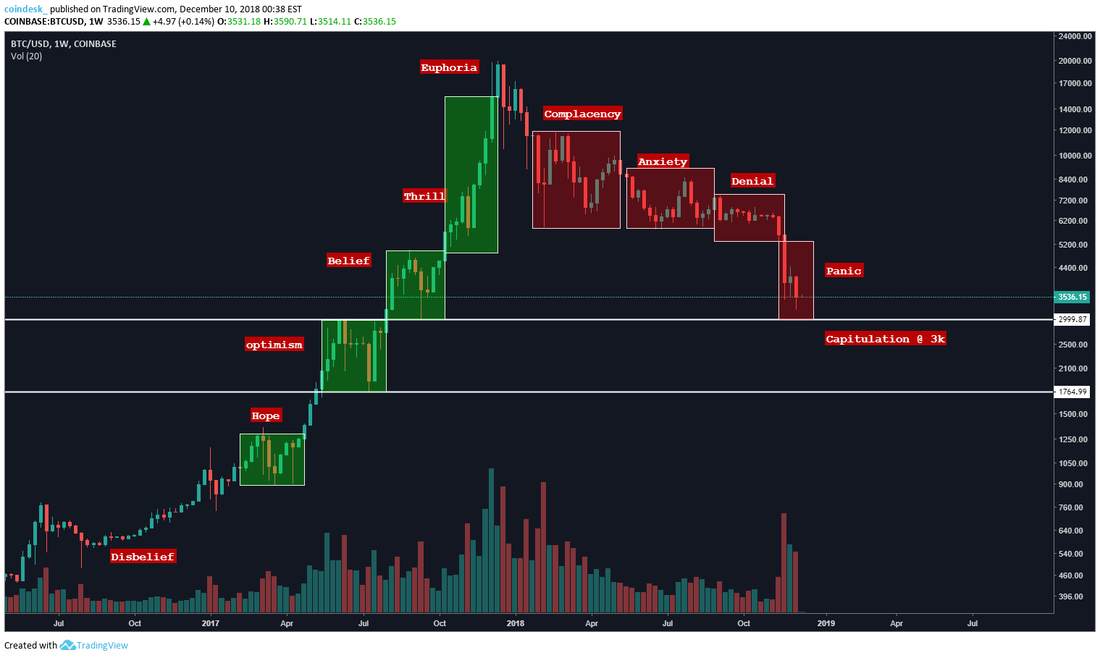

However, as is often the case, there does not appear to have been a clear trigger for the move, outside of the continued downward pressure that has plagued the market throughout the year and will continue to do so until BTC can establish a firm bottom. Investing in financial markets can be an emotional roller-coaster and the bitcoin market is no exception. When it comes to investment, human emotions tend to oscillate between two extremes – fear and greed – and the constant balancing act between the two creates a cycle of market emotions. For years, traders and investors alike have studied the cycle of market emotions with the help of a chart known as the “Wall Street Cheat Sheet.” As seen above, at the top of the market cycle is “euphoria” – a point of maximum financial risk. This is the time when investors think nothing can go wrong and a self-feeding cycle is established: more investors enter the market for its stellar returns, leading to a further rise in price and valuations reach dizzying heights before, eventually, reality bites hard. The cryptocurrency market was gripped by euphoria in the last quarter of 2017. Bitcoin prices rose from $6,000 to $20,000 within seven weeks on speculation that futures launch would open floodgates for large institutions to buy cryptos. Further, every other altcoin, regardless of its fundamental story, had rallied to record highs by the first week of January. Most pundits came out with bitcoin targets of $50,000 or more at the time. The bubble, however, was pricked just two weeks into January by a regulatory crackdown in China and South Korea – two of the biggest sources of demand for cryptocurrencies back then. Where are we now? Since then, the bitcoin market has arguably gone through “complacency,” “anxiety” and “denial.” In this interpretation, the denial stage, it could be argued, lasted for five months as BTC’s repeated defense of $6,000 offered hope that the broader market and altcoins with strong fundamentals would recover lost ground before the year-end. Those hopes, however, were shattered as BTC nosedived below $6,000 on Nov. 14, pushing the bitcoin market into the “panic” stage, causing investors to look for an exit with no price floor in sight. The price of bitcoin has since fallen nearly 50 percent from the $6,000 mark, trading at an average price of $3,327 according to CoinDesk data at press time. More importantly, trading volumes jumped more than 30 percent month-on-month in November. That high-volume sell-off likely indicates many weaker hands have left the market. The argument for capitulation not having set in yet is that it is usually a single extreme selling event, short in duration but backed by a surge in sell volume and subsequent buy volume. As recent as Nov. 1, bitcoin suffered just that and it seems panic is still the most likely candidate for bitcoin’s current stage in its market cycle, at least until a break below the psychological price level of $3,000 incites capitulation. What’s next? The result of capitulation is a lengthy period of sideways price action and misery felt by investors. So this leaves us studying the market cycle after recent violent price drops, searching for visual cues of a “bottoming out” of the current bear trend. And by having examined the different cycles it’s safe to assume bitcoin is close, but not quite there. Weekly chart The first stage after capitulation is ‘anger,’ when investors look for some reason for the horrific losses they’ve just experienced.

Finally, reality sets in for investors who then shift from feeling anger to “depression” in regards to the financial state they are left in and this is when the bottom hits. When all hope in the market is lost in the eyes of the public, the market quietly starts to pick up a bid. At this stage, investors have been emotionally battered to the extent they will not believe any rally from here on out can be sustainable. Although it may be hard to grasp, this point of what seems like utter disaster can be seen as the point of maximum financial opportunity and minimum risk. With all the sellers now out of the market, accumulation at basement prices can begin, which eventually provides the energy for the start of the next market cycle. Like billionaire investor Warren Buffett famously said, be “fearful when others are greedy and greedy when others are fearful.” SEC DELAYS: Hopes that a bitcoin exchange traded fund (ETF) would be approved before the new year were dashed Thursday when the U.S. Securities and Exchange Commission (SEC) officially postponed any decision to Feb. 27, 2019. VanEck and SolidX teamed up with Cboe earlier this year to propose the ETF, and under the SEC’s rules, the regulator must approve or reject the rule change outright in its next notice – it cannot be delayed further. Thursday’s announcement comes after months of uncertainty around bitcoin ETFs. The regulator previously rejected a number of proposals, including simultaneously rejecting nine in August. Those rejection were suspended the next day when the SEC announced it would review the proposals once more. Full Story BIPARTISAN BILLS: U.S. congressmen have introduced two bipartisan bills aimed to help prevent cryptocurrency price manipulation. Representatives Darren Soto (Dem.) and Ted Budd (Rep.) jointly announced Thursday that the proposed legislation is ultimately aimed at making the U.S. a “leader in the cryptocurrency industry.” The bills essentially ask the Commodity Futures Trading Commission (CFTC) and other U.S. financial regulators to come up with a roadmap to better regulate cryptocurrencies in order to protect individuals and businesses. The first bill seeks research on how crypto price manipulation takes place, its impact on investors, and how to prevent such activities through regulatory changes, and in turn, protect investors. The second asks regulators to carry out research on crypto regulations in jurisdictions across the globe and recommend legislative changes to promote the growth of adoption of cryptocurrencies in the U.S. For instance, it asks the regulators to clarify which virtual currencies might qualify as commodities and to suggest a new, optional regulatory structure for crypto exchanges that includes federal licensing, market supervision and consumer protection. Soto and Budd said that “Virtual currencies and the underlying blockchain technology has a profound potential to be a driver of economic growth.” Full Story TOKEN EXPLOSION: Crypto exchange Coinbase is looking at 31 assets to potentially list on its trading platforms, it said Friday. The list includes both independent token projects and ERC-20 tokens. Cryptocurrency trading platform Gemini founders Tyler and Cameron Winklevoss have launched a mobile crypto trading app together with a new investment vehicle, according to an official blog post published Dec. 11. As the post outlines, the new app allows users to buy and sell crypto, and monitor real-time and historical crypto market prices for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and ZCash (ZEC). Users can also see the total value of their current portfolio, and set price and percentage value change alerts for their chosen coins. Further functionality includes a “recurring buy” feature, as well as support for a newly-launched investment vehicle dubbed “The Cryptoverse” –– a basket of cryptocurrencies, weighted by market capitalization, to be bought as a single order. In an interview with Bloomberg published today, the twins struck a bullish tone in regard to the recent crypto market slump, Tyler stating “we’re totally at home in winter,” and his twin Cameron adding that “it gives us time to build internally, and refine and kind of catch our breath.” Cameron contextualized the new app as a bid to reach out to retail investors, telling Bloomberg that: “A lot of our decisions have perhaps given off a perception that we’re more institutional-based. The reality of the situation is that we have a diverse customer base. And the retail story is just beginning.” The twins also revealed their 2019 goal of expanding to the Asian crypto market, where they will face stiff competition from a thriving exchange industry that includes the likes of Bitfinex, Binance and Huobi. Gemini’s expansion plans have also been rumored to include possible entry to the United Kingdom market, as reported this September. The twins, stalwarts of the crypto space, have had a checkered history with regulators. Successes include a recent seal of approval from the New York State Department of Financial Services (NYDFS) to launch their own U.S. dollar-backed stablecoin, the Gemini dollar.

Gemini also obtained insurance coverage for custodied digital assets from lending services firm Aon, which will complement Gemini’s already available Federal Deposit Insurance Corporation (FDIC) coverage for U.S. dollar deposits (in place under the New York State BitLicense framework since 2015). The twins nonetheless faced a high-profile setback this July, when their application to launch a Bitcoin exchange-traded fund (ETF) received its second rejection from the U.S. Securities and Exchange Commission (SEC). Most recently, the twins have made crypto news with a lawsuit they filed against Bitcoin Foundation founder Charlie Shrem concerning an alleged Bitcoin theft dating back six years. As of press time, Gemini is ranked 51st among crypto exchanges in terms of adjusted trade volumes, seeing around $16.5 million in daily trades. The U.S. Securities and Exchange Commission (SEC) extended a rule change proposal allowing the nation’s first bitcoin exchange-traded fund (ETF), pushing the decision deadline to next year.

In a notice posted online, the securities regulator said it was extending the review period for the ETF to Feb. 27, 2019. The proposal was first submitted by money manager VanEck and blockchain startup SolidX, who partnered with the Cboe exchange earlier this year. Under SEC rules, a decision on the proposal cannot be delayed any further, meaning the next notice must either approve or reject the ETF. The decision comes after months of uncertainty as a number of previous ETF proposals were rejected by the SEC, most notably in August when the regulator simultaneously rejected nine proposals submitted by ProShares, GraniteShares and Direxion. The rejections were suspended the next day when the SEC announced it would review all of the proposals. It later reopened a comment period, giving the general public until November 6 to share any new statements in support of or against allowing the ETFs to be approved. The VanEck/SolidX proposal differs from the others in that its value is dependent on bitcoin itself, rather than futures markets like the other nine. The SEC similarly reopened a comment period for this proposal, designating October 17 as the deadline for any statements and October 31 as the deadline for any rebuttals. |

RSS Feed

RSS Feed